Exam 6: Inventories

Exam 1: Accounting in Action282 Questions

Exam 2: The Recording Process224 Questions

Exam 3: Adjusting the Accounts309 Questions

Exam 4: Completing the Accounting Cycle264 Questions

Exam 5: Accounting for Merchandising Operations245 Questions

Exam 6: Inventories258 Questions

Exam 7: Fraud, Internal Control, and Cash247 Questions

Exam 8: Accounting for Receivables270 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets342 Questions

Exam 10: Liabilities318 Questions

Exam 12: Investments228 Questions

Exam 13: Statement of Cash Flows217 Questions

Exam 14: Financial Statement Analysis235 Questions

Exam 15: Accounting Principles and Contingent Liabilities in Business Operations251 Questions

Select questions type

The ______________ method tracks the actual physical flow of each unit of inventory available for sale; however, management may be able to manipulate ______________ by using this method.

(Not Answered)

This question doesn't have any answer yet

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. Under the LIFO method, cost of goods sold is

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. Under the LIFO method, cost of goods sold is

(Multiple Choice)

4.8/5  (35)

(35)

Under the FIFO method, the costs of the earliest units purchased are the first charged to cost of goods sold.

(True/False)

4.8/5  (38)

(38)

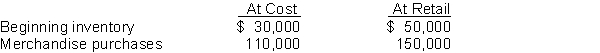

Flott Department Store prepares monthly financial statements but only takes a physical count of merchandise inventory at the end of the year. The following information has been developed for the month of July:  The net sales for July amounted to $140,000.

Instructions

Use the retail inventory method to estimate the ending inventory at cost for July. Show all computations to support your answer.

The net sales for July amounted to $140,000.

Instructions

Use the retail inventory method to estimate the ending inventory at cost for July. Show all computations to support your answer.

(Essay)

4.9/5  (34)

(34)

If the unit price of inventory is increasing during a period, a company using the average-cost inventory method will show less gross profit for the period, than if it had used the FIFO inventory method.

(True/False)

4.8/5  (39)

(39)

Ted's Used Cars uses the specific identification method of costing inventory. During March, Ted purchased three cars for $8,000, $10,000, and $13,000, respectively. During March, two cars are sold for $11,000 each. Ted determines that at March 31, the $13,000 car is still on hand. What is Ted's gross profit for March?

(Multiple Choice)

4.8/5  (37)

(37)

One reason a company using a perpetual inventory system must make a physical count of goods is to determine the amount of inventory on hand as of the statement of financial position date.

(True/False)

4.9/5  (39)

(39)

An auto manufacturer would classify vehicles in various stages of production as

(Multiple Choice)

4.9/5  (32)

(32)

Franco Company uses the FIFO inventory method. Its 2014, the company reported net income of €820,000. Had average-cost been used, the company would have reported net income of €760,000. Assuming a 40% tax rate, what is the impact of the inventory cost flow assumption on Franco's taxes for 2014?

(Multiple Choice)

4.8/5  (30)

(30)

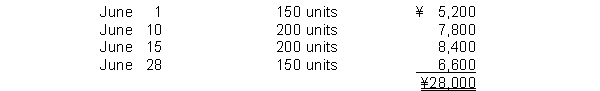

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 100 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for June is

A physical count of merchandise inventory on June 30 reveals that there are 100 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for June is

(Multiple Choice)

4.9/5  (37)

(37)

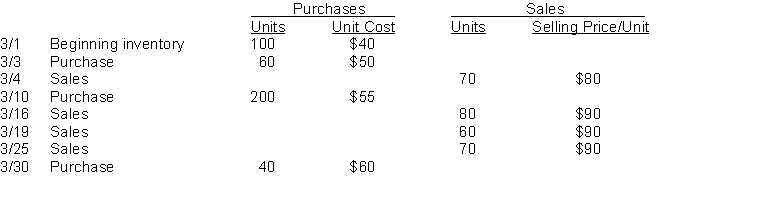

Kegin Company sells many products. Whamo is one of its popular items. Below is an analysis of the inventory purchases and sales of Whamo for the month of March. Kegin Company uses the periodic inventory system.  Instructions

(a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for March. (Show computations)

(b) Using the weighted average method, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(c) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

Instructions

(a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for March. (Show computations)

(b) Using the weighted average method, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(c) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(Essay)

5.0/5  (40)

(40)

The first-in, first-out (FIFO) inventory method results in an ending inventory valued at the most recent cost.

(True/False)

4.9/5  (39)

(39)

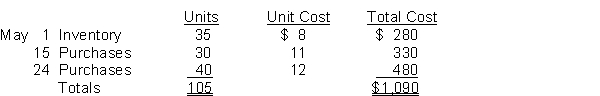

London Co. uses a periodic inventory system. Its records show the following for the month of May, in which 80 units were sold.

Instructions

Compute the ending inventory at May 31 and cost of goods sold using the (1) FIFO and (2) LIFO methods. Prove the amount allocated to cost of goods sold under each method.

Instructions

Compute the ending inventory at May 31 and cost of goods sold using the (1) FIFO and (2) LIFO methods. Prove the amount allocated to cost of goods sold under each method.

(Essay)

4.8/5  (38)

(38)

Accounting for inventories is important because inventories affect the ______________ section of the statement of financial position and the ______________ section on the income statement.

(Short Answer)

4.8/5  (35)

(35)

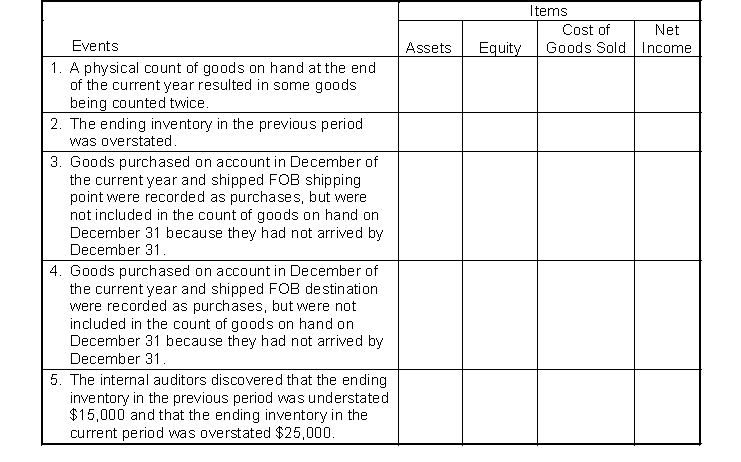

For each of the independent events listed below, analyze the impact on the indicated items at the end of the current year by placing the appropriate code letter in the box under each item.

Code: O = item is overstated

U = item is understated

NA = item is not affected

(Essay)

4.8/5  (34)

(34)

An error that overstates the ending inventory will also cause net income for the period to be overstated.

(True/False)

4.9/5  (35)

(35)

The 2014 financial statements of Vitturo Company reported beginning inventory of €973,000, ending inventory of €1,023,000, and cost of goods sold of €5,988,000 for the year. Vitturo's inventory turnover ratio for 2014 is

(Multiple Choice)

4.9/5  (27)

(27)

The following information was available for Hoover Company at December 31, 2014: beginning inventory $110,000; ending inventory $70,000; cost of goods sold $880,000; and sales $1,200,000. Hoover's inventory turnover ratio in 2014 was

(Multiple Choice)

4.8/5  (29)

(29)

The major difference between IFRS and GAAP in accounting for inventories is that

(Multiple Choice)

4.7/5  (30)

(30)

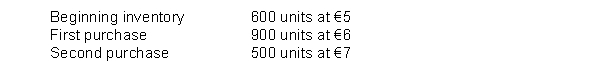

The following information is available for Massey Company:  Assume that Massey uses a periodic inventory system and that there are 700 units left at the end of the month.

Instructions

Compute the cost of ending inventory under the

(a) FIFO method.

(b) Average-cost method.

Assume that Massey uses a periodic inventory system and that there are 700 units left at the end of the month.

Instructions

Compute the cost of ending inventory under the

(a) FIFO method.

(b) Average-cost method.

(Essay)

4.8/5  (41)

(41)

Showing 201 - 220 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)