Exam 4: Income Statement and Related Information

Exam 1: Financial Accounting and Accounting Standards103 Questions

Exam 2: Conceptual Framework for Financial Reporting155 Questions

Exam 3: The Accounting Information System144 Questions

Exam 4: Income Statement and Related Information139 Questions

Exam 5: Balance Sheet and Statement of Cash Flows127 Questions

Exam 6: Accounting and the Time Value of Money152 Questions

Exam 7: Cash and Receivables173 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach173 Questions

Exam 9: Inventories: Additional Valuation Issues168 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment170 Questions

Exam 11: Depreciation, Impairments, and Depletion156 Questions

Exam 12: Intangible Assets171 Questions

Exam 13: Current Liabilities and Contingencies170 Questions

Exam 14: Long-Term Liabilities140 Questions

Exam 15: Stockholders Equity155 Questions

Exam 17: Investments141 Questions

Exam 18: Revenue Recognition145 Questions

Exam 19: Accounting for Income Taxes127 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits137 Questions

Exam 21: Accounting for Leases128 Questions

Exam 22: Accounting Changes and Error Analysis103 Questions

Exam 23: Statement of Cash Flows143 Questions

Exam 24: Full Disclosure in Financial Reporting108 Questions

Exam 25: Appendix89 Questions

Select questions type

Prior period adjustments can either be added or subtracted in the Retained Earnings Statement.

(True/False)

4.8/5  (43)

(43)

At Ruth Company, events and transactions during 2014 included the following. The tax rate for all items is 30%.(1) Depreciation for 2012 was found to be understated by $90,000.(2) A strike by the employees of a supplier resulted in a loss of $75,000.(3) The inventory at December 31, 2012 was overstated by $120,000.(4) A flood destroyed a building that had a book value of $1,500,000. Floods are very uncommon in that area.The effect of these events and transactions on 2014 net income net of tax would be

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following items will not appear in the retained earnings statement?

(Multiple Choice)

4.8/5  (36)

(36)

Intraperiod tax allocation relates the income tax expense of a fiscal period to the specific items that give rise to the amount of the tax provision.

(True/False)

4.8/5  (43)

(43)

The accountant for the Lintz Sales Company is preparing the income statement for 2014 and the balance sheet at December 31, 2014. The January 1, 2014 merchandise inventory balance will appear

(Multiple Choice)

4.9/5  (24)

(24)

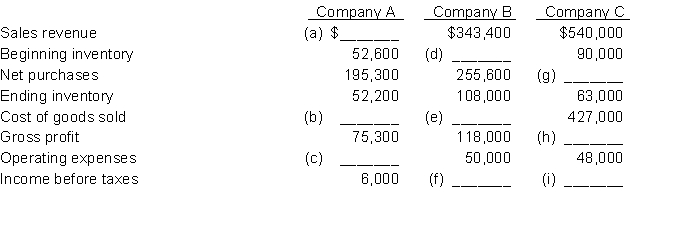

Income statement relationships.Fill in the appropriate blanks for each of the independent situations below.

(Essay)

4.8/5  (36)

(36)

What might a manager do during the last quarter of a fiscal year if she wanted to improve current annual net income?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following items would be reported net of tax on the face of the income statement?

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following is true of expense classification under IFRS?

(Multiple Choice)

4.8/5  (38)

(38)

Gains and losses identified as other comprehensive income have the same status as traditional gains and losses under

(Multiple Choice)

4.8/5  (30)

(30)

Which of the following is a required disclosure in the income statement when reporting the disposal of a component of the business?

(Multiple Choice)

4.8/5  (38)

(38)

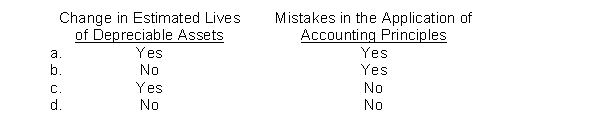

Which of the following should be reported as a prior period adjustment?

(Short Answer)

4.8/5  (34)

(34)

Under IFRS, a company may classify expenses by function, but must also disclose theclassification of expenses by nature.

(True/False)

4.8/5  (36)

(36)

Which of the following is an advantage of the single-step income statement over the multiple-step income statement?

(Multiple Choice)

4.9/5  (28)

(28)

Boston Company owns more than 50 percent of the ordinary shares of Dynamic Company. Assume Boston net income of $225,000 is allocated as $180,000 to Boston and $45,000 to noncontrolling interest. In Boston's consolidated income statement that includes Dynamic, under IFRS, how will the amount of non-controlling interest be reported?

(Multiple Choice)

5.0/5  (40)

(40)

Definitions.Provide clear, concise answers for the following.

1. What are revenues?

2. What are expenses?

3. What are gains?

4. What are losses?

5. What are the criteria (in addition to materiality) that must be met to classify an event or transaction as extraordinary?

6. When does a discontinued operation occur?

7. Indicate how earnings per share is computed.

8. State the primary category of prior period adjustments and indicate how they are reported in the financial statements.

(Essay)

4.7/5  (31)

(31)

Which one of the following types of losses is excluded from the determination of net income in income statements?

(Multiple Choice)

4.8/5  (45)

(45)

Showing 121 - 139 of 139

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)