Exam 16: Statement of Cash Flows

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

For each of the following activities that may take place during the accounting period, indicate the effect (a-g) on the statement of cash flows prepared using the indirect method. Choices may be selected as the answer for more than one question.

-Exchange of land for common stock

Free

(Multiple Choice)

4.9/5  (31)

(31)

Correct Answer:

G

In calculating cash flows from operating activities using the indirect method, a gain on the sale of equipment is

Free

(Multiple Choice)

4.9/5  (35)

(35)

Correct Answer:

B

Cash receipts received from the issuance of a mortgage notes payable would be classified as a (n)

Free

(Multiple Choice)

4.7/5  (41)

(41)

Correct Answer:

D

Depreciation on factory equipment would be reported in the statement of cash flows prepared by the indirect method in

(Multiple Choice)

4.8/5  (29)

(29)

The operating cash flow available for company use after purchasing the fixed assets that are necessary to maintain current productive capacity is called the

(Multiple Choice)

4.8/5  (40)

(40)

Under the indirect method, expenses that do not affect cash are added to net income in the operating activities section of the statement of cash flows.

(True/False)

4.7/5  (28)

(28)

A corporation uses the indirect method for preparing the statement of cash flows. A fixed asset has been sold for $25,000 representing a gain of $4,500. The value in the operating activities section regarding this event would be

(Multiple Choice)

4.9/5  (28)

(28)

To determine cash payments for merchandise for the statement of cash flows using the direct method, a decrease in accounts payable is added to the cost of merchandise sold.

(True/False)

5.0/5  (33)

(33)

On the statement of cash flows, the Cash flows from financing activities section would include

(Multiple Choice)

4.7/5  (37)

(37)

Land costing $140,000 was sold for $173,000 cash. The gain on the sale was reported on the income statement as other income. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?

(Multiple Choice)

4.8/5  (32)

(32)

Under the direct method of reporting cash flows from operations, the primary source of cash is cash received from customers.

(True/False)

4.9/5  (41)

(41)

Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method?

(Multiple Choice)

4.8/5  (34)

(34)

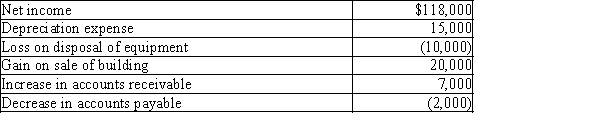

Kennedy, Inc. reported the following data:?  Prepare the Cash flows from operating activities section of the statement of cash flows using the indirect method.

Prepare the Cash flows from operating activities section of the statement of cash flows using the indirect method.

(Essay)

4.8/5  (29)

(29)

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported.

-Loss on sale of equipment

(Multiple Choice)

4.8/5  (44)

(44)

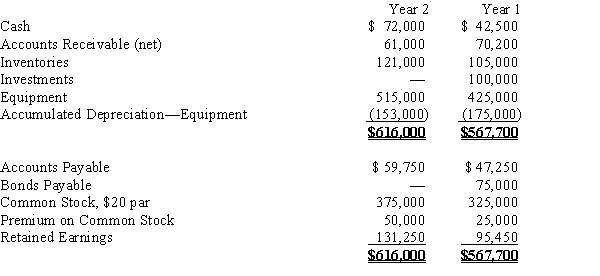

The comparative balance sheets of Barry Company, for Years 1 and 2 ended December 31, appear below in condensed form.  Additional data for the current year are as follows:

(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

Additional data for the current year are as follows:

(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

(Essay)

4.9/5  (41)

(41)

The direct method of preparing the operating activities section of the statement of cash flows reports major classes of cash receipts and cash payments related to the day-to-day operations of the business.

(True/False)

4.9/5  (31)

(31)

Accounts receivable from sales to customers amounted to $40,000 and $32,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $110,000. Exclusive of the effect of other adjustments, the net cash flows from operating activities to be reported on the statement of cash flows using the indirect method is

(Multiple Choice)

4.8/5  (25)

(25)

Cash flows from operating activities, as part of the statement of cash flows, include cash transactions that enter into the determination of net income.

(True/False)

4.9/5  (44)

(44)

Firefly Inc. sold land for $225,000 cash. The land had been purchased five years earlier for $275,000. The loss on the sale was reported on the income statement. On the statement of cash flows, what amount should Firefly report as an investing activity from the sale of the land?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 1 - 20 of 189

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)