Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

Match each definition that follows with the term (a-e) it defines.

-Includes manufacturing costs plus selling and administrative expenses

Free

(Multiple Choice)

4.9/5  (35)

(35)

Correct Answer:

B

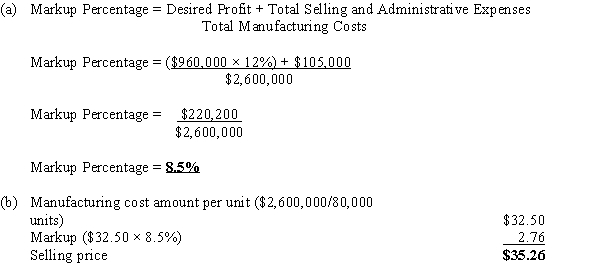

Goshawks Co. produces an automotive product and incurs total manufacturing costs of $2,600,000 in the production of 80,000 units. The company desires to earn a profit equal to a 12% rate of return on assets of $960,000. Total selling and administrative expenses are $105,000.

(a)Calculate the markup percentage, using the product cost concept.

(b)Compute the selling price per unit of the automotive product.Round the markup percentage to one decimal place, and other intermediate calculations and final answer to two decimal places.

Free

(Essay)

4.8/5  (32)

(32)

Correct Answer:

Activity-based costing is determined by charging products for only the services

(activities) they used during production.

Free

(True/False)

4.8/5  (31)

(31)

Correct Answer:

True

Differential revenue is the amount of increase or decrease in revenue expected from a particular course of action as compared with an alternative.

(True/False)

4.9/5  (40)

(40)

Use this information for Swan Company to answer the questions that follow.

Swan Company produces a product at a total cost of $43 per unit. Of this amount, $8 per unit is selling and administrative costs. The total variable cost is $30 per unit, and the desired profit is $20 per unit.

-What is the activity rate for production setup?

(Multiple Choice)

4.8/5  (22)

(22)

The lowest contribution margin per scarce resource is the most profitable.

(True/False)

4.9/5  (30)

(30)

What is the differential cost from the acceptance of the offer?

(Multiple Choice)

4.7/5  (32)

(32)

Crane Company's Division B recorded sales of $360,000, variable cost of goods sold of $315,000, variable selling expenses of $13,000, and fixed costs of $61,000; creating a loss from operations of $29,000. Determine the differential income or loss from the sales of Division B. Should this division be discontinued?

(Essay)

4.8/5  (41)

(41)

Cost-plus methods determine the normal selling price by estimating a cost amount per unit and adding a markup.

(True/False)

4.9/5  (28)

(28)

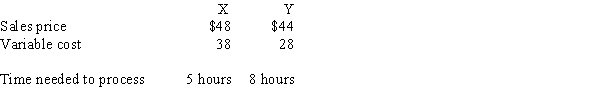

Peyton Company manufactures Phone X and Phone Y. Peyton can sell all it can make of either. Based on the following data, assuming the number of hours is a constraint, which statement is true?

(Multiple Choice)

4.8/5  (30)

(30)

Farris Company is considering a cash outlay of $500,000 for the purchase of land, which it could lease out for $40,000 per year. If alternative investments that yield a 15% return are available, the opportunity cost of the purchase of the land is

(Multiple Choice)

4.9/5  (33)

(33)

Delaney Company is considering replacing equipment that originally cost $600,000 and that has $420,000 accumulated depreciation to date. A new machine will cost $790,000, and the old equipment can be sold for $8,000. What is the sunk cost in this situation?

(Multiple Choice)

4.8/5  (31)

(31)

Product J is one of the many products manufactured and sold by Oceanside Company. An income statement by product line for the past year indicated a net loss for Product J of $12,250. This net loss resulted from sales of $260,000, cost of goods sold of $186,500, and operating expenses of $85,750. It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 40% of the operating expense is fixed. If Product J is retained, the revenue, costs, and expenses are not expected to change significantly from those of the current year. Because of the large number of products manufactured, the total fixed costs and expenses are not expected to decline significantly if Product J is discontinued.Prepare a differential analysis report, dated February 8 of the current year, on the proposal to discontinue Product J.

(Essay)

4.8/5  (32)

(32)

Ptarmigan Company produces two products. Product A has a contribution margin of $20 and requires 4 machine hours. Product B has a contribution margin of $18 and requires 3 machine hours. Determine the most profitable product assuming the machine hours are the constraint.

(Essay)

4.9/5  (33)

(33)

In using the total cost concept of applying the cost-plus approach to product pricing, selling expenses, administrative expenses, and profit are covered in the markup.

(True/False)

4.9/5  (33)

(33)

Use this information for Mallard Corporation to answer the questions that follow.

Mallard Corporation uses the product cost concept of product pricing. Below is the cost information for the production and sale of 45,000 units of its sole product. Mallard desires a profit equal to a 12% rate of return on invested assets of $800,000.

Fixed factory overhead cost \ 82,000 Fixed selling and administrative costs 45,000 Variable direct materials cost per unit 5.50 Variable direct labor cost per unit 7.65 Variable factory overhead cost per unit 2.25 Variable selling and administrative cost per unit 0.90

-The dollar amount of the desired profit from the production and sale of the company's product is

(Multiple Choice)

4.8/5  (38)

(38)

Use this information for Magpie Corporation to answer the questions that follow.

Magpie Corporation uses the total cost concept of product pricing. Below is the cost information for the production and sale of 60,000 units of its sole product. Magpie desires a profit equal to a 25% rate of return on invested assets of $700,000.

Fixed factory overhead cost \ 38,700 Fixed selling and administrative costs 7,500 Variable direct materials cost per unit 4.60 Variable direct labor cost per unit 1.88 Variable factory overhead cost per unit 1.13 Variable selling and administrative cost per unit 4.50

-The cost per unit for the production and sale of the company's product is

(Multiple Choice)

4.8/5  (45)

(45)

Keating Co. is considering disposing of equipment with a cost of $50,000 and accumulated depreciation of $40,000. Keating Co. can sell the equipment through a broker for $25,000, less a 5% broker commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $48,750. Keating will incur repair, insurance, and property tax expenses estimated at $8,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is

(Multiple Choice)

4.7/5  (35)

(35)

Use this information for Mallard Corporation to answer the questions that follow.

Mallard Corporation uses the product cost concept of product pricing. Below is the cost information for the production and sale of 45,000 units of its sole product. Mallard desires a profit equal to a 12% rate of return on invested assets of $800,000.

Fixed factory overhead cost \ 82,000 Fixed selling and administrative costs 45,000 Variable direct materials cost per unit 5.50 Variable direct labor cost per unit 7.65 Variable factory overhead cost per unit 2.25 Variable selling and administrative cost per unit 0.90

-The cost per unit for the production of the company's product is

(Multiple Choice)

4.8/5  (36)

(36)

Showing 1 - 20 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)