Exam 6: Reporting and Analyzing Inventory

Exam 1: The Purpose and Use of Financial Statements105 Questions

Exam 2: A Further Look at Financial Statements129 Questions

Exam 3: The Accounting Information System145 Questions

Exam 4: Accrual Accounting Concepts134 Questions

Exam 5: Merchandising Operations159 Questions

Exam 6: Reporting and Analyzing Inventory103 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables114 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets154 Questions

Exam 10: Reporting and Analyzing Liabilities92 Questions

Exam 12: Reporting and Analyzing Investments117 Questions

Exam 13: Statement of Cash Flows123 Questions

Exam 14: Performance Measurement127 Questions

Select questions type

To accurately determine inventory quantities, a company must

(Multiple Choice)

4.9/5  (36)

(36)

If net realizable value of the inventory is lower than its cost, the total assets on the statement of financial position and net income on the statement of income will be reduced.

(True/False)

4.7/5  (40)

(40)

All three methods of inventory cost formula will produce the same cumulative cost of goods sold over the life cycle of the business.

(True/False)

4.8/5  (41)

(41)

The cost formula a company chooses should correspond as closely as possible to the actual physical flow of goods.

(True/False)

4.8/5  (26)

(26)

For 2022, Superplus Inc.reported $48,000 beginning inventory and $52,000 ending inventory.Net sales were $320,000 and gross profit was $110,000 for the same period.Based on these figures, inventory turnover for 2022 was

(Multiple Choice)

4.7/5  (31)

(31)

The consistent application of an inventory cost formula is essential for

(Multiple Choice)

4.9/5  (31)

(31)

An inventory writedown from cost to net realizable value should not be made in the period in which the price decline occurs.

(True/False)

4.9/5  (32)

(32)

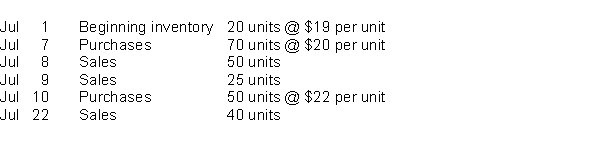

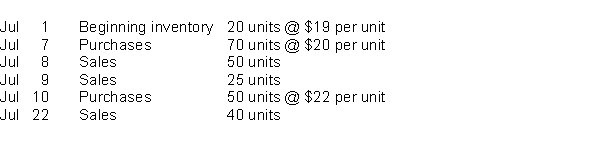

Use the following information for the month of July for questions

ABC Inc.uses the FIFO cost formula in a perpetual inventory system.

-If ABC Inc.used the average cost formula instead of FIFO, gross profit from the July 8 sale would be

-If ABC Inc.used the average cost formula instead of FIFO, gross profit from the July 8 sale would be

(Multiple Choice)

4.8/5  (34)

(34)

Consigned goods are held for sale by one party, although ownership of the goods is retained by another party.

(True/False)

4.9/5  (39)

(39)

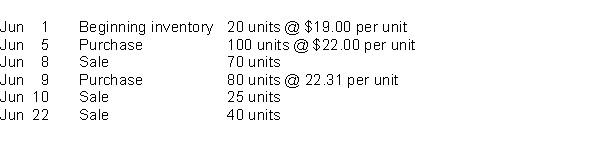

Use the following information for the month of June for questions

XYZ Inc.uses the average cost formula in a perpetual inventory system.

(Use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.)

-The cost of goods sold for the June 10 sale is

-The cost of goods sold for the June 10 sale is

(Multiple Choice)

4.9/5  (39)

(39)

The inventory cost formula that best matches cost and revenues is FIFO.

(True/False)

5.0/5  (36)

(36)

Use the following information for the month of July for questions

ABC Inc.uses the FIFO cost formula in a perpetual inventory system.

-The cost of goods sold for the July 8 sale was

-The cost of goods sold for the July 8 sale was

(Multiple Choice)

4.8/5  (41)

(41)

Mandy Corp.purchased inventory as follows:  On March 5, Mandy sold 600 units for $18 each.The average unit cost to be used for the cost of goods sold on March 5, in a perpetual inventory system, is

On March 5, Mandy sold 600 units for $18 each.The average unit cost to be used for the cost of goods sold on March 5, in a perpetual inventory system, is

(Multiple Choice)

4.9/5  (44)

(44)

A company just starting a business purchased three inventory items at the following prices: March 2, $150; March 7, $160; and March 15, $180.If the company sold one unit for $230 on March 10 and one unit for $250 on March 20 and uses the average cost formula in a perpetual inventory system, what is the cost of ending inventory?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 61 - 80 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)