Exam 19: Cost-Volume-Profit Analysis: Additional Issues

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

Ramirez Corporation sells two types of computer hard drives. The sales mix is 30% (Q-Drive) and 70% (Q-Drive Plus). Q-Drive has variable costs per unit of $90 and a selling price of $150. Q-Drive Plus has variable costs per unit of $105 and a selling price of $195. Ramirez's fixed costs are $891,000. How many units of Q-Drive would be sold at the break-even point?

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

A

The CVP income statement classifies costs

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

A

A CVP income statement is frequently prepared for internal use by management. Describe the features of the CVP income statement that make it more useful for management decision-making than the traditional income statement that is prepared for external users.

Free

(Essay)

4.9/5  (40)

(40)

Correct Answer:

Several features of the CVP income statement make it more useful for internal decision-making. The CVP income statement classifies costs as either fixed or variable, rather than by function. Being able to identify the behavior of costs in this manner can aid management in controlling those costs.

Also, the CVP income statement shows the contribution margin, rather than a gross profit. This helps management establish the extent to which their sales are able to cover their fixed costs, and to analyze the impact on net income of changes in sales or costs.

For Sanborn Co., sales is $1,000,000, fixed expenses are $300,000, and the contribution margin per unit is $60. What is the break-even point?

(Multiple Choice)

4.9/5  (31)

(31)

The _________________________ provides a measure of a company's earnings volatility and can be used to compare companies.

(Short Answer)

4.9/5  (40)

(40)

Use the following information for questions.

Roosevelt Corporation has a weighted-average unit contribution margin of $30 for its two products, Standard and Supreme. Expected sales for Roosevelt are 40,000 Standard and 60,000 Supreme. Fixed expenses are $1,800,000.

-At the expected sales level, Roosevelt's net income will be

(Multiple Choice)

4.9/5  (32)

(32)

Reducing reliance on human workers and instead investing heavily in computers and online technology will

(Multiple Choice)

4.9/5  (44)

(44)

For Franklin, Inc., sales is $2,000,000, fixed expenses are $600,000, and the contribution margin ratio is 36%. What are the total variable expenses?

(Multiple Choice)

4.9/5  (34)

(34)

Net income can be increased or decreased by changing the sales mix.

(True/False)

4.9/5  (39)

(39)

Hinge Manufacturing's cost of goods sold is $420,000 variable and $240,000 fixed. The company's selling and administrative expenses are $300,000 variable and $360,000 fixed. If the company's sales is $1,580,000, what is its contribution margin?

(Multiple Choice)

4.8/5  (40)

(40)

Qwik Service has over 200 auto-maintenance service outlets nationwide. It provides primarily two lines of service: oil changes and brake repair. Oil change-related services represent 75% of its sales and provide a contribution margin ratio of 20%. Brake repair represents 25% of its sales and provides a 60% contribution margin ratio. The company's fixed costs are $15,000,000 (that is, $75,000 per service outlet).

Instructions

(a) Calculate the dollar amount of each type of service that the company must provide in order to break even.

(b) The company has a desired net income of $45,000 per service outlet. What is the dollar amount of each type of service that must be provided by each service outlet to meet its target net income per outlet?

(Essay)

4.7/5  (34)

(34)

Operating leverage refers to the extent to which a company's net income reacts to a given change in fixed costs.

(True/False)

4.8/5  (42)

(42)

Greg's Breads can produce and sell only one of the following two products:  The company has oven capacity of 1,500 hours. How much will contribution margin be if it produces only the most profitable product?

The company has oven capacity of 1,500 hours. How much will contribution margin be if it produces only the most profitable product?

(Multiple Choice)

4.9/5  (36)

(36)

For Buffalo Co., at a sales level of 4,000 units, sales is $75,000, variable expenses total $50,000, and fixed expenses are $21,000. What is the contribution margin per unit?

(Multiple Choice)

4.7/5  (32)

(32)

Sales mix is a measure of the percentage increase in sales from period to period.

(True/False)

4.7/5  (35)

(35)

The break-even point in dollars is variable costs divided by the weighted-average contribution margin ratio.

(True/False)

4.9/5  (37)

(37)

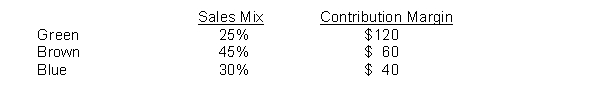

Seaver Corporation manufactures mountain bikes. It has fixed costs of $4,140,000. Seaver's sales mix and contribution margin per unit is shown as follows:  Instructions

Compute the number of each type of bike that the company would need to sell in order to break even under this product mix.

Instructions

Compute the number of each type of bike that the company would need to sell in order to break even under this product mix.

(Essay)

4.8/5  (45)

(45)

Showing 1 - 20 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)