Exam 13: Corporations: Organization, Stock Transactions, and Dividends

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

Match each of the following stockholders' equity concepts to the appropriate term (a-h).

-Account used when shares are issued for an amount greater than par value

(Multiple Choice)

4.9/5  (32)

(32)

A corporation has 50,000 shares of $25 par stock outstanding that has a current market value of $150 per share. If the corporation issues a 5-for-1 stock split, the market value of the stock after the split will be approximately

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following would appear as a prior period adjustment?

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following is not a characteristic of a corporation?

(Multiple Choice)

4.9/5  (28)

(28)

On April 10, Maranda Corporation issued for cash 11,000 shares of no-par common stock at $25. On May 5, Maranda issued at par 1,000 shares of 4%, $50 par preferred stock for cash. On May 25, Maranda issued for cash 15,000 shares of 4%, $50 par preferred stock at $55.Journalize the entries to record the April 10, May 5, and May 25 transactions.

(Essay)

4.8/5  (30)

(30)

On May 1, 10,000 shares of $10 par common stock were issued at $30, and on May 7, 5,000 shares of $50 par preferred stock were issued at $111. Journalize the entries for May 1 and May 7.

(Essay)

4.8/5  (29)

(29)

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:Year 1$10,000Year 245,000Year 390,000Determine the dividends per share for preferred and common stock for the third year.

(Multiple Choice)

4.8/5  (40)

(40)

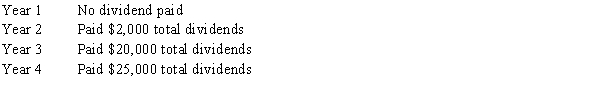

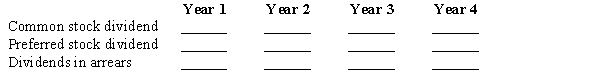

On January 1, Year 1, a company had the following transactions:Issued 10,000 shares of $2 par common stock for $12 per share.Issued 3,000 shares of $50 par, 6% cumulative preferred stock for $70 per share.Purchased 1,000 shares of previously issued common stock for $15 per share.The company had the following dividend information available:  Using the following format, fill in the correct values for each year:

Using the following format, fill in the correct values for each year:

(Essay)

4.7/5  (31)

(31)

A corporation has 50,000 shares of $28 par stock outstanding that has a current market value of $150 per share. If the corporation issues a 4-for-1 stock split, the market value of the stock will fall to approximately

(Multiple Choice)

4.8/5  (40)

(40)

One of the main disadvantages of the corporate form is the

(Multiple Choice)

4.9/5  (42)

(42)

Match each of the following stockholders' equity concepts to the most appropriate term (a-h).

-A class of stock having first rights to dividends of a corporation

(Multiple Choice)

4.8/5  (38)

(38)

Under the cost method, when treasury stock is purchased by the corporation, the par value and the price at which the stock was originally issued are important.

(True/False)

4.8/5  (34)

(34)

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 10,000 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2-per-share dividend is declared?

(Multiple Choice)

4.7/5  (24)

(24)

Assume that retained earnings had a beginning balance of $75,000. Match the following amounts to the appropriate term (a-h).

-Retained Earnings = Beginning Retained Earnings + Net Income + Ending Retained Earnings - Cash Dividends = $75,000 + $200,000 - $40,000 = $235,000

(Multiple Choice)

4.9/5  (42)

(42)

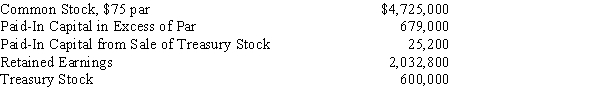

Using the following information, prepare the Stockholders' equity section of the balance sheet. Seventy thousand shares of common stock are authorized and 7,000 shares have been reacquired.

(Essay)

4.8/5  (27)

(27)

The two main sources of stockholders' equity are investments contributed by stockholders and net income retained in the business.

(True/False)

4.9/5  (32)

(32)

A prior period adjustment should be reported as an adjustment to the retained earnings balance at the beginning of the period in which the adjustment was made.

(True/False)

4.9/5  (39)

(39)

A company with 100,000 authorized shares of $4 par common stock issued 40,000 shares at $8. Subsequently, the company declared a 2% stock dividend on a date when the market price was $11 per share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend?

(Multiple Choice)

4.7/5  (26)

(26)

A corporation was organized on January 1 of the current year, with an authorization of 20,000 shares of 4%, $12 par preferred stock, and 100,000 shares of $3 par common stock.The following selected transactions were completed during the first year of operations:Jan. 3Issued 15,000 shares of common stock at $23 per share for cash.31Issued 200 shares of common stock to an attorney in payment of legal fees for organizing the corporation. The value of the stock at the time of payment was $25 per share.Feb. 24Issued 20,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $65,000, $120,000, and $45,000, respectively.Mar. 15Issued 2,000 shares of preferred stock at $56 for cash.Journalize the transactions.

(Essay)

4.8/5  (37)

(37)

Showing 121 - 140 of 217

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)