Exam 7: Internal Control and Cash

Exam 1: Accounting in Business219 Questions

Exam 2: Analyzing and Recording Transactions122 Questions

Exam 3: Adjusting Accounts for Financial Statements191 Questions

Exam 4: Completing the Accounting Cycle and Classifying Accounts63 Questions

Exam 5: Accounting for Merchandising Activities123 Questions

Exam 6: Inventory Costing and Valuation148 Questions

Exam 7: Internal Control and Cash142 Questions

Exam 8: Receivables151 Questions

Exam 9: Appendix148 Questions

Select questions type

When used to monitor and control operations, internal control systems are a low priority for managers.

(True/False)

4.9/5  (34)

(34)

Maintaining accurate records is an important internal control principle.

(True/False)

4.8/5  (36)

(36)

A bank reconciliation results in creating an adjusted bank balance as well as an adjusted book balance.

(True/False)

4.8/5  (43)

(43)

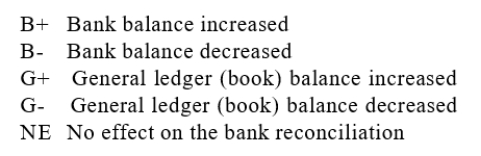

Identify how each of the following items would be treated on a bankreconciliation by entering one of the following codes in the space provided.  1. Outstanding cheques.2. Deposits in transit.3. Cheque #32, subtracted from the bank balance on last month's bank reconciliation, was returned with this month's statement.4. Included with the bank statement was a debit memo for bank servicecharges.5. Cash receipts placed in the bank's night depository after banking hours were not included on the bank statement prepared on the same date.6. Cheque #47 was written and recorded by the bank as $753. The business recorded the cheque as $735.7. A cheque listed as outstanding on last month's bank reconciliation was not returned with the current month's cancelled cheques.8. A deposit listed as outstanding on last month's bank reconciliationappeared as a deposit on the current month's bank statement.9. A credit memo enclosed with the bank statement shows that the bank collected a note on behalf of the account holder.10. A debit memo enclosed with the bank statement shows that the bankpaid a note on behalf of the account holder.

1. Outstanding cheques.2. Deposits in transit.3. Cheque #32, subtracted from the bank balance on last month's bank reconciliation, was returned with this month's statement.4. Included with the bank statement was a debit memo for bank servicecharges.5. Cash receipts placed in the bank's night depository after banking hours were not included on the bank statement prepared on the same date.6. Cheque #47 was written and recorded by the bank as $753. The business recorded the cheque as $735.7. A cheque listed as outstanding on last month's bank reconciliation was not returned with the current month's cancelled cheques.8. A deposit listed as outstanding on last month's bank reconciliationappeared as a deposit on the current month's bank statement.9. A credit memo enclosed with the bank statement shows that the bank collected a note on behalf of the account holder.10. A debit memo enclosed with the bank statement shows that the bankpaid a note on behalf of the account holder.

(Essay)

4.8/5  (46)

(46)

The Petty Cash account is a separate chequing account used for small amounts.

(True/False)

4.8/5  (36)

(36)

Identify each of the following items as either (a)cash or (b)cash equivalent._____ 1. Coins_____ 2. Petty cash_____ 3. Three-month certificate of deposit_____ 4. Currency_____ 5. Certified cheque_____ 6. Cashier's cheque_____ 7. Loose change in a coffee tin_____ 8. Money orders

(Essay)

4.8/5  (37)

(37)

Cash equivalents are short-term investments that a company invests in to increase earnings.

(True/False)

4.8/5  (35)

(35)

Preventing unauthorized access to company resources is one of the most difficult and time-consuming tasks for internal control experts.

(True/False)

4.8/5  (39)

(39)

Prenumbered printed cheques are an example of which internal control principle?

(Multiple Choice)

4.8/5  (29)

(29)

DMS offers lawn and garden maintenance services. DMS customers pay largely by cheque and submit a remittance slip with their payment, to identify thecustomer account number to which the payment is applied. Ditta Mistry is the company owner and she attended a conference on internal controls. She plans to institute stronger internal controls over customer cash receipts. What controls might Ditta introduce?

(Essay)

4.7/5  (30)

(30)

In reconciling the bank balance, an unrecorded debit memorandum for printing cheques should be:

(Multiple Choice)

4.8/5  (41)

(41)

Credit cards are seen as an advantage by businesses because the cash is normally received quicker than with other forms of extended credit.

(True/False)

4.9/5  (34)

(34)

Bonding does not discourage loss from theft because employees know that bonding is an insurance policy against loss from theft.

(True/False)

4.9/5  (42)

(42)

A properly designed internal control system is a key part of systems design, analysis, and performance.

(True/False)

4.8/5  (31)

(31)

The use of internal controls provides guaranteed protection against losses due to operating activities.

(True/False)

4.9/5  (41)

(41)

All monies disbursed from petty cash should be documented by a petty cash receipt.

(True/False)

4.9/5  (39)

(39)

Showing 81 - 100 of 142

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)