Exam 19: Job Order Costing

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

Aspen Technologies has the following budget data:? Estimated direct labor hours 15,000 Estimated direct labor dollars \ 90,000 Estimated factory overhead costs \ 198,000 If factory overhead is to be applied based on direct labor hours, the predetermined overhead rate is

(Multiple Choice)

4.7/5  (32)

(32)

Which of the following is the formula to calculate the predetermined factory overhead rate?

(Multiple Choice)

4.9/5  (40)

(40)

Winston Company estimates that the factory overhead for the following year will be $1,250,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 50,000 hours. The total machine hours for the year were 54,300. The actual factory overhead costs for the year were $1,375,000. Determine the over- or underapplied amount for the year.

(Multiple Choice)

4.8/5  (34)

(34)

Nonmanufacturing costs are generally classified into two categories: selling and administrative.

(True/False)

4.8/5  (43)

(43)

Match each of the following phrases with the term (a-e) that it most closely describes it. Each term will be used only once.

-Serve as the basis for recording materials used

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following costs are not included in finished goods inventory?

(Multiple Choice)

4.8/5  (32)

(32)

Cavy Company estimates that the factory overhead for the following year will be $1,470,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 40,000 hours. The machine hours for the month of April for all of the jobs were 4,780. Prepare the journal entry to apply factory overhead.

(Essay)

4.9/5  (31)

(31)

In a job order cost accounting system used by a service business, which of the following items would normally not be included as part of overhead?

(Multiple Choice)

4.8/5  (34)

(34)

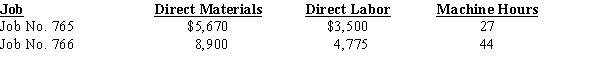

At the end of April, Cavy Company had completed Jobs 766 and 765. The individual job cost sheets reveal the following information:  Job 765 produced 152 units, and Job 766 consisted of 250 units.Assuming that the predetermined overhead rate is applied by using machine hours at a rate of $200 per hour, determine the

(a) balance on the job cost sheets for each job and

(b) the cost per unit at the end of April.

Job 765 produced 152 units, and Job 766 consisted of 250 units.Assuming that the predetermined overhead rate is applied by using machine hours at a rate of $200 per hour, determine the

(a) balance on the job cost sheets for each job and

(b) the cost per unit at the end of April.

(Essay)

4.9/5  (33)

(33)

On May 15, the Stamping Department accepted Job 051507A to make 1,000 funnels. Materials requisitioned were 1,100 sheets at $1.20 per sheet and 1,150 grommets at $0.15 per set. The cost driver used by the Stamping Department is the drop-forge strokes indicated by a machine-mounted counter. Overhead is applied at $2.25 for each drop-forge stroke. Additionally, $375 of overhead is applied to each job due to setup and tear down. Direct labor is applied at $22.50 per hour for the machine operator and $11.10 for the machine loader. The job required 6.5 hours of labor.?Upon completion, the job was transferred to finished goods inventory.?Journalize all events as of May 15.

(Essay)

4.9/5  (37)

(37)

The debit to Factory Overhead for the cost of indirect materials is obtained from the summary of the materials requisitions.

(True/False)

4.7/5  (34)

(34)

Generally accepted accounting principles require companies to use only one factory overhead rate for product costing.

(True/False)

4.8/5  (38)

(38)

Match the costs that follow to the type of product cost (a-c) or designate as not a product cost (d).

-Maintenance supplies

(Multiple Choice)

4.9/5  (28)

(28)

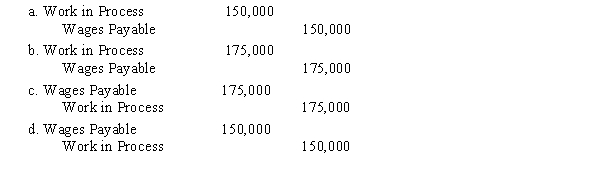

During the period, labor costs incurred on account amounted to $175,000, including $150,000 for production orders and $25,000 for general factory use. In addition, factory overhead charged to production was $32,000. The entry to record the direct labor costs is

(Short Answer)

4.9/5  (33)

(33)

Showing 181 - 195 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)