Exam 21: Cost-Volume-Profit Analysis

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

Match the following terms (a-e) with their definitions.

-Plots only the difference between total sales and total costs

(Multiple Choice)

4.9/5  (31)

(31)

Match the following terms (a-e) with their definitions.

-Indicates the possible decrease in sales that may occur before operating loss results

(Multiple Choice)

4.9/5  (31)

(31)

Use this information for Timmer Corporation to answer the questions that follow.

Timmer Corporation just started business in January. There were no beginning inventories. During the year, it manufactured 12,000 units of product and sold 10,000 units. The selling price of each unit was $20. Variable manufacturing costs were $4 per unit, and variable selling and administrative costs were $2 per unit. Fixed manufacturing costs were $24,000, and fixed selling and administrative costs were $6,000.

-What would Timmer's net income be for the year using variable costing?

(Multiple Choice)

4.7/5  (38)

(38)

If fixed costs are $600,000 and the unit contribution margin is $40, what is the break-even point if fixed costs are increased by $90,000?

(Multiple Choice)

4.9/5  (40)

(40)

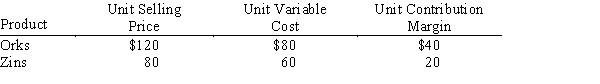

Safari Co. sells two products, orks and zins. Last year, Safari sold 21,000 units of orks and 14,000 units of zins. Related data are as follows:?  ?Calculate the following:

a. Safari Co.'s sales mix

b. Safari Co.'s unit selling price of E

c. Safari Co.'s unit contribution margin of E

d. Safari Co.'s break-even point assuming that last year's fixed costs were $160,000

?Calculate the following:

a. Safari Co.'s sales mix

b. Safari Co.'s unit selling price of E

c. Safari Co.'s unit contribution margin of E

d. Safari Co.'s break-even point assuming that last year's fixed costs were $160,000

(Essay)

4.9/5  (31)

(31)

The fixed cost per unit varies with changes in the level of activity.

(True/False)

4.8/5  (30)

(30)

A business had a margin of safety ratio of 20%, variable costs of 75% of sales, fixed costs of $240,000, a break-even point of $960,000, and operating income of $60,000 for the current year. Calculate the current year's sales.

(Essay)

4.8/5  (36)

(36)

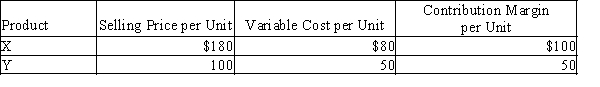

Steven Company has fixed costs of $160,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below.?  The sales mix for products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. If required, round answer to nearest whole number.

The sales mix for products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. If required, round answer to nearest whole number.

(Essay)

4.8/5  (34)

(34)

If fixed costs are $500,000, the unit selling price is $55, and the unit variable costs are $30, what are the break-even sales (units) if fixed costs are increased by $80,000?

(Multiple Choice)

4.7/5  (33)

(33)

If the property tax rates are increased, this change in fixed costs will result in a decrease in the break-even point.

(True/False)

4.8/5  (27)

(27)

If sales are $400,000, variable costs are 80% of sales, and operating income is $40,000, what is the operating leverage?

(Multiple Choice)

4.8/5  (34)

(34)

Gladstorm Enterprises sells a product for $60 per unit. The variable cost is $20 per unit, while fixed costs are $85,000. Determine the

(a) break-even point in sales units and

(b) break-even point in sales units if the selling price increased to $80 per unit. Round your answer to the nearest whole number.

(Essay)

4.8/5  (39)

(39)

Assuming that last year's fixed costs totaled $675,000, what was Rusty Co.'s break-even point in units?

(Multiple Choice)

4.8/5  (34)

(34)

The dollars available from each unit of sales to cover fixed cost and profit are the unit variable cost.

(True/False)

4.9/5  (34)

(34)

Cost-volume-profit analysis cannot be used if which of the following occurs?

(Multiple Choice)

4.7/5  (39)

(39)

Consider the following:

?Variable cost as a percentage of sales = 60%

Unit variable cost = $30

Fixed costs = $200,000

?What is the break-even point in units? If required, round answer to nearest whole number.

(Essay)

4.9/5  (38)

(38)

For the coming year, River Company estimates fixed costs at $109,000, the unit variable cost at $21, and the unit selling price at $85. Determine

(a) the break-even point in units of sales,

(b) the unit sales required to realize operating income of $150,000 and

(c) the probable operating income if sales total $500,000.?Round units to the nearest whole number and percentage to one decimal place.

(Essay)

4.9/5  (31)

(31)

If fixed costs are $1,200,000, the unit selling price is $240, and the unit variable costs are $110, what is the amount of sales in units (rounded to a whole number) required to realize an operating income of $200,000?

(Multiple Choice)

4.8/5  (41)

(41)

Showing 81 - 100 of 225

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)