Exam 8: Valuation of Inventories: a Cost-Basis Approach

Exam 1: Financial Accounting and Accounting Standards103 Questions

Exam 2: Conceptual Framework for Financial Reporting155 Questions

Exam 3: The Accounting Information System144 Questions

Exam 4: Income Statement and Related Information139 Questions

Exam 5: Balance Sheet and Statement of Cash Flows127 Questions

Exam 6: Accounting and the Time Value of Money152 Questions

Exam 7: Cash and Receivables173 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach173 Questions

Exam 9: Inventories: Additional Valuation Issues168 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment170 Questions

Exam 11: Depreciation, Impairments, and Depletion156 Questions

Exam 12: Intangible Assets171 Questions

Exam 13: Current Liabilities and Contingencies170 Questions

Exam 14: Long-Term Liabilities140 Questions

Exam 15: Stockholders Equity155 Questions

Exam 17: Investments141 Questions

Exam 18: Revenue Recognition145 Questions

Exam 19: Accounting for Income Taxes127 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits137 Questions

Exam 21: Accounting for Leases128 Questions

Exam 22: Accounting Changes and Error Analysis103 Questions

Exam 23: Statement of Cash Flows143 Questions

Exam 24: Full Disclosure in Financial Reporting108 Questions

Exam 25: Appendix89 Questions

Select questions type

The acquisition cost of a certain raw material changes frequently. The book value of the inventory of this material at year end will be the same if perpetual records are kept as it would be under a periodic inventory method only if the book value is computed under the

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

D

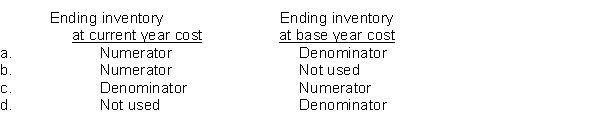

When the double-extension approach to the dollar-value LIFO inventory cost flow method is used, the inventory layer added in the current year is multiplied by an index number. How would the following be used in the calculation of this index number?

Free

(Short Answer)

4.8/5  (36)

(36)

Correct Answer:

A

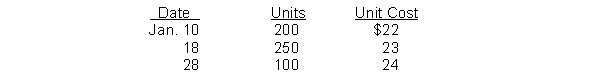

Keck Co. had 150 units of product A on hand at January 1, 2014, costing $21 each. Purchases of product A during January were as follows:  A physical count on January 31, 2014 shows 200 units of product A on hand. The cost of the inventory at January 31, 2014 under the LIFO method is

A physical count on January 31, 2014 shows 200 units of product A on hand. The cost of the inventory at January 31, 2014 under the LIFO method is

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

C

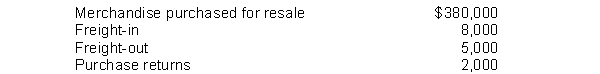

The following information applied to Howe, Inc. for 2014:  Howe's 2014 inventoriable cost was

Howe's 2014 inventoriable cost was

(Multiple Choice)

4.8/5  (38)

(38)

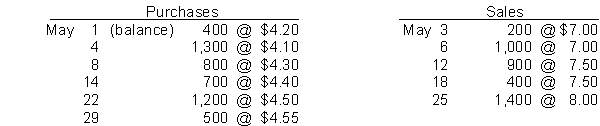

Perpetual LIFO.

A record of transactions for the month of May was as follows:  Assuming that perpetual inventory records are kept in dollars, determine the ending inventory using LIFO.

Assuming that perpetual inventory records are kept in dollars, determine the ending inventory using LIFO.

(Essay)

4.7/5  (45)

(45)

If the beginning inventory for 2014 is overstated, the effects of this error on cost of goods sold for 2014, net income for 2014, and assets at December 31, 2015, respectively, are

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following types of interest cost incurred in connection with the purchase or manufacture of inventory should be capitalized as a product cost?

(Multiple Choice)

4.9/5  (41)

(41)

Which method of inventory pricing best approximates specific identification of the actual flow of costs and units in most manufacturing situations?

(Multiple Choice)

4.8/5  (44)

(44)

In a period of rising prices which inventory method generally provides the greatest amount of net income?

(Multiple Choice)

4.8/5  (39)

(39)

Use the following information for questions 96 and 97.

Winsor Co. records purchases at net amounts. On May 5 Winsor purchased merchandise on account, $40,000, terms 2/10, n/30. Winsor returned $3,000 of the May 5 purchase and received credit on account. At May 31 the balance had not been paid.

-The amount to be recorded as a purchase return is

(Multiple Choice)

4.8/5  (37)

(37)

Checkers uses the periodic inventory system. For the current month, the beginning inventory consisted of 4,800 units that cost $12 each. During the month, the company made two purchases: 2,000 units at $13 each and 8,000 units at $13.50 each. Checkers also sold 8,600 units during the month. Using the FIFO method, what is the ending inventory?

(Multiple Choice)

4.9/5  (34)

(34)

Use the following information for questions 103 through 106.

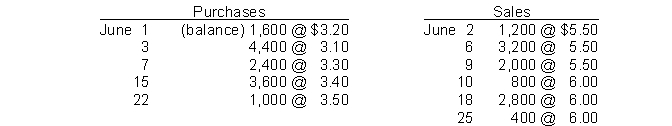

Transactions for the month of June were:  -Assuming that perpetual inventory records are kept in dollars, the ending inventory on a FIFO basis is

-Assuming that perpetual inventory records are kept in dollars, the ending inventory on a FIFO basis is

(Multiple Choice)

4.8/5  (34)

(34)

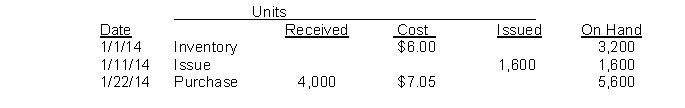

Groh Co. recorded the following data pertaining to raw material X during January 2014:  The moving-average unit cost of X inventory at January 31, 2014 is

The moving-average unit cost of X inventory at January 31, 2014 is

(Multiple Choice)

4.9/5  (37)

(37)

A disadvantage of LIFO is that it does not match more recent costs against current revenues as well as FIFO.

(True/False)

4.8/5  (48)

(48)

Which method may be used to record cash discounts a company receives for paying suppliers promptly?

(Multiple Choice)

4.8/5  (41)

(41)

If ending inventory is understated, then net income is understated.

(True/False)

4.9/5  (39)

(39)

Lawson Manufacturing Company has the following account balances at year end:  What amount should Lawson report as inventories in its balance sheet?

What amount should Lawson report as inventories in its balance sheet?

(Multiple Choice)

4.9/5  (36)

(36)

Based on your answers to Questions 6 and 7, which of the following is a disadvantage of using the IFRS FIFO method, as compared to Average-cost under U.S. GAAP?

(Multiple Choice)

4.8/5  (40)

(40)

Showing 1 - 20 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)