Exam 6: Reporting and Analyzing Inventory

Exam 1: The Purpose and Use of Financial Statements105 Questions

Exam 2: A Further Look at Financial Statements129 Questions

Exam 3: The Accounting Information System145 Questions

Exam 4: Accrual Accounting Concepts134 Questions

Exam 5: Merchandising Operations159 Questions

Exam 6: Reporting and Analyzing Inventory103 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables114 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets154 Questions

Exam 10: Reporting and Analyzing Liabilities92 Questions

Exam 12: Reporting and Analyzing Investments117 Questions

Exam 13: Statement of Cash Flows123 Questions

Exam 14: Performance Measurement127 Questions

Select questions type

Under the lower of cost and net realizable value basis, the adjusting entry to record a decline in net realizable value below cost includes a

(Multiple Choice)

4.8/5  (43)

(43)

The selection of an appropriate inventory cost formula for a company is made by

(Multiple Choice)

4.9/5  (46)

(46)

If prices never changed, there would be no need for alternative inventory cost formulas.

(True/False)

4.7/5  (33)

(33)

Of the following businesses, which one would not be likely to use the specific identification formula for inventory costing?

(Multiple Choice)

4.9/5  (35)

(35)

Wholesome Ltd.has a days in inventory ratio of 50 and average inventory of $320,000.What is its cost of goods sold?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following statements regarding inventory cost formulas is correct?

(Multiple Choice)

4.9/5  (39)

(39)

The FIFO inventory cost formula agrees closely to the actual physical movement of goods in most businesses.

(True/False)

4.8/5  (25)

(25)

The lower of cost and net realizable value should be applied to the total inventory, rather than to individual inventory items.

(True/False)

4.8/5  (30)

(30)

The specific identification formula is desirable when a company sells a large number of low-unit-cost items.

(True/False)

4.8/5  (34)

(34)

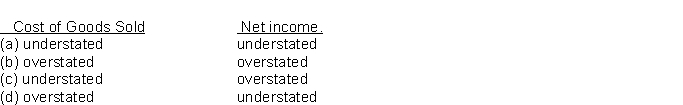

If beginning inventory is understated by $10,000, the effect of this error in the current period is

(Short Answer)

4.9/5  (35)

(35)

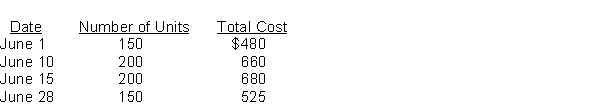

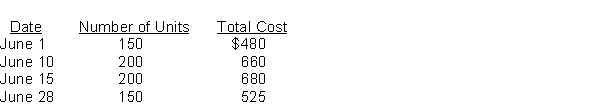

Use the following information for questions

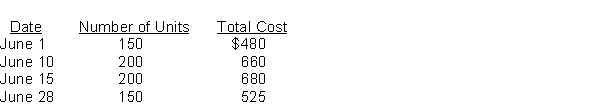

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500.The company uses a perpetual inventory system.

-Using the FIFO cost formula, the cost of the ending inventory on June 30 is

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500.The company uses a perpetual inventory system.

-Using the FIFO cost formula, the cost of the ending inventory on June 30 is

(Multiple Choice)

4.8/5  (37)

(37)

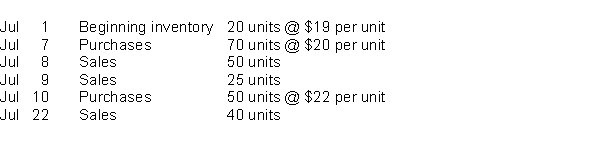

Use the following information for the month of July for questions

ABC Inc.uses the FIFO cost formula in a perpetual inventory system.

-The cost of goods sold for the July 9 sale was

-The cost of goods sold for the July 9 sale was

(Multiple Choice)

4.8/5  (37)

(37)

In a period of declining prices, which of the following inventory cost formulas generally results in the lowest inventory figure on the statement of financial position?

(Multiple Choice)

4.8/5  (37)

(37)

The inventory turnover ratio is calculated by dividing cost of goods sold by

(Multiple Choice)

4.8/5  (42)

(42)

Use the following information for questions

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500.The company uses a perpetual inventory system.

-The inventory cost formula that results in the highest gross profit for June is

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500.The company uses a perpetual inventory system.

-The inventory cost formula that results in the highest gross profit for June is

(Multiple Choice)

4.9/5  (44)

(44)

Which of the following statements regarding inventories is correct?

(Multiple Choice)

4.9/5  (42)

(42)

Use the following information for questions

A company just starting its business made the following four inventory purchases in June:

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500.The company uses a perpetual inventory system.

-Using the FIFO cost formula, the amount of the cost of goods sold for June is

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500.The company uses a perpetual inventory system.

-Using the FIFO cost formula, the amount of the cost of goods sold for June is

(Multiple Choice)

4.8/5  (34)

(34)

What is the impact on cost of goods sold, gross profit, net income before taxes and retained earnings, respectively, if inventory is understated?

(Multiple Choice)

4.9/5  (29)

(29)

Two companies report the same cost of goods available for sale but each employs a different inventory cost formula.If the price of goods has increased during the period, then the company using

(Multiple Choice)

4.9/5  (34)

(34)

Westcom Corporation's goods in transit at December 31 include (1) sales made FOB destination, (2) sales made FOB shipping point, (3) purchases made FOB destination, and (4) purchases made FOB shipping point.Which items should be included in Westcom's inventory at December 31?

(Multiple Choice)

4.7/5  (30)

(30)

Showing 41 - 60 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)