Exam 8: Reporting and Analyzing Receivables

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

Trade receivables can be an account receivable or a note receivable.

(True/False)

4.8/5  (41)

(41)

Leary Corporation had net credit sales during the year of $900,000 and cost of goods sold of $540,000. The balance in receivables at the beginning of the year was $120,000 and at the end of the year was $180,000. What was the accounts receivable turnover?

(Multiple Choice)

4.8/5  (43)

(43)

Thompson Corporation's unadjusted trial balance includes the following balances (assume normal balances): - Accounts receivable

- Allowance for doubtful accounts Bad debts are estimated to be 6% of outstanding receivables. What amount of bad debt expense will the company record?

(Multiple Choice)

4.8/5  (38)

(38)

The average collection period for receivables is computed by dividing 365 days by

(Multiple Choice)

4.8/5  (37)

(37)

When the due date of a note is stated in months, the time factor in computing interest is the number of months divided by 360 days.

(True/False)

4.9/5  (34)

(34)

The collection of an account that had been previously written off under the allowance method of accounting for uncollectibles

(Multiple Choice)

4.9/5  (41)

(41)

When an account receivable that was previously written off is collected, it is first necessary to reverse the entry to reinstate the customer's account before recording the collection.

(True/False)

4.8/5  (36)

(36)

Under the allowance method of accounting for bad debts, why must uncollectible accounts receivable be estimated at the end of the accounting period?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following receivables would not be classified as an "other receivable"?

(Multiple Choice)

4.9/5  (42)

(42)

If a retailer regularly sells its receivables to a factor, the service charge of the factor should be classified as a(n)

(Multiple Choice)

4.9/5  (33)

(33)

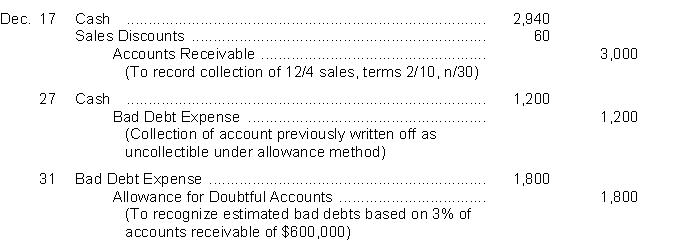

An inexperienced accountant made the following entries. In each case, the explanation to the entry is correct.

Instructions

Prepare the correcting entries.

Instructions

Prepare the correcting entries.

(Essay)

4.8/5  (40)

(40)

On January 10 Donna Stark uses her Baver Co. credit card to purchase merchandise from Baver Co. for $2,600. On February 10, she is billed for the amount due of $2,600. On February 12 Stark pays $1,600 on the balance due. On March 10 Stark is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12.

Instructions

Prepare the entries on Baver Co.'s books related to the transactions that occurred on January 10, February 12, and March 10.

(Essay)

4.8/5  (45)

(45)

The percentage of receivables basis for estimating uncollectible accounts emphasizes

(Multiple Choice)

4.8/5  (33)

(33)

The financial statements of the Phelps Manufacturing Company reports net sales of $500,000 and accounts receivable of $80,000 and $40,000 at the beginning of the year and end of year, respectively. What is the accounts receivable turnover for Phelps?

(Multiple Choice)

4.9/5  (38)

(38)

The financial statements of the Nelson Manufacturing Company reports net sales of $300,000 and accounts receivable of $50,000 and $30,000 at the beginning of the year and end of year, respectively. What is the accounts receivable turnover for Nelson?

(Multiple Choice)

4.7/5  (29)

(29)

In 2014 the Golic Co. had net credit sales of $600,000. On January 1, 2014, the Allowance for Doubtful Accounts had a credit balance of $15,000. During 2014, $24,000 of uncollectible accounts receivable were written off. Past experience indicates that the allowance should be 10% of the balance in receivables (percentage-of-receivables basis). If the accounts receivable balance at December 31 was $160,000 what is the required adjustment to the Allowance for Doubtful Accounts at December 31, 2014?

(Multiple Choice)

4.7/5  (33)

(33)

Showing 121 - 140 of 261

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)