Exam 13: Current Liabilities and Contingencies

Exam 1: Financial Accounting and Accounting Standards103 Questions

Exam 2: Conceptual Framework for Financial Reporting155 Questions

Exam 3: The Accounting Information System144 Questions

Exam 4: Income Statement and Related Information139 Questions

Exam 5: Balance Sheet and Statement of Cash Flows127 Questions

Exam 6: Accounting and the Time Value of Money152 Questions

Exam 7: Cash and Receivables173 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach173 Questions

Exam 9: Inventories: Additional Valuation Issues168 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment170 Questions

Exam 11: Depreciation, Impairments, and Depletion156 Questions

Exam 12: Intangible Assets171 Questions

Exam 13: Current Liabilities and Contingencies170 Questions

Exam 14: Long-Term Liabilities140 Questions

Exam 15: Stockholders Equity155 Questions

Exam 17: Investments141 Questions

Exam 18: Revenue Recognition145 Questions

Exam 19: Accounting for Income Taxes127 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits137 Questions

Exam 21: Accounting for Leases128 Questions

Exam 22: Accounting Changes and Error Analysis103 Questions

Exam 23: Statement of Cash Flows143 Questions

Exam 24: Full Disclosure in Financial Reporting108 Questions

Exam 25: Appendix89 Questions

Select questions type

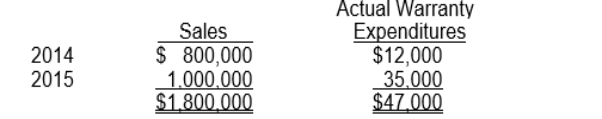

During 2014, Eaton Co. introduced a new product carrying a two-year warranty against defects. The estimated warranty costs related to dollar sales are 2% within 12 months following sale and 3% in the second 12 months following sale. Sales and actual warranty expenditures for the years ended December 31, 2014 and 2015 are as follows:  At December 31, 2015, (assuming the accrual method) Eaton should report an estimated warranty liability of

A) $0.

B) $15,000.

C) $35,000.

D) $43,000.

At December 31, 2015, (assuming the accrual method) Eaton should report an estimated warranty liability of

A) $0.

B) $15,000.

C) $35,000.

D) $43,000.

Free

(Short Answer)

4.9/5  (39)

(39)

Correct Answer:

D

Prepaid insurance should be included in the numerator when computing the acid-test (quick) ratio.

Free

(True/False)

4.8/5  (40)

(40)

Correct Answer:

False

A company must accrue a liability for sick pay that accumulates but does not vest.

Free

(True/False)

4.9/5  (40)

(40)

Correct Answer:

False

Current liabilities are usually recorded and reported in financial statements at their full maturity value.

(True/False)

4.8/5  (28)

(28)

Which of the following should not be included in the current liabilities section of the balance sheet?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is not considered a part of the definition of a liability?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following is not true about the discount on short-term notes payable?

(Multiple Choice)

4.9/5  (29)

(29)

All long-term debt maturing within the next year must be classified as a current liability on the balance sheet.

(True/False)

4.8/5  (37)

(37)

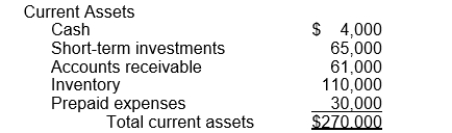

Presented below is information available for Marley Company.  Total current liabilities are $100,000. The acid-test ratio for Marley is:

Total current liabilities are $100,000. The acid-test ratio for Marley is:

(Multiple Choice)

5.0/5  (33)

(33)

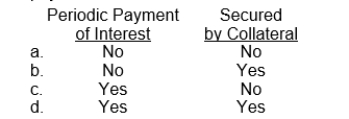

Which of the following is generally associated with payables classified as accounts payable?

(Short Answer)

4.9/5  (39)

(39)

Merritt Equipment Company sells computers for $1,500 each and also gives each customer a 2-year warranty that requires the company to perform periodic services and to replace defective parts. During 2014, the company sold 900 computers. Based on past experience, the company has estimated the total 2-year warranty costs as $40 for parts and $60 for labor. (Assume sales all occur at December 31, 2014.)In 2015, Merritt incurred actual warranty costs relative to 2014 computer sales of $12,000 for parts and $18,000 for labor.

Instructions

(a) Under the expense warranty approach, give the entries to reflect the above transactions (accrual method) for 2014 and 2015.

(b) Under the cash-basis method, what are the Warranty Expense balances for 2014 and 2015?

(c) The transactions of part

(a) create what balance under current liabilities in the 2014 balance sheet?

(Essay)

4.8/5  (33)

(33)

Dividends in arrears on cumulative preferred stock should be recorded as a current liability.

(True/False)

4.9/5  (35)

(35)

Examples of contingent assets include all of the following except:

(Multiple Choice)

5.0/5  (31)

(31)

Sawyer Company self-insures its property for fire and storm damage. If the company were to obtain insurance on the property, it would cost them $1,500,000 per year. The company estimates that on average it will incur losses of $1,200,000 per year. During 2014, $525,000 worth of losses were sustained. How much total expense and/or loss should be recognized by Sawyer Company for 2014?

(Multiple Choice)

5.0/5  (36)

(36)

Which of the following taxes does not represent a common employee payroll deduction?

(Multiple Choice)

4.8/5  (29)

(29)

Provisions are only recorded if it is likely that the company will have to settle an obligation at some point in the future.

(True/False)

4.9/5  (34)

(34)

Which of the following situations may give rise to unearned revenue?

(Multiple Choice)

4.9/5  (34)

(34)

Jeff Brown is a farmer who owns land which borders on the right-of-way of the Northern Railroad. On August 10, 2014, due to the admitted negligence of the Railroad, hay on the farm was set on fire and burned. Brown had a dispute with the Railroad for several years concerning the ownership of a small parcel of land. The representative of the Railroad has offered to assign any rights which the Railroad may have in the land to Brown in exchange for a release of his right to reimbursement for the loss he has sustained from the fire. Brown appears inclined to accept the Railroad's offer. The Railroad's 2014 financial statements should include the following related to the incident:

(Multiple Choice)

4.7/5  (39)

(39)

Use of the accrual method in accounting for product warranty costs

(Multiple Choice)

4.8/5  (30)

(30)

Which of the following is not a factor that is considered when evaluating whether or not to record a liability for pending litigation?

(Multiple Choice)

4.9/5  (46)

(46)

Showing 1 - 20 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)