Exam 4: Accrual Accounting Concepts

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

The balances of the Depreciation Expense and the Accumulated Depreciation accounts should always be the same.

(True/False)

4.8/5  (37)

(37)

An accounting time period that is one year in length is called:

(Multiple Choice)

4.9/5  (40)

(40)

From an accounting standpoint, the acquisition of long-lived assets is essentially a(n):

(Multiple Choice)

4.8/5  (41)

(41)

Prepare adjusting entries for the following transactions. Omit explanations.

1. Depreciation on equipment is $1,340 for the accounting period.

2. Interest owed on a loan but not paid or recorded is $275.

3. There was no beginning balance of supplies and $550 of office supplies were purchased during the period. At the end of the period $100 of supplies were on hand.

4. Prepaid rent had a $1,000 normal balance prior to adjustment. By year end $700 had expired.

5. Accrued salaries at the end of the period amounted to $900.

(Essay)

4.9/5  (28)

(28)

Under the cash basis of accounting, an amount received from a customer in advance of providing the services would be reported as a(n):

(Multiple Choice)

4.8/5  (42)

(42)

The Scarlet Pages, a semi-professional hockey team, prepare financial statements on a monthly basis. Their season begins in October, but in September the team engaged in the following transactions:

(a) Paid $150,000 to Oklahoma City as advance rent for use of Oklahoma City Arena for the six-month period October 1 through March 31.

(b) Collected $450,000 cash from sales of season tickets for the team's 30 home games. This amount was credited to Unearned Ticket Revenue.

(c) During the month of October, the Scarlet Pages played five home games.

Instructions:

Prepare the adjusting entries required at October 31 for the transactions above.

(Essay)

4.9/5  (38)

(38)

At the end of the fiscal year, the usual adjusting entry for accrued salaries owed to employees was omitted. Which of the following statements is true?

(Multiple Choice)

4.8/5  (31)

(31)

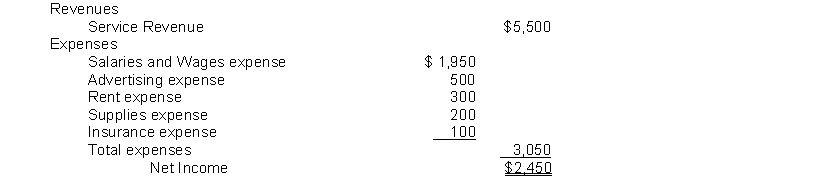

The following information is from the Income Statement of the Dirt Poor Laundry Service:  The entry to close the Income Summary includes a:

The entry to close the Income Summary includes a:

(Multiple Choice)

4.9/5  (24)

(24)

Mary Richardo has performed $500 of CPA services for a client but has not billed the client as of the end of the accounting period. What adjusting entry must Mary make?

(Multiple Choice)

4.8/5  (37)

(37)

The expense recognition principle requires that efforts be related to accomplishments.

(True/False)

4.8/5  (34)

(34)

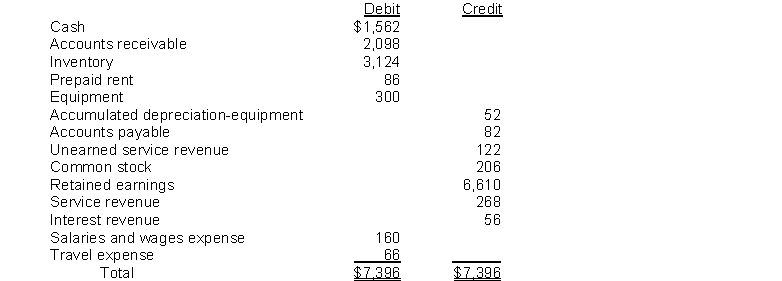

Given the following adjusted trial balance:  After closing entries have been posted, the balance in retained earnings will be:

After closing entries have been posted, the balance in retained earnings will be:

(Multiple Choice)

4.8/5  (33)

(33)

Financial statements can be prepared from the information provided by an adjusted trial balance.

(True/False)

4.8/5  (38)

(38)

Greese Company purchased office supplies costing $4,000 and debited Supplies for the full amount. At the end of the accounting period, a physical count of office supplies revealed $1,500 still on hand. The appropriate adjusting journal entry to be made at the end of the period would be:

(Multiple Choice)

4.7/5  (29)

(29)

On January 1, the Biddle & Biddle, CPAs received a $7,500 cash retainer for accounting services to be provided rateably over the next 3 months. The full amount was credited to the liability account Service Unearned Revenue. Assuming that the revenue is recognized rateably over the 3 month period, what adjusting journal entry should be made at January 31?

(Essay)

4.7/5  (35)

(35)

A company spends $20 million dollars for an office building. Over what period should the cost be written off?

(Multiple Choice)

4.8/5  (43)

(43)

Expenses paid and recorded in an asset account before they are used or consumed are called _______________. Revenue received and recorded as a liability before it is earned is referred to as _________________.

(Short Answer)

4.9/5  (34)

(34)

Showing 201 - 220 of 312

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)