Exam 4: Income Statement and Related Information

Exam 1: Financial Accounting and Accounting Standards103 Questions

Exam 2: Conceptual Framework for Financial Reporting155 Questions

Exam 3: The Accounting Information System144 Questions

Exam 4: Income Statement and Related Information139 Questions

Exam 5: Balance Sheet and Statement of Cash Flows127 Questions

Exam 6: Accounting and the Time Value of Money152 Questions

Exam 7: Cash and Receivables173 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach173 Questions

Exam 9: Inventories: Additional Valuation Issues168 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment170 Questions

Exam 11: Depreciation, Impairments, and Depletion156 Questions

Exam 12: Intangible Assets171 Questions

Exam 13: Current Liabilities and Contingencies170 Questions

Exam 14: Long-Term Liabilities140 Questions

Exam 15: Stockholders Equity155 Questions

Exam 17: Investments141 Questions

Exam 18: Revenue Recognition145 Questions

Exam 19: Accounting for Income Taxes127 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits137 Questions

Exam 21: Accounting for Leases128 Questions

Exam 22: Accounting Changes and Error Analysis103 Questions

Exam 23: Statement of Cash Flows143 Questions

Exam 24: Full Disclosure in Financial Reporting108 Questions

Exam 25: Appendix89 Questions

Select questions type

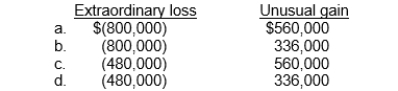

Prophet Corporation has an extraordinary loss of $800,000, an unusual gain of $560,000, and a tax rate of 40%. At what amount should Prophet report each item?

Free

(Short Answer)

4.7/5  (33)

(33)

Correct Answer:

C

How should an unusual event not meeting the criteria for an extraordinary item be disclosed in the financial statements?

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

A

A change in accounting principle requires that the cumulative effect of the change for prior periods be shown as an adjustment to:

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

A

Gross profit and income from operations are reported on a multiple-step but not on a single-step income statement.

(True/False)

4.8/5  (33)

(33)

When a company discontinues an operation and disposes of the discontinued operation (component), the transaction should be included in the income statement as a gain or loss on disposal reported as

(Multiple Choice)

4.8/5  (47)

(47)

Which of these is generally an example of an extraordinary item?

(Multiple Choice)

4.8/5  (41)

(41)

A company is not required to report a per share amount on the face of the income statement for which one of the following items?

(Multiple Choice)

4.8/5  (35)

(35)

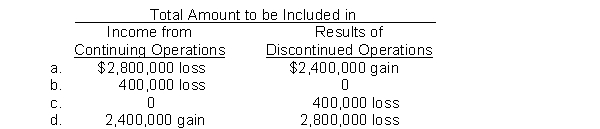

During 2014, Lopez Corporation disposed of Pine Division, a major component of its business. Lopez realized a gain of $2,400,000, net of taxes, on the sale of Pine's assets. Pine's operating losses, net of taxes, were $2,800,000 in 2014. How should these facts be reported in Lopez's income statement for 2014?

(Short Answer)

4.9/5  (35)

(35)

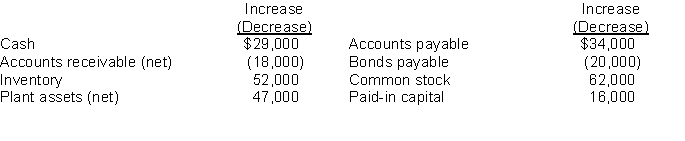

Calculation of net income from the change in stockholders' equity.Presented below are changes in the account balances of Wenn Company during the year, except for retained earnings.  The only entries in Retained Earnings were for net income and a dividend declaration of $17,000.1. Compute the net income for the current year.2. Explain what else can affect the Retained Earnings account.

The only entries in Retained Earnings were for net income and a dividend declaration of $17,000.1. Compute the net income for the current year.2. Explain what else can affect the Retained Earnings account.

(Essay)

4.9/5  (38)

(38)

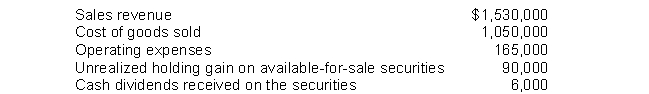

Madsen Company reported the following information for 2014:  For 2014, Madsen would report other comprehensive income of

For 2014, Madsen would report other comprehensive income of

(Multiple Choice)

4.8/5  (37)

(37)

A company should report a restructuring charge as an extraordinary item because these write-offs are not part of a company's ordinary and typical activities.

(True/False)

4.8/5  (48)

(48)

Which of the following is true about intraperiod tax allocation?

(Multiple Choice)

4.9/5  (44)

(44)

Classification of income statement and retained earnings statement items.For each of the items listed below, indicate how it should be treated in the financial statements. Use the following letter code for your selections:a. Ordinary or unusual (but not extraordinary) item on the income statementb. Discontinued operationsc. Extraordinary item on the income statementd. Prior period adjustment

1. The bad debt rate was increased from 1% to 2%, thus increasing bad debt expense.

2. Obsolete inventory was written off. This was the first loss of this type in the company's history.

3. An uninsured casualty loss was incurred by the company. This was the first loss of this type in the company's 50-year history.

4. Recognition of income earned last year which was inadvertently omitted from last year's income statement.

5. The company sold one of its warehouses at a loss.

6. Settlement of litigation with federal government related to income taxes of three years ago. The company is continually involved in various adjustments with the federal government related to its taxes.

7. A loss incurred from expropriation (the company owned resources in South America which were taken over by a dictator unsympathetic to American business).

8. The company neglected to record its depreciation in the previous year.

9. Discontinuance of all production in the United States. The manufacturing operations were relocated in Mexico.

10. Loss on sale of investments. The company last sold some of its investments two years ago.

11. Loss on the disposal of a component of a business.

(Essay)

4.7/5  (40)

(40)

At Ruth Company, events and transactions during 2014 included the following. The tax rate for all items is 30%.(1) Depreciation for 2012 was found to be understated by $90,000.(2) A strike by the employees of a supplier resulted in a loss of $75,000.(3) The inventory at December 31, 2012 was overstated by $120,000.(4) A flood destroyed a building that had a book value of $1,500,000. Floods are very uncommon in that area.The effect of these events and transactions on 2014 income from continuing operations net of tax would be

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following earnings per share figures must be disclosed on the face of the income statement?

(Multiple Choice)

4.9/5  (43)

(43)

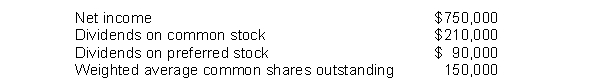

Benedict Corporation reports the following information:  Benedict should report earnings per share of

Benedict should report earnings per share of

(Multiple Choice)

4.7/5  (39)

(39)

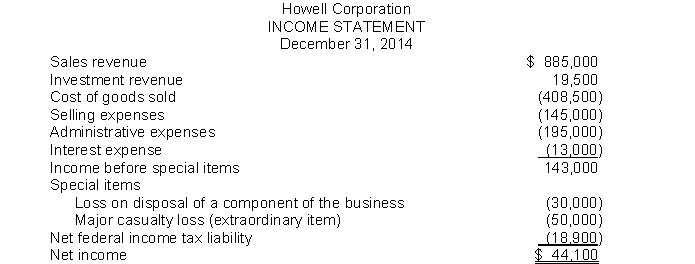

Multiple-step income statement.Shown below is an income statement for 2014 that was prepared by a poorly trained bookkeeper of Howell Corporation.  InstructionsPrepare a multiple-step income statement for 2014 for Howell Corporation that is presented in accordance with generally accepted accounting principles (including format and terminology). Howell Corporation has 50,000 shares of common stock outstanding and has a 30% federal income tax rate on all tax related items. Round all earnings per share figures to the nearest cent.

InstructionsPrepare a multiple-step income statement for 2014 for Howell Corporation that is presented in accordance with generally accepted accounting principles (including format and terminology). Howell Corporation has 50,000 shares of common stock outstanding and has a 30% federal income tax rate on all tax related items. Round all earnings per share figures to the nearest cent.

(Essay)

4.9/5  (43)

(43)

The occurrence that most likely would have no effect on 2014 net income is the

(Multiple Choice)

4.8/5  (33)

(33)

Manning Company has the following items: write-down of inventories, $360,000; loss on disposal of Sports Division, $555,000; and loss due to strike, $359,000. Ignoring income taxes, what amount should Manning Company report as extraordinary losses?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 1 - 20 of 139

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)