Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable

Exam 1: The Demand for and Supply of Financial Accounting Information85 Questions

Exam 2: Financial Reporting: Its Conceptual Framework83 Questions

Exam 3: Review of a Company S Accounting System148 Questions

Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module136 Questions

Exam 6: Cash and Receivables172 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions114 Questions

Exam 8: Inventories: Special Valuation Issues141 Questions

Exam 9: Current Liabilities and Contingent Obligations125 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments111 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal136 Questions

Exam 12: Intangibles136 Questions

Exam 13: Investments and Long-Term Receivables135 Questions

Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable192 Questions

Exam 15: Contributed Capital153 Questions

Exam 17: Advanced Issues in Revenue Recognition103 Questions

Exam 18: Accounting for Income Taxes113 Questions

Exam 19: Accounting for Post-Retirement Benefits94 Questions

Exam 20: Accounting for Leases116 Questions

Exam 21: The Statement of Cash Flows103 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Understanding Time Value of Money Formulas and Concepts142 Questions

Select questions type

If a company sells its bonds at more than face value, the effective interest rate is

(Multiple Choice)

4.9/5  (28)

(28)

On May 1, 2013, Legacy Corporation sold $250,000 of its 15%, five-year bonds dated January 1, 2013, for 100 plus accrued interest. How much cash was received?

(Multiple Choice)

4.9/5  (33)

(33)

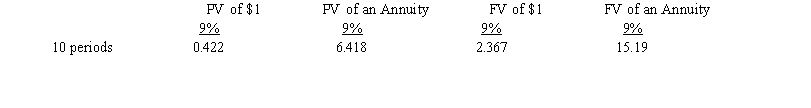

Exhibit 14-4

A $900,000, ten-year, 4% bond issue was sold to yield 5% interest payable annually. Actuarial information for 10 periods is as follows:  -Refer to Exhibit 14-4. At date of issuance cash received would be

-Refer to Exhibit 14-4. At date of issuance cash received would be

(Multiple Choice)

4.8/5  (41)

(41)

Barley, Inc. sold $30,000 of 8% bonds for $40,200. Each $1,000 bond carried eight rights and each right allowed the holder to acquire one share of $10 par stock for $16 a share. After the issuance of the securities, the bonds were quoted at 104 and the rights were quoted at $4 each. Later, one-half of the rights were exercised. At date of exercise, how much should be credited to Additional Paid-in Capital?

(Multiple Choice)

4.9/5  (37)

(37)

How is the stated interest rate on the bond different from the effective rate? What can cause the difference between the two rates?

(Essay)

4.8/5  (40)

(40)

Exhibit 14-15

Elaine, Inc. issued a seven-year non-interest-bearing note with a face value of $20,000 and received $13,301. Actuarial information for seven periods is as follows:  -Refer to Exhibit 14-15. What is the implied interest rate?

-Refer to Exhibit 14-15. What is the implied interest rate?

(Multiple Choice)

4.8/5  (34)

(34)

On January 1, 2016, Snow, Inc. issued $50,000 of ten-year 6% bonds for $43,800. Interest was payable semiannually. The effective yield was 8%. The effective interest method of discount amortization was used. What amount of interest expense should be recorded for the six-month period ending December 31, 2016?

(Multiple Choice)

4.7/5  (48)

(48)

Exhibit 14-15

Elaine, Inc. issued a seven-year non-interest-bearing note with a face value of $20,000 and received $13,301. Actuarial information for seven periods is as follows:  -Refer to Exhibit 14-15.What is the interest expense for the first year?

-Refer to Exhibit 14-15.What is the interest expense for the first year?

(Multiple Choice)

4.8/5  (35)

(35)

On January 1, 2016, the Rangler Company issued $600,000 of eight-year bonds at 102. The stated annual interest rate is 8%, and interest is paid on June 30 and December 31. The bonds are callable at 105 plus accrued interest. The bond issue costs were $7,200. The Rangler Company uses the straight-line method to amortize bond discounts and premiums.

Required:

a. Prepare the journal entryies) to record the issuance of the bonds and the bond issue costs.

b. At the end of the sixth year, the company exercised the call option and retired the bonds.

Prepare the journal entries to record the related interest and retirement.

(Essay)

4.8/5  (45)

(45)

Durham, Inc. issued $500,000 of its ten-year zero-coupon bonds on January 1, 2016, to yield 9%. The effective interest method is used.  Required:

a. Compute the cash proceeds from the sale of the bond.

b. Prepare the journal entry to record the sale.

c. Prepare the journal entry to record interest for 2017.

Required:

a. Compute the cash proceeds from the sale of the bond.

b. Prepare the journal entry to record the sale.

c. Prepare the journal entry to record interest for 2017.

(Essay)

4.9/5  (32)

(32)

Showing 181 - 192 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)