Exam 28: Payroll Accounting

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

Which one of the following payroll taxes does not result in a payroll tax expense for the employer?

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

B

Lucie Ball's regular rate of pay is $15 per hour with one and one-half times her regular rate for any hours which exceed 40 hours per week. She worked 48 hours last week. Therefore, her gross wages were

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

C

Which of the following employees would likely receive a salary instead of wages?

Free

(Multiple Choice)

4.8/5  (44)

(44)

Correct Answer:

C

Diane Lane earns a salary of $9,900 per month during the year. FICA taxes are 7.65% on the first $117,000 of gross earnings and 1.45% in excess of $117,000. Federal unemployment insurance taxes are 6.2% of the first $7,000; however, a credit is allowed equal to the state unemployment insurance taxes of 5.4% on the $7,000. During the year, $32,300 was withheld for federal income taxes and $6,700 was withheld for state income taxes.

Instructions

(a) Prepare a journal entry summarizing the payment of Lane's total salary during the year.

(b) Prepare a journal entry summarizing the employer payroll tax expense on Lane's salary for the year.

(c) Determine the cost of employing Lane for the year.

(Essay)

4.7/5  (40)

(40)

Internal control over payroll is not necessary because employees will complain if they do not receive the correct amount on their payroll checks.

(True/False)

4.7/5  (41)

(41)

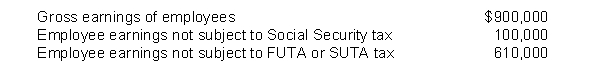

Banner Company had the following payroll data for the year:  Assume the following:

Assume the following:  Instructions

Compute Banner's payroll tax expense for the year. Make a summary journal entry to record the payroll tax expense.

Instructions

Compute Banner's payroll tax expense for the year. Make a summary journal entry to record the payroll tax expense.

(Essay)

4.7/5  (42)

(42)

A good internal control feature is to have several employees choose one person to punch all of their time cards.

(True/False)

4.9/5  (29)

(29)

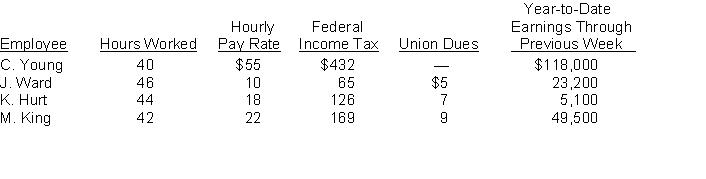

Assume that the payroll records of Erroll Oil Company provided the following information for the weekly payroll ended November 30, 2018.  Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

(Essay)

4.9/5  (46)

(46)

The tax that is paid equally by the employer and employee is the

(Multiple Choice)

4.7/5  (31)

(31)

Changes in pay rates during employment should be authorized by the

(Multiple Choice)

4.9/5  (43)

(43)

Assuming a FICA tax rate of 7.65% on the first $117,000 in wages and 1.45% in excess of $117,000 and a federal income tax rate of 20% on all wages, what would be an employee's net pay for the year if he earned $180,000? Round all calculations to the nearest dollar.

(Multiple Choice)

4.8/5  (35)

(35)

Jerri Rice has worked 44 hours this week. She worked at least 8 hours each day. Her regular hourly wage is $12 per hour with one and one-half times her regular rate for any hours which exceed 40 hours per week. What are Jerri's gross wages for the week?

(Multiple Choice)

4.8/5  (38)

(38)

Match the procedures listed below with the following payroll functions:

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (35)

(35)

A Wage and Tax Statement shows gross earnings, FICA taxes withheld, and income taxes withheld for the year.

(True/False)

4.9/5  (41)

(41)

FICA taxes withheld and federal income taxes withheld are mandatory payroll deductions.

(True/False)

4.9/5  (31)

(31)

Ann Hech's regular hourly wage is $18 an hour. She receives overtime pay at the rate of time and a half. The FICA tax rate is 7.65%. Ann is paid every two weeks. For the first pay period in January, Ann worked 86 hours of which 6 were overtime hours. Ann's federal income tax withholding is $400 and her state income tax withholding is $170. Ann has authorized that $50 be withheld from her check each pay period for savings bonds.

Instructions

Compute Ann Hech's gross earnings and net pay for the pay period showing each payroll deduction in arriving at net pay.

(Essay)

4.9/5  (41)

(41)

Match the items below by entering the appropriate code letter in the space provided.

A. Wage and Tax Statement

B. Net pay

C. Federal income taxes

D. FICA taxes

E. Federal unemployment taxes

1. Levied against employees' wages without limit.

2. A payroll tax expense levied only against the employer based on employees' wages.

3. Gross earnings less payroll deductions.

4. A form showing gross earnings and income taxes withheld.

5. Levied against employees' wages with a maximum limit.

(Essay)

4.9/5  (45)

(45)

Showing 1 - 20 of 38

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)