Exam 17: Financial Statement Analysis

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

A change from one acceptable accounting method to another is reported

(Multiple Choice)

4.8/5  (29)

(29)

A company with working capital of $720,000 and a current ratio of 2.2 pays a $125,000 short-term liability. The amount of working capital immediately after payment is

(Multiple Choice)

4.9/5  (32)

(32)

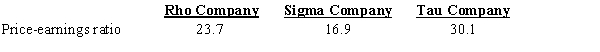

Rho, Sigma, and Tau companies have the following data for the current year:  Which company would be expected to have the best potential for future common stock price appreciation?

Which company would be expected to have the best potential for future common stock price appreciation?

(Essay)

4.7/5  (32)

(32)

Assume the following sales data for a company:?? Current year \ 325,000 Preceding year 250,000 What is the percentage increase in sales from the preceding year to the current year?

(Multiple Choice)

4.8/5  (30)

(30)

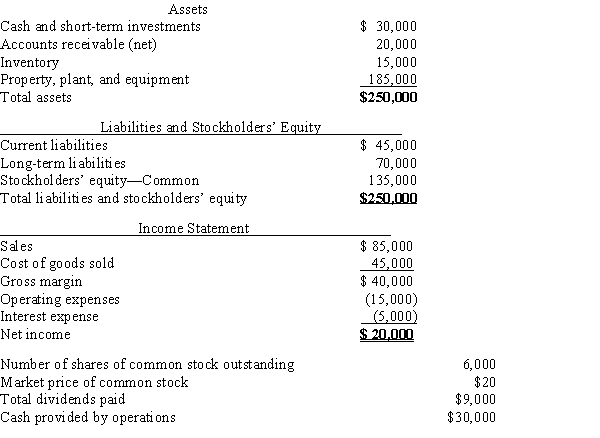

The following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Use this information to answer the questions that follow.

-Using the data provided for Diane Company, what is the return on total assets?

-Using the data provided for Diane Company, what is the return on total assets?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following is not included in the computation of the quick ratio?

(Multiple Choice)

4.8/5  (35)

(35)

A balance sheet shows cash, $75,000; marketable securities, $115,000; receivables, $150,000; and inventories, $222,500. Current liabilities are $225,000. The current ratio is 2.5.

(True/False)

4.9/5  (35)

(35)

If the accounts receivable turnover for the current year has decreased when compared with the ratio for the preceding year, there has been an acceleration in the collection of receivables.

(True/False)

4.8/5  (42)

(42)

The excess of current assets over current liabilities is referred to as working capital.

(True/False)

4.8/5  (38)

(38)

The relationship of each asset item as a percent of total assets is an example of vertical analysis.

(True/False)

4.9/5  (32)

(32)

In a company's annual report, the section called Management Discussion and Analysis provides critical information for interpreting the financial statements and assessing the future of the company.

(True/False)

4.8/5  (34)

(34)

On a common-sized income statement, all items are stated as a percent of total assets or equities at year-end.

(True/False)

4.7/5  (33)

(33)

Assume the following sales data for a company:Current year$1,025,000Preceding year820,000What is the percentage increase in sales from the preceding year to the current year?

(Multiple Choice)

4.7/5  (38)

(38)

Match each definition that follows with the term (a-h) it defines.

-Useful for comparing one company to another or to industry averages

(Multiple Choice)

4.7/5  (34)

(34)

Match each ratio that follows to its use (items a-h). Items may be used more than once.

-Asset turnover ratio

(Multiple Choice)

5.0/5  (35)

(35)

Ratios and various other analytical measures are not a substitute for sound judgment, nor do they provide definitive guides for action.

(True/False)

4.8/5  (35)

(35)

An analysis in which all the components of an income statement are expressed as a percentage of sales is a

(Multiple Choice)

4.9/5  (30)

(30)

Showing 61 - 80 of 201

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)