Exam 8: Valuation of Inventories: a Cost-Basis Approach

Exam 1: Financial Accounting and Accounting Standards103 Questions

Exam 2: Conceptual Framework for Financial Reporting155 Questions

Exam 3: The Accounting Information System144 Questions

Exam 4: Income Statement and Related Information139 Questions

Exam 5: Balance Sheet and Statement of Cash Flows127 Questions

Exam 6: Accounting and the Time Value of Money152 Questions

Exam 7: Cash and Receivables173 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach173 Questions

Exam 9: Inventories: Additional Valuation Issues168 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment170 Questions

Exam 11: Depreciation, Impairments, and Depletion156 Questions

Exam 12: Intangible Assets171 Questions

Exam 13: Current Liabilities and Contingencies170 Questions

Exam 14: Long-Term Liabilities140 Questions

Exam 15: Stockholders Equity155 Questions

Exam 17: Investments141 Questions

Exam 18: Revenue Recognition145 Questions

Exam 19: Accounting for Income Taxes127 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits137 Questions

Exam 21: Accounting for Leases128 Questions

Exam 22: Accounting Changes and Error Analysis103 Questions

Exam 23: Statement of Cash Flows143 Questions

Exam 24: Full Disclosure in Financial Reporting108 Questions

Exam 25: Appendix89 Questions

Select questions type

Use the following information for 123 and 124

Hay Company had January 1 inventory of $180,000 when it adopted dollar-value LIFO. During the year, purchases were $1,080,000 and sales were $1,800,000. December 31 inventory at year-end prices was $227,700, and the price index was 110.

-What is Hay Company's ending inventory?

(Multiple Choice)

4.8/5  (41)

(41)

Use the following information for questions 100 and 101.

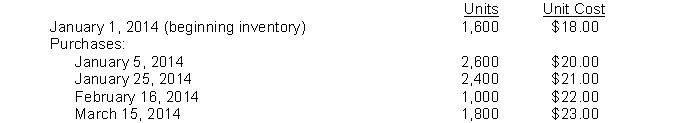

Niles Co. has the following data related to an item of inventory:  -The value assigned to ending inventory if Niles uses LIFO is

-The value assigned to ending inventory if Niles uses LIFO is

(Multiple Choice)

4.9/5  (34)

(34)

Inventory methods.

Jones Company was formed on December 1, 2013. The following information is available from Jones's inventory record for Product X.  A physical inventory on March 31, 2014, shows 2,000 units on hand.

Instructions

Prepare schedules to compute the ending inventory at March 31, 2014, under each of the following inventory methods:

(a) FIFO.

(b) LIFO.

(c) Weighted-average.Show supporting computations in good form.

A physical inventory on March 31, 2014, shows 2,000 units on hand.

Instructions

Prepare schedules to compute the ending inventory at March 31, 2014, under each of the following inventory methods:

(a) FIFO.

(b) LIFO.

(c) Weighted-average.Show supporting computations in good form.

(Essay)

4.9/5  (32)

(32)

On June 15, 2014, Wynne Corporation accepted delivery of merchandise which it pur-chased on account. As of June 30, Wynne had not recorded the transaction or included the merchandise in its inventory. The effect of this on its balance sheet for June 30, 2014 would be

(Multiple Choice)

4.9/5  (44)

(44)

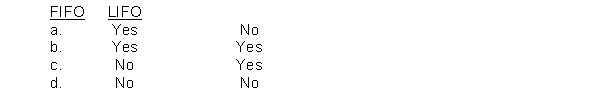

During periods of rising prices, a perpetual inventory system would result in the same dollar amount of ending inventory as a periodic inventory system under which of the following inventory cost flow methods?

(Short Answer)

4.8/5  (46)

(46)

Tanner Corporation's inventory on its balance sheet was lower using first-in, first-out than it would have been using last-in, first-out. Assuming no beginning inventory, in what direction did the cost of purchases move during the period?

(Multiple Choice)

4.8/5  (36)

(36)

Emley Company has been using the LIFO method of inventory valuation for 10 years, since it began operations. Its 2014 ending inventory was $50,000, but it would have been $75,000 if FIFO had been used. Thus, if FIFO had been used, Emley's income before income taxes would have been

(Multiple Choice)

4.9/5  (38)

(38)

Both U.S. GAAP and IFRS exclude which of the following from the cost of inventory?

(Multiple Choice)

5.0/5  (35)

(35)

Goods in transit which are shipped F.o.b. destination should be

(Multiple Choice)

4.9/5  (32)

(32)

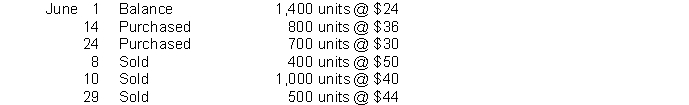

FIFO and LIFO inventory methods.During June, the following changes in inventory item 27 took place:  Perpetual inventories are maintained.

InstructionsWhat is the cost of the ending inventory for item 27 under the following methods? (Show calculations.)

(a) FIFO.

(b) LIFO.

Perpetual inventories are maintained.

InstructionsWhat is the cost of the ending inventory for item 27 under the following methods? (Show calculations.)

(a) FIFO.

(b) LIFO.

(Essay)

4.9/5  (37)

(37)

How is a significant amount of consignment inventory reported in the balance sheet?

(Multiple Choice)

4.8/5  (30)

(30)

Analysis of gross profit.

During 2014, King's Drug Company experienced a significant increase in the rate of gross profit on sales, compared with the rate it has averaged in recent years. You are asked to determine the most likely reason for this improvement. Support your answer.The following data are from the records of the company:2014 sales (at an average price of $40 a unit) were $2,300,000.2014 purchases (at an average cost of $24 a unit) were $1,200,000.The company uses the LIFO inventory method and has used it since 1985.

(Essay)

4.9/5  (35)

(35)

In all cases when FIFO is used, the cost of goods sold would be the same whether a perpetual or periodic system is used.

(True/False)

4.7/5  (34)

(34)

Showing 161 - 173 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)