Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

What is the purpose of an adjusted trial balance? What type

(s) of error does it detect? What type

(s) of error does it not detect?

(Essay)

4.8/5  (39)

(39)

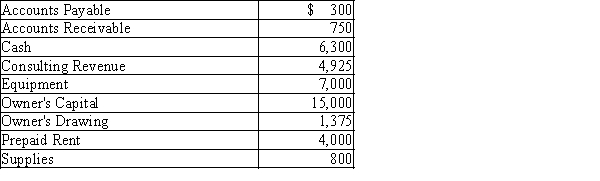

Jordon James started JJJ Consulting on January 1. The following are the account balances at the end of the first month of business, before adjusting entries were recorded:  Adjustment data:Supplies on hand at the end of the month, $200Unbilled consulting revenue, $700Rent expense for the month, $1,000Depreciation on equipment, $90

(a) Prepare the required adjusting entries, adding accounts as needed.

(b) Prepare an adjusted trial balance for JJJ Consulting as of January 31.

Adjustment data:Supplies on hand at the end of the month, $200Unbilled consulting revenue, $700Rent expense for the month, $1,000Depreciation on equipment, $90

(a) Prepare the required adjusting entries, adding accounts as needed.

(b) Prepare an adjusted trial balance for JJJ Consulting as of January 31.

(Essay)

4.7/5  (25)

(25)

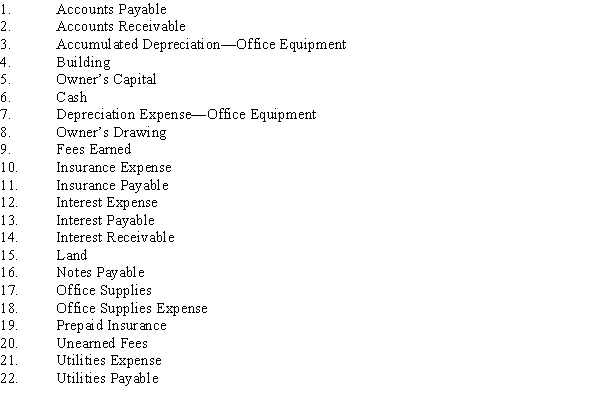

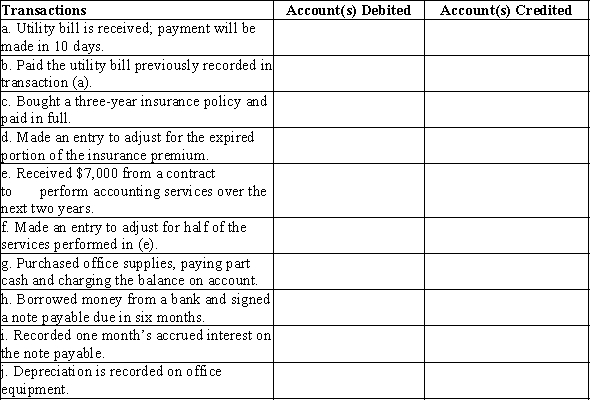

Listed below are accounts to use for transactions

(a) through

(j), each identified by a number. Following this list are the transactions. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number (s) in the appropriate box.?  ?

?

(Essay)

4.8/5  (27)

(27)

List the four basic types of accounts that require adjusting entries and give an example of each.

(Essay)

4.8/5  (27)

(27)

The adjusting entry for gym memberships earned that were previously recorded in the unearned gym memberships account is

(Multiple Choice)

4.8/5  (33)

(33)

If there is a balance in the prepaid rent account after adjusting entries are made, it represents a (n)

(Multiple Choice)

4.7/5  (44)

(44)

If the debit portion of an adjusting entry is to an asset account, then the credit portion must be to a liability account.

(True/False)

4.8/5  (32)

(32)

How will the following adjusting journal entry affect the accounting equation? Unearned Subscription Revenue 11,500 Subscription Revenue 11,500

(Multiple Choice)

4.8/5  (40)

(40)

Classify the following items as:

(1) prepaid expense,

(2) unearned revenue,

(3) accrued expense, or

(4) accrued revenue.a) Fees received but not yet earnedb) Fees earned but not yet receivedc) Paid premium on a one-year insurance policyd) Property tax owed to be paid beginning of next year

(Essay)

4.8/5  (46)

(46)

Indicate whether the following error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much.The adjustment for accrued fees of $1,170 was journalized as a debit to Accounts Receivable for $1,170 and a credit to Fees Earned for $1,107.

(Essay)

5.0/5  (37)

(37)

Adjusting entries affect balance sheet accounts to the exclusion of income statement accounts.

(True/False)

4.8/5  (30)

(30)

Bloom's Company pays biweekly salaries of $40,000 every other Friday for a 10-day period ending on that day. The last payday of December is Friday, December 27. Assuming the next pay period begins on Monday, December 30, journalize the adjusting entry necessary at the end of the fiscal period

(December 31). Date Description Post. Ref. Debit Credit

(Essay)

4.7/5  (27)

(27)

For each of the following, journalize the necessary adjusting entry:

(a)A business pays weekly salaries of $22,000 on Friday for a five-day week ending on that day. Journalize the necessary adjusting entry at the end of the fiscal period, assuming that the fiscal period ends

(1) on Tuesday or

(2) on Wednesday.

(b)The balance in the prepaid insurance account before adjustment at the end of the year is $18,000. Journalize the adjusting entry required under each of the following alternatives:

(1) the amount of insurance expired during the year is $5,300 or

(2) the amount of unexpired insurance applicable to a future period is $2,700.

(c)On July 1 of the current year, a business pays $54,000 to the city for license taxes for the coming fiscal year. The same business is also required to pay an annual property tax at the end of the year. The estimated amount of the current year's property tax allocated to July is $4,800.

(1) Journalize the two adjusting entries required to bring the accounts affected by the taxes up to date as of July 31.

(2) What is the amount of tax expense for July?

(d)The estimated depreciation on equipment for the year is $32,000.

(Essay)

4.7/5  (44)

(44)

Accumulated Depreciation and Depreciation Expense are classified, respectively, as

(Multiple Choice)

4.7/5  (29)

(29)

The supplies account had a beginning balance of $1,750. Supplies purchased during the period totaled $3,500. At the end of the period before adjustment, $350 of supplies was on hand. Prepare the adjusting entry for supplies.

(Essay)

4.9/5  (38)

(38)

If the effect of the credit portion of an adjusting entry is to increase the balance of a liability account, which of the following describes the effect of the debit portion of the entry?

(Multiple Choice)

4.8/5  (33)

(33)

If there is a balance in the unearned subscriptions account after adjusting entries are made, it represents a (n)

(Multiple Choice)

4.9/5  (34)

(34)

As time passes, fixed assets other than land lose their capacity to provide useful services. To account for this decrease in usefulness, the cost of fixed assets is systematically allocated to expense through a process called

(Multiple Choice)

4.8/5  (27)

(27)

Generally accepted accounting principles require the accrual basis of accounting.

(True/False)

4.8/5  (34)

(34)

Showing 41 - 60 of 209

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)