Exam 7: Fraud, Internal Control, and Cash

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

Match the appropriate cash receipts procedure described below with the internal control principlE.

Correct Answer:

Premises:

Responses:

Free

(Matching)

4.7/5  (40)

(40)

Correct Answer:

Employees of a company who evaluate the effectiveness of the company's system of internal controls on a year-round basis are called ______________.

Free

(Short Answer)

5.0/5  (41)

(41)

Correct Answer:

internal auditors

Compensating balances are a restriction on the use of a company's cash and should be

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

C

The responsibility for ordering, receiving, and paying for merchandise should be assigned to different individuals.

(True/False)

4.8/5  (26)

(26)

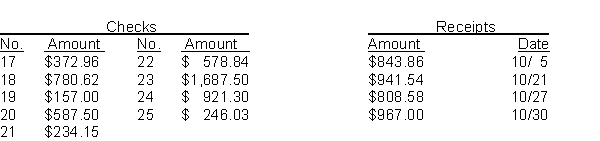

The cash balance per books for Feagen Company on September 30, 2018 is $10,740.93. The following checks and receipts were recorded for the month of October, 2018:  In addition, the bank statement for the month of October is presented below:

Check No. 18 was correctly written for $708.62 for a payment on account. The NSF check was from S. Long, a customer, in settlement of an accounts receivable. An entry had not been made for the NSF check. The credit memo is for the collection of a note receivable including interest of $60 which has not been accrued. The bank service charge is $25.00.

Instructions

(a) Prepare a bank reconciliation at October 31.

(b) Prepare the adjusting journal entries required by the bank reconciliation.

In addition, the bank statement for the month of October is presented below:

Check No. 18 was correctly written for $708.62 for a payment on account. The NSF check was from S. Long, a customer, in settlement of an accounts receivable. An entry had not been made for the NSF check. The credit memo is for the collection of a note receivable including interest of $60 which has not been accrued. The bank service charge is $25.00.

Instructions

(a) Prepare a bank reconciliation at October 31.

(b) Prepare the adjusting journal entries required by the bank reconciliation.

(Essay)

4.8/5  (36)

(36)

In the month of November, Kinsey Company Inc. wrote checks in the amount of $27,750. In December, checks in the amount of $37,974 were written. In November, $25,404 of these checks were presented to the bank for payment, and $32,649 were presented in December. What is the amount of outstanding checks at the end of December?

(Multiple Choice)

4.8/5  (28)

(28)

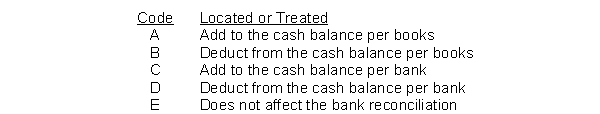

Listed below are items that may be useful in preparing the March 2018, bank reconciliation for Walker Machine Works.

Using the following code, insert in the space before each item the letter where the amount would be located or otherwise treated in the bank reconciliation process.  1. Included with the bank statement materials was a check from Bob Simpson for $40 stamped "account closed."

2. A personal deposit by Annie Walker to her personal account in the amount of $300 for dividends on her General Electric common stock was credited to the company account.

3. The bank statement included a debit memorandum for $22.00 for two books of blank checks for Walker Machine Works.

4. The bank statement contains a credit memorandum for $24.75 interest on the average checking account balance.

5. The daily deposits of March 30 and March 31, for $3,362 and $3,125 respectively, were not included in the bank statement postings.

6. Two checks totaling $316.86, which were outstanding at the end of February, cleared in March and were returned with the March statement.

7. The bank statement included a credit memorandum dated March 28, 2018, for $45.00 for the monthly interest on a 6-month, $15,000 certificate of deposit that the company owns.

8. Four checks, #8712, #8716, #8718, #8719, totaling $5,369.65, did not clear the bank during March.

9. On March 24, 2018, Walker Machine Works delivered to the bank for collection a $2,500, 3-month note from Don Decker. A credit memorandum dated March 29, 2018, indicated the collection of the note and $90.00 of interest.

10. The bank statement included a debit memorandum for $25.00 for the collection service on the above note and interest.

1. Included with the bank statement materials was a check from Bob Simpson for $40 stamped "account closed."

2. A personal deposit by Annie Walker to her personal account in the amount of $300 for dividends on her General Electric common stock was credited to the company account.

3. The bank statement included a debit memorandum for $22.00 for two books of blank checks for Walker Machine Works.

4. The bank statement contains a credit memorandum for $24.75 interest on the average checking account balance.

5. The daily deposits of March 30 and March 31, for $3,362 and $3,125 respectively, were not included in the bank statement postings.

6. Two checks totaling $316.86, which were outstanding at the end of February, cleared in March and were returned with the March statement.

7. The bank statement included a credit memorandum dated March 28, 2018, for $45.00 for the monthly interest on a 6-month, $15,000 certificate of deposit that the company owns.

8. Four checks, #8712, #8716, #8718, #8719, totaling $5,369.65, did not clear the bank during March.

9. On March 24, 2018, Walker Machine Works delivered to the bank for collection a $2,500, 3-month note from Don Decker. A credit memorandum dated March 29, 2018, indicated the collection of the note and $90.00 of interest.

10. The bank statement included a debit memorandum for $25.00 for the collection service on the above note and interest.

(Short Answer)

4.8/5  (39)

(39)

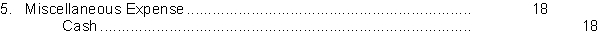

The following adjusting entries for Donkey Company were prepared after completing a bank reconciliation. For each of the following adjustments, prepare a probable explanation for the adjusting entry.

(Essay)

4.9/5  (25)

(25)

Controls that enhance the accuracy and reliability of the accounting records are

(Multiple Choice)

4.7/5  (31)

(31)

The cash account shows a balance of $90,000 before reconciliation. The bank statement does not include a deposit of $5,000 made on the last day of the month. The bank statement shows a collection by the bank of $2,400 and a customer's check for $640 was returned because it was NSF. A customer's check for $900 was recorded on the books as $1,080, and a check written for $138 was recorded as $192. The correct balance in the cash account was

(Multiple Choice)

4.9/5  (46)

(46)

Riley Company received a notice with its bank statement that the bank had collected a note receivable for $5,000 plus $150 of interest. The bank had credited these amounts to Riley 's account less a collection fee of $10. Riley Company had already accrued the interest for this note on its books.

(a) How will these items affect Riley Company's bank reconciliation?

(b) Prepare the journal entry that Riley Company will make to record this information on its books.

(Essay)

4.8/5  (31)

(31)

A voucher system is a series of prescribed control procedures

(Multiple Choice)

4.9/5  (45)

(45)

Companies that are subject to, but fail to comply with, the Foreign Corrupt Practices Act of 1977

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following would not be reported on the balance sheet as a cash equivalent?

(Multiple Choice)

4.9/5  (40)

(40)

Collusion may result when one individual circumvents prescribed controls and may significantly impair the effectiveness of a system.

(True/False)

4.9/5  (39)

(39)

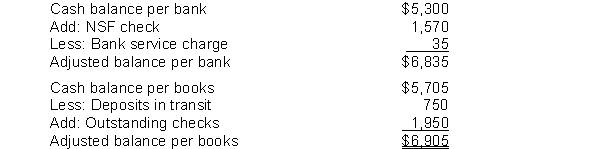

Sky Company is unable to reconcile the bank balance at January 31. Sky's reconciliation is as follows.  Instructions

(a) Prepare a correct bank reconciliation.

(b) Journalize the entries required by the reconciliation.

Instructions

(a) Prepare a correct bank reconciliation.

(b) Journalize the entries required by the reconciliation.

(Essay)

4.8/5  (32)

(32)

The principles of internal control include all of the following except

(Multiple Choice)

4.7/5  (36)

(36)

Showing 1 - 20 of 229

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)