Exam 6: Inventories

Exam 1: Accounting in Action282 Questions

Exam 2: The Recording Process224 Questions

Exam 3: Adjusting the Accounts309 Questions

Exam 4: Completing the Accounting Cycle264 Questions

Exam 5: Accounting for Merchandising Operations245 Questions

Exam 6: Inventories258 Questions

Exam 7: Fraud, Internal Control, and Cash247 Questions

Exam 8: Accounting for Receivables270 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets342 Questions

Exam 10: Liabilities318 Questions

Exam 12: Investments228 Questions

Exam 13: Statement of Cash Flows217 Questions

Exam 14: Financial Statement Analysis235 Questions

Exam 15: Accounting Principles and Contingent Liabilities in Business Operations251 Questions

Select questions type

Goods out on consignment should be included in the inventory of the consignor.

(True/False)

4.9/5  (37)

(37)

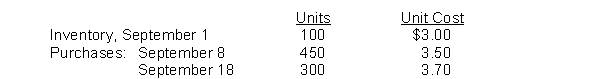

Hoyt Company's inventory records show the following data for the month of September:  A physical inventory on September 30 shows 200 units on hand. Calculate the value of ending inventory and cost of goods sold if the company uses LIFO inventory costing and a periodic inventory system.

A physical inventory on September 30 shows 200 units on hand. Calculate the value of ending inventory and cost of goods sold if the company uses LIFO inventory costing and a periodic inventory system.

(Essay)

4.8/5  (38)

(38)

Unitech has the following inventory information.  A physical count of merchandise inventory on July 31 reveals that there are 75 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for July is

A physical count of merchandise inventory on July 31 reveals that there are 75 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for July is

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following should be included in the physical inventory of a company?

(Multiple Choice)

4.8/5  (36)

(36)

Jerry White is studying for the next accounting mid-term examination. What should Jerry know about (a) departing from the cost basis of accounting for inventories and (b) the meaning of "net realizable value" in the lower-of-cost-or- net realizable value method?

(Essay)

4.9/5  (42)

(42)

______________ is calculated as cost of goods sold divided by average inventory.

(Not Answered)

This question doesn't have any answer yet

Paulson, Inc. has 8 computers which have been part of the inventory for over two years. Each computer cost ₤600 and originally retailed for ₤825. At the statement date, each computer has a net realizable value of ₤350. How much loss should Paulson, Inc., record for the year?

(Multiple Choice)

4.9/5  (48)

(48)

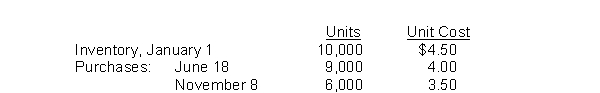

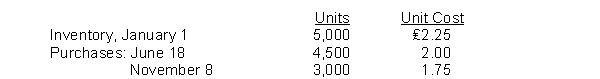

Rudolf Diesel Company's inventory records show the following data:  A physical inventory on December 31 shows 8,000 units on hand. Under the FIFO method, the December 31 inventory is

A physical inventory on December 31 shows 8,000 units on hand. Under the FIFO method, the December 31 inventory is

(Multiple Choice)

4.9/5  (47)

(47)

In a period of rising prices which inventory method generally provides the greatest amount of net income?

(Multiple Choice)

4.8/5  (37)

(37)

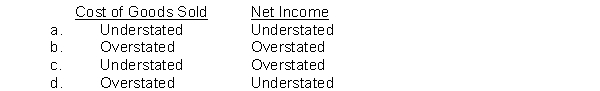

If beginning inventory is understated by $10,000, the effect of this error in the current period is

(Short Answer)

4.8/5  (37)

(37)

At May 1, 2014, Deitrich Company had beginning inventory consisting of 200 units with a unit cost of €3.50. During May, the company purchased inventory as follows: 400 units at €3.50

600 units at €4.00

The company sold 1,000 units during the month for €6 per unit. Deitrich uses the average cost method. The value of Deitrich's inventory at May 31, 2014 is

(Multiple Choice)

4.9/5  (40)

(40)

The lower-of-cost-or-net realizable value basis of valuing inventories is an example of

(Multiple Choice)

4.8/5  (36)

(36)

One difference between IFRS and GAAP in valuing inventories is that

(Multiple Choice)

4.9/5  (39)

(39)

Transactions that affect inventories on hand have an effect on both the statement of financial position and the income statement.

(True/False)

4.8/5  (35)

(35)

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. What is the cost of goods available for sale?

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for ₤3 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. What is the cost of goods available for sale?

(Multiple Choice)

4.8/5  (35)

(35)

Companies have the choice of physically counting inventory on hand at the end of the year or using the gross profit method to estimate the ending inventory.

(True/False)

4.9/5  (41)

(41)

Aiwa Inc. uses the average-cost inventory method. In 2014, the company reported net income of ¥59,600,000. Had average-cost been used, the company would have reported net income of ¥58,900,000. Assuming a 25% tax rate, what is the impact of the inventory cost flow assumption on Aiwa's taxes for 2014?

(Multiple Choice)

4.8/5  (38)

(38)

If a company uses the FIFO cost assumption, the cost of goods sold for the period will be the same under a perpetual or periodic inventory system.

(True/False)

4.7/5  (40)

(40)

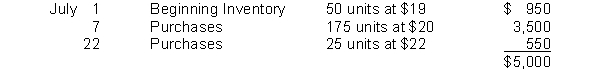

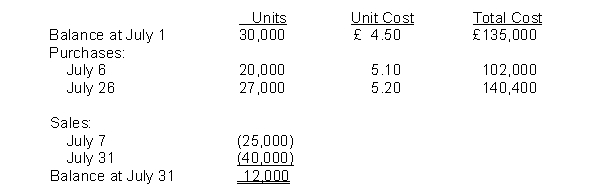

The following information was available from the inventory records of Queen Company for July:  What should be the inventory reported on Queen's July 31 statement of financial position using the average-cost inventory method (round per unit amounts to two decimal places)?

What should be the inventory reported on Queen's July 31 statement of financial position using the average-cost inventory method (round per unit amounts to two decimal places)?

(Multiple Choice)

4.9/5  (33)

(33)

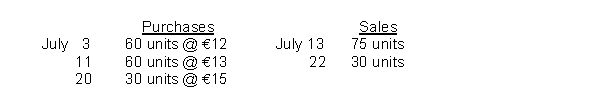

During July, the following purchases and sales were made by James Company. There was no beginning inventory. James Company uses a perpetual inventory system.  Under the LIFO method, the cost of goods sold for each sale is:

July 13 July 22

Under the LIFO method, the cost of goods sold for each sale is:

July 13 July 22

(Multiple Choice)

4.9/5  (34)

(34)

Showing 141 - 160 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)