Exam 23: Derivatives and Related Accounting Issues

Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice46 Questions

Exam 2: Consolidated Statements: Date of Acquisition41 Questions

Exam 3: Consolidated Statements: Subsequent to Acquisition34 Questions

Exam 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes38 Questions

Exam 5: Intercompany Transactions: Bonds and Leases52 Questions

Exam 6: Cash Flow, Eps, and Taxation46 Questions

Exam 7: Special Issues in Accounting for an Investment in a Subsidiary39 Questions

Exam 9: The International Accounting Environment14 Questions

Exam 10: Foreign Currency Transactions67 Questions

Exam 11: Translation of Foreign Financial Statements73 Questions

Exam 12: Interim Reporting and Disclosures About Segments of an Enterprise56 Questions

Exam 13: Partnerships: Characteristics, Formation, and Accounting for Activities45 Questions

Exam 14: Partnerships: Ownership Changes and Liquidations57 Questions

Exam 15: Governmental Accounting: the General Fund and the Account Groups74 Questions

Exam 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds58 Questions

Exam 17: Financial Reporting Issues29 Questions

Exam 18: Accounting for Private Not-For-Profit Organizations55 Questions

Exam 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations79 Questions

Exam 20: Estates and Trusts: Their Nature and the Accountants Role52 Questions

Exam 21: Debt Restructuring, Corporate Reorganizations, and Liquidations43 Questions

Exam 22: Accounting for Influential Investments13 Questions

Exam 23: Derivatives and Related Accounting Issues45 Questions

Select questions type

All of the following are examples of cash flow hedges except:

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

B

On September 1st of the current year, Mooney Company writes a contract agreeing to sell to Berry Company 200,000 foreign currency (FC) units at a specific price of $2.14 per FC with delivery in 30 days. The spot rate at the end of 30 days is $2.17. The appropriate discount rate for both Mooney Company and Berry Company is 9%, and Mooney's year end is December 31.

On the settlement of the contract, Mooney would record a

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

C

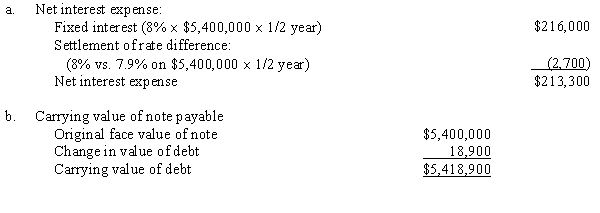

On January 3, 20X4, Realto Company issued a $5,400,000, 3-year note payable with a fixed interest rate of 8% payable semiannually. By the end of June 20X5, Realto's controller, believed that interest rate would fall over the next year. On July 3, 20X5, Realto Company entered into an interest rate swap with the First Columbia Bank. The bank required a premium of $10,400. The swap had a notional amount of $5,400,000 and called for the payment of a variable interest rate in exchange for the 8% fixed rate. The variable rates are reset semiannually beginning on July 1, 20X5, in order to determine the next interest payment. Differences between rates on the swap will be settled on a semiannual basis. Variable interest rates and the value of the swap on selected dates are as follows:  Required:

For December 31, 20X5, determine:

a.The net interest expense.

b.The carrying value of the note payable.

Required:

For December 31, 20X5, determine:

a.The net interest expense.

b.The carrying value of the note payable.

Free

(Essay)

4.9/5  (34)

(34)

Correct Answer:

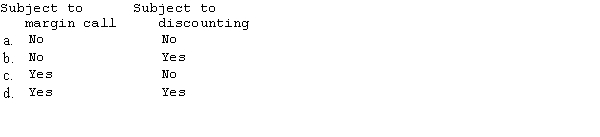

Both forward contracts and futures contracts provide for the receipt or payment of a specific amount of an asset at a specific price with delivery at a specified future point in time. Which combination of characteristics is true for a futures contract?

(Short Answer)

4.8/5  (34)

(34)

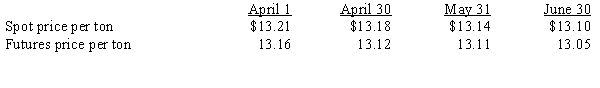

During the second quarter of 20X5, Bertke Company entered into a futures contract that calls for the sale of 2,500 tons of soybean meal in July at a future price of $13.26 per ton. Bertke Company designated the contract as a hedge on a forecasted sale of soybean meal. The changed in the time value of the futures contract is excluded from the assessment of hedge effectiveness. The information regarding the contract and soybean meal is as follows:  Required:

Prepare a schedule to show the effect of this hedge on current earnings of Bertke Company.

Required:

Prepare a schedule to show the effect of this hedge on current earnings of Bertke Company.

(Essay)

5.0/5  (44)

(44)

A hedge to avoid the potential unfavorable effects of changing prices associated with all of the following would qualify for special fair value hedge accounting except:

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is not true regarding using an option to hedge financial risks versus a forward contract?

(Multiple Choice)

4.8/5  (32)

(32)

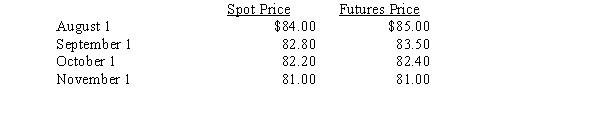

On August 1, an oil producer decided to hedge the fair value of its inventory by acquiring a futures contract to sell 100,000 barrels of oil on November 1 for $85.00 each. Price data follow:  What is the current period change in time value that would be recognized in earnings as of October 1?

What is the current period change in time value that would be recognized in earnings as of October 1?

(Multiple Choice)

4.7/5  (36)

(36)

A fair value hedge may be used for all of the following except:

(Multiple Choice)

4.8/5  (39)

(39)

The difference between the strike price of an option and spot price of the item being hedge at any one time represents the option's:

(Multiple Choice)

4.8/5  (34)

(34)

On May 11, McElroy Inc. purchased a call option on 5,000 bushels of wheat with delivery on August 31 for a premium of $750. The strike price is $1.85 per bushel. The values of the option at the end of May and June are $790 and $810, respectively. The option is sold on July 26 for $804. McElroy Inc. prepares quarterly and annual financial statements. Its year end is June 30. McElroy Inc. will

(Multiple Choice)

4.9/5  (39)

(39)

Identify the various types of information that should be included in disclosures regarding derivative instruments and hedging.

(Essay)

4.8/5  (33)

(33)

Under special accounting treatment for cash flow hedge of a forecasted transaction, the relationship between the change in value of a derivative instrument and the change in value of the forecasted transaction affects the amount of gain(loss) that should be in Other Comprehensive Income (OCI). If the amount of gain on derivatives that is classified as OCI is $17,500 and the cumulative loss on the remaining forecasted transaction is ($13,200), the amount of OCI to be reclassified as a component of current earnings is

(Multiple Choice)

4.9/5  (30)

(30)

With respect to derivative instruments that are designated as hedges, the FASB calls for which of the following general disclosures?

(Multiple Choice)

4.8/5  (33)

(33)

In order for a fair value hedge to receive special accounting treatment, the

(Multiple Choice)

4.8/5  (37)

(37)

Forward contracts are contracts to buy or sell a specified amount of an asset at a specified, fixed price with delivery at a specified future point in time. Which of the following is true about these contracts?

(Multiple Choice)

4.9/5  (28)

(28)

Showing 1 - 20 of 45

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)