Exam 4: Recognizing Revenues in Governmental Funds

Exam 1: The Government and Not-For-Profit Environment50 Questions

Exam 2: Fund Accounting50 Questions

Exam 3: Issues of Budgeting and Control50 Questions

Exam 4: Recognizing Revenues in Governmental Funds62 Questions

Exam 5: Recognizing Expenditures in Governmental Funds67 Questions

Exam 6: Accounting for Capital Projects and Debt Service69 Questions

Exam 7: Capital Assets and Investments in Marketable Securities58 Questions

Exam 8: Long-Term Obligations53 Questions

Exam 9: Business-Type Activities66 Questions

Exam 10: Pensions and Other Fiduciary Activities64 Questions

Exam 11: Issues of Reporting, Disclosure, and Financial Analysis68 Questions

Exam 12: Not-For-Profit Organizations63 Questions

Exam 13: Colleges and Universities39 Questions

Exam 14: Health Care Providers47 Questions

Exam 15: Managing for Results50 Questions

Exam 16: Auditing Governments and Notforprofit Organizations59 Questions

Exam 17: Federal Government Accounting66 Questions

Select questions type

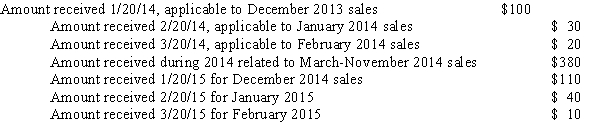

A city levies a 2 percent sales tax that is collected for them by the state.Sales taxes must be remitted by the merchants to the state by the 20th day of the month following the month in which the sale occurred.The state has a policy of remitting sales taxes to the city within 30 days of collection by the state.Cash received by the state related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/14?

(Multiple Choice)

4.7/5  (37)

(37)

Showing 61 - 62 of 62

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)