Exam 14: Understanding Investments and Acquisitions in Accounting

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

In accordance with the historical cost principle, the cost of debt investments includes brokerage fees and accrued interest.

(True/False)

4.9/5  (41)

(41)

The Fair Value Adjustment account is a balance sheet account. Identify the asset account it is related to. Explain how this account is increased and describe the procedure followed when its related asset account is disposed of.

(Essay)

4.9/5  (36)

(36)

Using the cost method of accounting for a stock investment, the journal entry to record the receipt of dividends involves a credit to Dividend Revenue.

(True/False)

4.9/5  (35)

(35)

Short-term investments are securities that are readily marketable and intended to be converted into cash within the next

(Multiple Choice)

4.8/5  (34)

(34)

Grafton Company had the following transactions pertaining to its short-term stock investments.

Jan. 1 Purchased 2,000 shares of Hortez Company stock for $101,100 cash.

June 1 Received cash dividends of $2.70 per share on the Hortez Company stock.

Sept. 15 Sold 1,000 shares of the Hortez Company stock for $49,600.

Dec. 31 The fair values of the securities were $50,800. Prepare the adjusting entry to report the portfolio at fair value.

Instructions

(a) Journalize the transactions.

(b) Indicate the income statement effects of the transactions.

(Essay)

4.8/5  (32)

(32)

The following transactions were made by Aquavore Company. Assume all investments are temporary.

July 1 Purchased 400 shares of Delta Corporation common stock for $35 per share.

30 Received a cash dividend of $1.25 per share from the Delta Corporation.

Sept. 15 Sold 80 shares of Delta Corporation stock for $38 per share.

Instructions

Journalize the transactions.

(Essay)

4.9/5  (44)

(44)

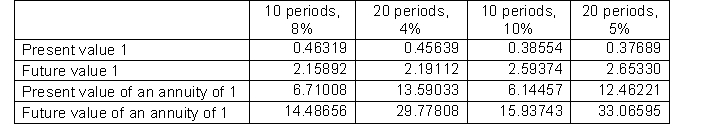

Patterson Company is about to issue $8,000,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The discount rate for such securities is 10%. Below are time value of money factors that Patterson uses to calculate compounded interest.  To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

(Multiple Choice)

4.9/5  (33)

(33)

An unrealized gain or loss on available-for-sale securities is reported as a separate component of _________________.

(Short Answer)

4.9/5  (32)

(32)

The cost method of accounting for investments in stock should be used when the investment is

(Multiple Choice)

4.8/5  (32)

(32)

On January 1, 2014, Chic Corp. paid $1,200,000 for 100,000 shares of Toto Company's common stock, which represents 40% of Toto's outstanding common stock. Toto reported income of $300,000 and paid cash dividends of $80,000 during 2014 Chic should report the investment in Toto Company on its December 31, 2014, balance sheet at

(Multiple Choice)

5.0/5  (40)

(40)

To compute the present value of a bond, both the interest payments and the principal amount must be discounted using the bond's contractual interest rate.

(True/False)

4.7/5  (46)

(46)

In computing the present value of an annuity, it is necessary to know the _____________ rate and the _____________ of discount periods.

(Short Answer)

4.7/5  (40)

(40)

Sandafor Company had these transactions pertaining to stock investments:

Feb 1 Purchased 2,400 shares of BFF common stock (2% of outstanding shares) for $16,500 cash.

July 1 Received cash dividends of $0.80 per share on BFF common stock.

Sept. 1 Sold 800 shares of BFF common stock for $7,900

Dec. 1 Received cash dividends of $.80per share on BFF common stock.

Instructions

Journalize the transactions.

(Essay)

4.9/5  (37)

(37)

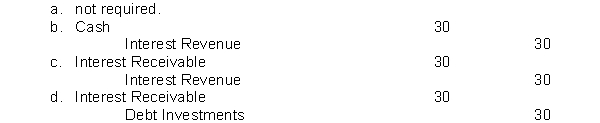

On January 1, 2014, JBT Company purchased at face value, a $1,000 6%, bond that pays interest on January 1 and July 1. JBT Company has a calendar year end. The adjusting entry on December 31, 2014, is

(Short Answer)

4.8/5  (36)

(36)

Showing 301 - 314 of 314

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)