Exam 6: Inventories

Exam 1: Accounting in Action282 Questions

Exam 2: The Recording Process224 Questions

Exam 3: Adjusting the Accounts309 Questions

Exam 4: Completing the Accounting Cycle264 Questions

Exam 5: Accounting for Merchandising Operations245 Questions

Exam 6: Inventories258 Questions

Exam 7: Fraud, Internal Control, and Cash247 Questions

Exam 8: Accounting for Receivables270 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets342 Questions

Exam 10: Liabilities318 Questions

Exam 12: Investments228 Questions

Exam 13: Statement of Cash Flows217 Questions

Exam 14: Financial Statement Analysis235 Questions

Exam 15: Accounting Principles and Contingent Liabilities in Business Operations251 Questions

Select questions type

The lower-of-cost-or-net realizable value basis is an example of the accounting concept of prudence.

(True/False)

4.8/5  (26)

(26)

Nolvo Company uses the periodic inventory system. For February 2014, the beginning inventory consisted of 400 units that cost CHF65 each. During the month, the company made two purchases: 1,600 units at CHF68 each and 600 units at CHF72 each. Nolvo sold 2,000 units during the month of February at CHF110 per unit. Using the average cost method, what is the amount of ending inventory at February 28, 2014?

(Multiple Choice)

4.8/5  (34)

(34)

A company just starting in business purchased three inventory items at the following prices. First purchase $80; Second purchase $95; Third purchase $85. If the company sold two units for a total of $260 and used FIFO costing, the gross profit for the period would be

(Multiple Choice)

4.9/5  (36)

(36)

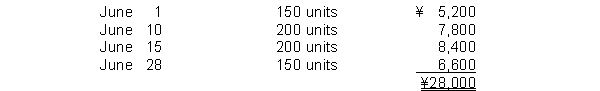

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 100 units on hand. Using the LIFO inventory method, the value of the ending inventory on June 30 is

A physical count of merchandise inventory on June 30 reveals that there are 100 units on hand. Using the LIFO inventory method, the value of the ending inventory on June 30 is

(Multiple Choice)

5.0/5  (47)

(47)

Moore Company reported net income of $60,000 in 2013 and $80,000 in 2014. However, ending inventory was overstated by $8,000 in 2013.

Instructions

Compute the correct net income for Moore Company for 2013 and 2014.

(Essay)

4.8/5  (42)

(42)

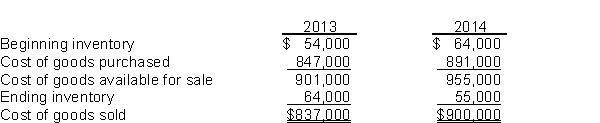

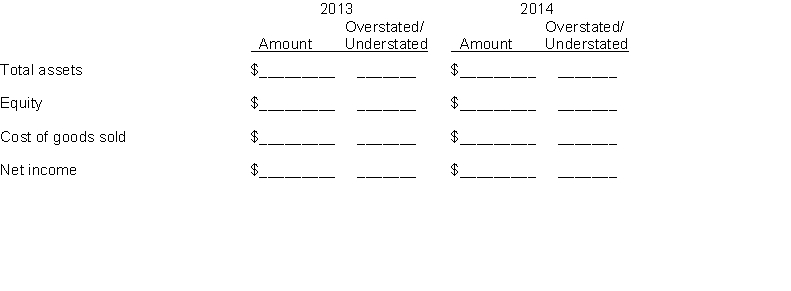

Graves Pharmacy reported cost of goods sold as follows:  Hill, the bookkeeper, made two errors:

(1) 2013 ending inventory was overstated by $4,000.

(2) 2014 ending inventory was understated by $10,000.

Instructions

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

Hill, the bookkeeper, made two errors:

(1) 2013 ending inventory was overstated by $4,000.

(2) 2014 ending inventory was understated by $10,000.

Instructions

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

(Essay)

4.8/5  (39)

(39)

Breguet Company uses the FIFO inventory method. The company reported inventory of CHF2,270,000 on its December 31, 2014 statement of financial position. Had average-cost been used, the company would have reported inventory of CHF1,860,000. The company's tax rate is 30%. What is the impact of the inventory cost flow assumption on Breguet's 2014 financial statements?

(Multiple Choice)

4.9/5  (36)

(36)

As a result of a thorough physical inventory, Hastings Company determined that it had inventory worth $570,000 at December 31, 2014. This count did not take into consideration the following facts: Carlin Consignment store currently has goods worth $104,000 on its sales floor that belong to Hastings but are being sold on consignment by Carlin. The selling price of these goods is $150,000. Hastings purchased $40,000 of goods that were shipped on December 27 FOB destination, that will be received by Hastings on January 3. Determine the correct amount of inventory that Hastings should report.

(Multiple Choice)

4.7/5  (28)

(28)

If a company has no beginning inventory and the unit cost of inventory items does not change during the year, the value assigned to the ending inventory will be the same under FIFO and average cost flow assumptions.

(True/False)

4.8/5  (42)

(42)

A major advantage of LIFO is that the inventory reported on the statement of financial position will approximate current cost.

(True/False)

4.8/5  (43)

(43)

The retail inventory method requires a company to value its inventory on the statement of financial position at retail prices.

(True/False)

4.8/5  (27)

(27)

East Asia Inc., Hong Kong subsidiary of a US company, uses the periodic inventory system. At April 1, the inventory consisted of 600 units that cost HK$650 each. During the month, the company made two purchases: 900 units at HK$680 each and 450 units at HK$700 each. East Asia also sold 1,500 units during the month. Using the LIFO cost flow assumption, what is the amount of cost of goods sold for the month?

(Multiple Choice)

4.9/5  (39)

(39)

The gross profit method is based on the assumption that the rate of gross profit remains constant from one year to the next.

(True/False)

4.9/5  (37)

(37)

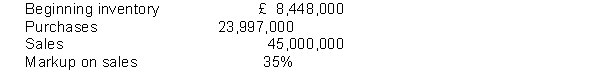

The following information is available for 2014 for Greenwich Company:  In May 2014, a flood washed away Greenwich's inventory. Using the gross profit method, the estimated value of the inventory destroyed is:

In May 2014, a flood washed away Greenwich's inventory. Using the gross profit method, the estimated value of the inventory destroyed is:

(Multiple Choice)

4.8/5  (40)

(40)

Match the statements below with the appropriate terms

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (46)

(46)

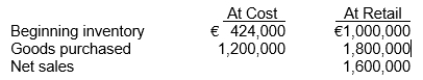

Stark Department Store estimates inventory by using the retail inventory method. The following information was developed:  The estimated cost of the ending inventory is

The estimated cost of the ending inventory is

(Multiple Choice)

4.9/5  (25)

(25)

Which of the following should not be included in the inventory of a company using GAAP?

(Multiple Choice)

4.8/5  (44)

(44)

At May 1, 2014, Deitrich Company had beginning inventory consisting of 200 units with a unit cost of €3.50. During May, the company purchased inventory as follows: 400 units at €3.50

600 units at €4.00

The company sold 1,000 units during the month for €6 per unit. Deitrich uses the average-cost method. The average cost per unit for May is

(Multiple Choice)

4.9/5  (37)

(37)

Raw materials inventories are the goods that a manufacturer has completed and are ready to be sold to customers.

(True/False)

4.8/5  (43)

(43)

The inventory turnover ratio is computed by dividing cost of goods sold by

(Multiple Choice)

4.8/5  (36)

(36)

Showing 221 - 240 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)