Exam 8: Reporting and Analyzing Receivables

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

The sale or transfer of accounts receivable in order to raise funds is called

(Multiple Choice)

4.8/5  (41)

(41)

The percentage of receivables approach to estimating bad debts expense is used by Hayes Company. On February 28, the firm had accounts receivable in the amount of $585,000 and Allowance for Doubtful Accounts had a credit balance of $370 before adjustment. Net credit sales for February amounted to $3,000,000. The credit manager estimated that uncollectible accounts would amount to 5% of accounts receivable. On March 10, an accounts receivable from Mark Dole for $2,100 was determined to be uncollectible and written off. However, on March 31, Dole received an inheritance and immediately paid his past due account in full.

(a) Prepare the journal entries made by Hayes Company on the following dates:

1. February 28

2. March 10

3. March 31

(b) Assume no other transactions occurred that affected the allowance account during March. Determine the balance of Allowance for Doubtful Accounts at March 31.

(Essay)

4.8/5  (38)

(38)

Ramos Company has a 90-day note that carries an annual interest rate of 8%. If the amount of the total interest on the note is equal to $700, then what is the principal of the note?

(Multiple Choice)

4.8/5  (27)

(27)

A popular variation of the accounts receivable turnover is the

(Multiple Choice)

4.9/5  (41)

(41)

When using the direct write-off method year-end adjustments for bad debt expense must be made.

(True/False)

4.8/5  (37)

(37)

The balance of Allowance for Doubtful Accounts prior to making the adjusting entry to record Bad Debt Expense

(Multiple Choice)

4.8/5  (37)

(37)

The bookkeeper recorded the following journal entry Allowance for Doubtful Accounts 1,000

Accounts Receivable - Richard James 1,000

Which one of the following statements is false?

(Multiple Choice)

4.9/5  (37)

(37)

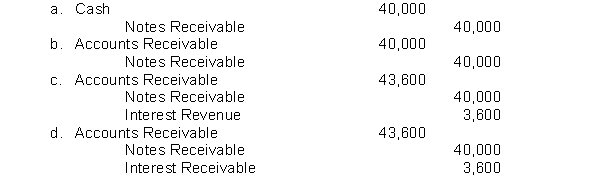

Young Company lends Dobson industries $40,000 on January 1, 2014, accepting a 9-month, 12% interest note. If Dobson dishonors the note and does not pay it in full at maturity but Young expects that it will eventually be able to collect the debt, which of the following entries should most likely be made by Young Company?

(Short Answer)

4.9/5  (39)

(39)

An article in the Wall Street Journal indicated that companies are selling receivables at a record rate. Why do companies sell their receivables?

(Essay)

4.7/5  (39)

(39)

The allowance for doubtful accounts is similar to accumulated depreciation in that it shows the total of all accounts written off over the years.

(True/False)

4.8/5  (33)

(33)

Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $30,000. If the balance of the Allowance for Doubtful Accounts is $4,000 credit before adjustment what is the amount of bad debt expense for that period?

(Multiple Choice)

4.7/5  (41)

(41)

Receivables are valued and reported in the balance sheet at their gross amount less any sales returns and allowances and less any cash discounts.

(True/False)

4.8/5  (37)

(37)

Showing 61 - 80 of 261

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)