Exam 9: Current Liabilities and Contingent Obligations

Exam 1: The Demand for and Supply of Financial Accounting Information85 Questions

Exam 2: Financial Reporting: Its Conceptual Framework83 Questions

Exam 3: Review of a Company S Accounting System148 Questions

Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module136 Questions

Exam 6: Cash and Receivables172 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions114 Questions

Exam 8: Inventories: Special Valuation Issues141 Questions

Exam 9: Current Liabilities and Contingent Obligations125 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments111 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal136 Questions

Exam 12: Intangibles136 Questions

Exam 13: Investments and Long-Term Receivables135 Questions

Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable192 Questions

Exam 15: Contributed Capital153 Questions

Exam 17: Advanced Issues in Revenue Recognition103 Questions

Exam 18: Accounting for Income Taxes113 Questions

Exam 19: Accounting for Post-Retirement Benefits94 Questions

Exam 20: Accounting for Leases116 Questions

Exam 21: The Statement of Cash Flows103 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Understanding Time Value of Money Formulas and Concepts142 Questions

Select questions type

Which of the following would not be an acceptable method of presenting current liabilities on the balance sheet?

(Multiple Choice)

4.8/5  (33)

(33)

Exhibit 9-4

During 2016, the Thomas Company began selling a new type of machine that carries a two-year assurance-type warranty against all defects. Based on past industry and company experience, estimated warranty costs should total

$2,000 per machine sold. During 2016, sales and actual warranty expenditures were $4,000,000 80 machines) and

$44,000, respectively. Thomas uses the GAAP approach of accruing warranty expense and the related liability) in the year of the sale.

-Refer to Exhibit 9-4. What amount should Thomas report as its warranty expense for 2016?

(Multiple Choice)

4.9/5  (36)

(36)

Lucas Company provides a bonus compensation plan under which key employees receive bonuses equal to 10% of Lucas's income after deducting income taxes but before deducting the bonus. If income before income tax and the bonus is $400,000 and the income tax rate is 30%, the bonuses should total

(Multiple Choice)

4.8/5  (39)

(39)

When a contingency must be accrued under IFRS, the charge is referred to as

(Multiple Choice)

4.8/5  (36)

(36)

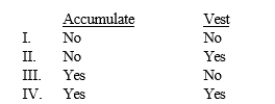

Claymont Company instituted a vacation and sick pay policy on January 1, 2014. Thirty employees, whose salaries averaged $100 per day, were covered under the plan. The policy allows each employee five days of sick pay and twelve days of vacation pay per year. The sick pay accumulates up to a ten-day maximum. Vacation pay accumulates without a maximum. The sick pay vests, but vacation pay does not. A total of 400 days of sick and vacation days were taken during 2015.

Required:

Prepare the December 31, 2015 year-end accrual for compensated absences.

(Essay)

4.8/5  (38)

(38)

The sales manager of the Walbrook Company receives an annual bonus of 10% of net income after bonus and taxes. In 2015, Walbrook's income, before bonus and taxes, was $400,000. The effective tax rate is 30%.

Required:

a. Compute the sales manager's bonus and the income tax expense for the Walbrook Company.

b. Why does Walbrook compute the sales manager bonus after taxes and the bonus?

(Essay)

4.9/5  (39)

(39)

Exhibit 9-3

John Company includes three coupons in each package of cookies it sells. In exchange for 20 coupons, a customer will receive a cookie sheet. John estimates that 30% of the coupons will be redeemed. In 2016, John sold 4,000,000 boxes of cookies and purchased 150,000 Cookie sheets at $2.50 each. During the year, 970,000 coupons were redeemed.

-Refer to Exhibit 9-3. What amount should John report as estimated premium claims outstanding at December 31, 2016?

(Multiple Choice)

4.9/5  (42)

(42)

On January 1, 2016, the Pruett Company signed a six-month, non-interest-bearing note payable for $170,000 and received $162,800 from Your Neighborhood Bank. On January 31, 2016, what amount should Pruett record for interest expense, and what is the net carrying value of the note?

(Multiple Choice)

4.8/5  (35)

(35)

Barlo Lunch Snacks places a coupon in each box of its cracker product. Customers may send in five coupons and $3, and the company will send them a recipe book. Sufficient books were purchased at a cost of $5 each. A total of 500,000 boxes of product were sold in 2016. It was estimated that 4% of the coupons would be redeemed. During 2016, 9,000 coupons were redeemed. What is Barlo's premium expense for 2016?

(Multiple Choice)

4.8/5  (44)

(44)

The tax rate is not determined until October 10, and the tax bills are mailed October 20 with payment due by December 31. For the prior fiscal year, the Radar Company paid $18,000. The tax bill for the current fiscal year July 1, 2016-June 30, 2017) is received on October 23, and property taxes have increased to $18,900. The company pays this amount on October 29.

Required:

a. Record the monthly property tax accrual recorded in July of 2014.

b. Record the payment of the taxes on October 29.

c. Record the monthly adjusting entry on October 31.

(Essay)

4.9/5  (46)

(46)

All of the following payroll taxes are levied against the employer except

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following statements concerning contingencies is true?

(Multiple Choice)

4.8/5  (27)

(27)

From the list of accounts below determine which ones are the following:

A) Contractual Amounts

B) Contingent Amounts

C) Amounts determined by operating activities Required:

Write the appropriate letter for the accounts listed below.

______ 1) Premium Expense

______ 2) Dividends Payable

______ 3) Sales Tax Payable

______ 4) Accounts Payable

______ 5) Loss from Litigation

______ 6) Warranty Expense

______ 7) Property Taxes payable

______ 8) Notes Payable

______ 9) Federal Income Taxes Payable

______ 10) Accrued Expenses

(Essay)

4.7/5  (37)

(37)

Compensated absences include vacation, holiday, sick, or other activities for which the company pays its employees.

(True/False)

4.9/5  (35)

(35)

Sick pay benefits that are related to an employee's services already rendered, whose payment is probable and whose amount can reasonably be estimated, must be accrued and recognized as a current liability if the obligation relates to rights that

(Multiple Choice)

4.9/5  (40)

(40)

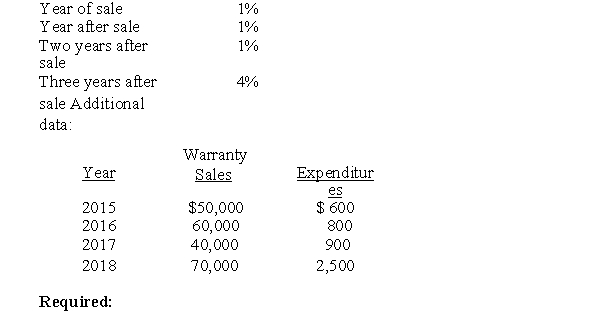

Munster sells a product with a four-year warranty. Warranty costs are estimated as a percentage of sales as follows:  a. If this is an assurance-type warranty and the company uses the modified cash method, what would be warranty expense for 2017?

b. If this is an assurance-type warranty and and the company uses the GAAP approach of accruing warranty expense and the related liability) in the year of the sale, what would be warranty expense for 2017?

c. If the company considers that 7% of the selling price of the produce represents payment for an implied service-type warranty, what amount of unearned warranty revenue would be disclosed on the balance sheet on December 31, 2018?

a. If this is an assurance-type warranty and the company uses the modified cash method, what would be warranty expense for 2017?

b. If this is an assurance-type warranty and and the company uses the GAAP approach of accruing warranty expense and the related liability) in the year of the sale, what would be warranty expense for 2017?

c. If the company considers that 7% of the selling price of the produce represents payment for an implied service-type warranty, what amount of unearned warranty revenue would be disclosed on the balance sheet on December 31, 2018?

(Essay)

4.8/5  (47)

(47)

Showing 21 - 40 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)