Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable

Exam 1: The Demand for and Supply of Financial Accounting Information85 Questions

Exam 2: Financial Reporting: Its Conceptual Framework83 Questions

Exam 3: Review of a Company S Accounting System148 Questions

Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module136 Questions

Exam 6: Cash and Receivables172 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions114 Questions

Exam 8: Inventories: Special Valuation Issues141 Questions

Exam 9: Current Liabilities and Contingent Obligations125 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments111 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal136 Questions

Exam 12: Intangibles136 Questions

Exam 13: Investments and Long-Term Receivables135 Questions

Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable192 Questions

Exam 15: Contributed Capital153 Questions

Exam 17: Advanced Issues in Revenue Recognition103 Questions

Exam 18: Accounting for Income Taxes113 Questions

Exam 19: Accounting for Post-Retirement Benefits94 Questions

Exam 20: Accounting for Leases116 Questions

Exam 21: The Statement of Cash Flows103 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Understanding Time Value of Money Formulas and Concepts142 Questions

Select questions type

When a company sells bonds between interest dates, the company normally will collect from the investors both the selling price and the interest accrued on the bonds from the interest payment date prior to the date of sale.

(True/False)

4.9/5  (34)

(34)

Exhibit 14-14

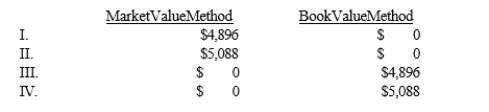

Marley, Inc. sold $500,000 of its ten-year 8% bonds at 96 on January 1, 2014. Interest is paid each January 1 and July 1 and straight-line amortization is used. Each $1,000 bond is convertible into 100 shares of $10 par common stock. One-half of the bonds were converted on January 1, 2019, when the market value of the stock was $14 per share.

-Refer to Exhibit 14-14. The entry to record the conversion using the book value method would include a

(Multiple Choice)

4.8/5  (47)

(47)

Interest expense recognized each period on zero-coupon bonds sold at a discount is equal to the

(Multiple Choice)

4.7/5  (33)

(33)

When a debtor satisfies a liability by exchanging an asset of lesser value, it records the transfer based on the fair value of the asset and recognizes a loss on the debt restructuring.

(True/False)

4.9/5  (41)

(41)

Exhibit 14-6

Jones Corporation issued $400,000 of its 8%, 10-year bonds, dated January 1, 2016, at face value plus accrued interest on May 1, 2016. Interest is paid on January 1 and July 1. Jones uses the most common method to record the sale of the bonds between interest payment periods.

-Refer to Exhibit 14-6. The amount of bond interest expense reported on the year-end 2016 income statement would be

(Multiple Choice)

4.9/5  (43)

(43)

If a company sells its 20-year bonds at a discount, how is the discount account reported on the balance sheet?

(Multiple Choice)

4.8/5  (29)

(29)

The effective rate is less than the contract rate when bonds are issued at a discount.

(True/False)

4.9/5  (45)

(45)

When a long-term non-interest-bearing note is exchanged solely for cash, the difference between the cash received and the face value of the note is recorded as

(Multiple Choice)

4.9/5  (24)

(24)

Small and medium-size companies typically have more difficulty attracting equity capital than debt capital.

(True/False)

4.9/5  (37)

(37)

How can a company restructure their debt in the event of financial difficulties?

(Essay)

4.9/5  (30)

(30)

On January 1, 2013, Angle Products issued $24,000 of ten-year bonds at 98. These bonds were each convertible into ten shares of $100 par common stock. On January 1, 2020, Angle converted two-thirds of these bonds when the common stock was selling at $130 a share. What would be the loss on bond conversion?

(Multiple Choice)

4.8/5  (30)

(30)

A company may want to increase its equity capital at a later date in time, in order to accomplish this goal the company decides to issue convertible debt.

(True/False)

4.8/5  (34)

(34)

Exhibit 14-12

On January 1, 2016, Jewels, Inc. sold $200,000 of its 12% five-year bonds to yield 10%. Interest is paid each January 1 and July 1, and effective interest amortization is used. On May 1, 2018, Jewels, retired $100,000 of the bonds at 104. The book value of the bonds on December 31, 2017, was $212,926.

-Refer to Exhibit 14-12. The entry to record the retirement in May, 2018 would include a

(Multiple Choice)

4.8/5  (32)

(32)

Exhibit 14-5

Joseph Company had underwriters prepare a bond issue for $100,000 9%, ten-year bonds dated January 1, 2014 The bonds were issued on March 1, 2014 at 102 plus accrued interest on. Expenses connected with the issue totaled

$5,000 and were deducted in arriving at the net proceeds. Joseph amortizes premiums and discounts using the straight-line method.

-Refer to Exhibit 14-5. The entry to record the issue would include

(Multiple Choice)

4.9/5  (37)

(37)

Exhibit 14-1

A $300,000, ten-year, 8% bond issue was sold to yield 9% interest payable annually. Actuarial information for 10 periods is as follows:  -Refer to Exhibit 14-1. These bonds sold at

-Refer to Exhibit 14-1. These bonds sold at

(Multiple Choice)

4.8/5  (28)

(28)

Which of the following is always equal to the face rate of interest?

(Multiple Choice)

4.8/5  (48)

(48)

A company could decide to call its bonds because it will eliminate any restrictions on operations from certain debt covenants.

(True/False)

4.9/5  (40)

(40)

Showing 121 - 140 of 192

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)