Exam 3: Adjusting Accounts for Financial Statements

Exam 1: Accounting in Business219 Questions

Exam 2: Analyzing and Recording Transactions122 Questions

Exam 3: Adjusting Accounts for Financial Statements191 Questions

Exam 4: Completing the Accounting Cycle and Classifying Accounts63 Questions

Exam 5: Accounting for Merchandising Activities123 Questions

Exam 6: Inventory Costing and Valuation148 Questions

Exam 7: Internal Control and Cash142 Questions

Exam 8: Receivables151 Questions

Exam 9: Appendix148 Questions

Select questions type

MegaTech Company has total monthly revenues of $325,000 and expenses of

$198,000 for the month ended July 31 before monthly adjusting entries are made. The following data are provided on the end of month adjustments to be made:

a. Insurance expired in July, $2,520.

b. Unbilled amounts to customers for July is $4,200.

c. Salaries earned by employees but not yet paid by MegaTech for the last week of July, $13,125.

d. Depreciation on equipment for July, $1,290.

e. Supplies used in July, $1,650.

f. Fees collected in advance from customers which have now been earned during

July, $23,400.

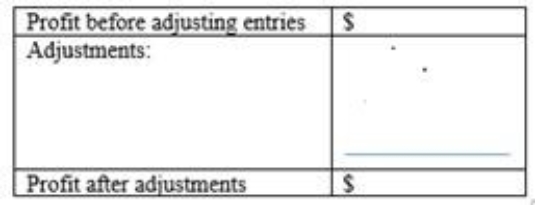

Complete the schedule below to determine the profit of MegaTech for July after these adjustments are recorded. Begin your schedule with income before

adjusting entries and then show the effect of each adjustment to arrive at profit

after adjustment.

(Essay)

4.8/5  (43)

(43)

A business pays each of its two office employees each Friday at the rate of $60 per day for a five-day week that begins on Monday. If the accounting period ends on Tuesday and the employees worked on both Monday and Tuesday, the adjusting entry to record the salaries earned but unpaid is:

(Multiple Choice)

4.9/5  (39)

(39)

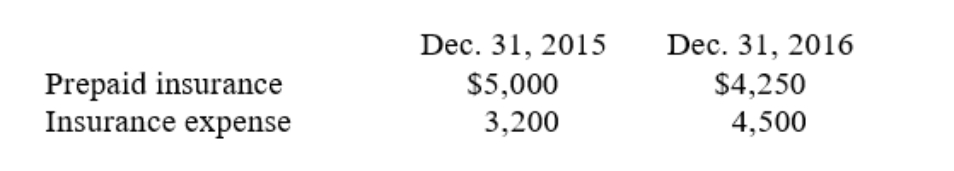

The Creative Company has several insurance policies in force with payments due atvarious times. The following information refers to prepaid insurance and insurance expense on two successive dates.  The amount of cash paid for insurance by Creative Company in 2016 was:

The amount of cash paid for insurance by Creative Company in 2016 was:

(Multiple Choice)

4.8/5  (28)

(28)

Adjusting entries are always dated at the end of the accounting period

(True/False)

4.8/5  (39)

(39)

Discuss the types of adjusting entries used for prepaid expenses, depreciation,and unearned revenues.

(Essay)

4.7/5  (38)

(38)

The adjusting entry to record the earned but unpaid salaries of employees at the end of the accounting period is:

(Multiple Choice)

4.8/5  (39)

(39)

The approach to preparing financial statements based on recognizing revenues when they are earned and matching expenses to those revenues is:

(Multiple Choice)

4.8/5  (42)

(42)

The equipment has a useful life of 8 years. Compute the book value of theequipment after the proper June adjustment has been made.

(Essay)

4.7/5  (38)

(38)

On December 31, 2015, the accountant for a proprietorship forgot to record$7,000 of depreciation on office equipment. In the 2015 financial statements, what is the effect of this error on assets, profit, and equity?

(Essay)

4.7/5  (35)

(35)

The expense created by allocating the cost of plant and equipment to the periods in which they are used, representing the expense of using the assets, is called:

(Multiple Choice)

4.8/5  (37)

(37)

A trial balance prepared before any adjustments have been recorded is

(Multiple Choice)

4.8/5  (38)

(38)

Explain the difference between the book value and the market value of an asset

(Essay)

4.8/5  (51)

(51)

A broad principle that requires identifying the activities of a business with specific time periods such as months, quarters, or years is the:

(Multiple Choice)

5.0/5  (38)

(38)

Adjusting entries are journal entries made at the end of an accounting period for the purpose of:

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following accounts is most likely to be associated with an accruedexpense?

(Multiple Choice)

4.9/5  (44)

(44)

The timeliness principle assumes that an organization's activities can be divided intospecific time periods including:

(Multiple Choice)

4.8/5  (46)

(46)

Showing 41 - 60 of 191

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)