Exam 3: Financial Reporting Concepts

Exam 1: Long-Lived Assets263 Questions

Exam 2: Current Liabilities and Payroll191 Questions

Exam 3: Financial Reporting Concepts138 Questions

Exam 4: Accounting for Partnerships171 Questions

Exam 5: Introduction to Corporations210 Questions

Exam 6: Corporations: Additional Topics and IFRS42 Questions

Exam 7: Non-Current Liabilities39 Questions

Exam 8: Investments273 Questions

Exam 9: The Cash Flow Statement169 Questions

Exam 10: Financial Statement Analysis172 Questions

Exam 11: Understanding Interest, Annuities, and Bond Valuation188 Questions

Select questions type

In order to assess the financial performance of a company, the financial statements must

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is not a criterion pertaining to revenue recognition for the sale of goods under the earnings approach?

(Multiple Choice)

4.8/5  (32)

(32)

Spanish Marine Supplies is a marine supplier of tugboat engines. As part of the selling process, the company will install the tugboat engine, conduct sea trials on the engine, provide any servicing required on the engine for the first year of operation, and not require a payment from the client until 60 days after the client's acceptance of the engine. The engine will remain the property of Spanish until the first payment is made, even though the boat is not the property of Spanish. The company's customers frequently ask Spanish to customize the engines to suit their needs. These customization changes can be extensive and may take several months.

Instructions

Comment on when you think Shediac should recognize revenue.

(Essay)

4.9/5  (28)

(28)

Revenue recognition criteria state that revenue is recognized at the same time that a decrease in an asset is recognized or an increase in a liability is recognized for profit-generating activities.

(True/False)

4.7/5  (39)

(39)

Target Security Company provides surveillance services to numerous corporate customers. The company has recently signed a new surveillance contract with Martin Manufacturing on January 1 for a period of one month at a cost of $ 500. On January 31, Target completed the contract and invoiced Martin for the full contract price due in 30 days.

Instructions

Complete the following steps to determine if the appropriate criteria have been met for Target to recognize revenue under the contract-based approach to revenue recognition. Be sure to conclude whether Target can recognize the revenue and when it would be appropriate to do so.

1. Is there a contract?

2. What is the performance obligation?

3. What is the transaction price?

4. Is there a need to allocate the selling price?

5. Has the performance obligation been satisfied?

(Essay)

5.0/5  (28)

(28)

For each of the independent situations described below, list the assumption, concept, constraint, or recognition criteria that have been violated and describe the appropriate treatment.

1. MacDonald Industrial purchased a piece of land that was listed for $ 150,000. The company worked very hard in negotiations and both parties agreed on a purchase price of $ 139,000. Lawson's accountant has recorded the land on the books at $ 150,000 because she felt this was the most representative fair value at the time of purchase.

2. Chantal's Hair Salon purchases many different hair and cosmetic supplies to be used within the salon and sold to customers. Darlene only has one credit card that she uses to make personal and business purchases. She often gets confused which purchases are for business purposes so she records all credit card transactions through the salon.

3. Buddie's Furniture operates in a small town and often sells on credit without any detailed credit checks. The company sold merchandise to Darcy last year and he failed to pay the amount owing so Buddie wrote off his account. Buddie has recently made another sale to Darcy on credit for $ 12,000 without any security on the transaction. Buddie records all sale transactions once the goods are delivered and title passes.

4. Fancy Diamonds is a Canadian company that reports its financial statements in Canadian dollars. The company often sells its diamonds to customers in the United States and receives U.S. dollars. Fancy records the U.S. dollar amounts within the accounting records without any currency exchange.

(Essay)

4.9/5  (31)

(31)

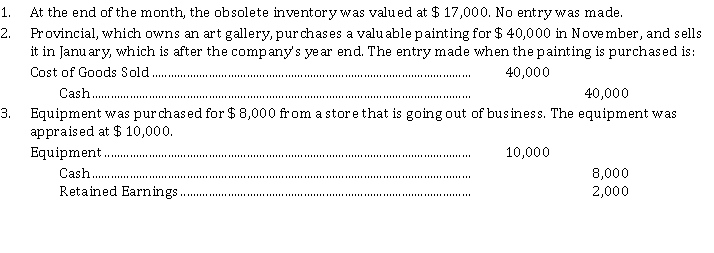

A number of unrelated transactions recorded by Farm Company are as follows:  Instructions

For each of the above situations, identify the accounting assumption, concept, constraint, or recognition criteria that have been violated. Prepare the correct journal entry as it should have been made. If no entry should have been made, or if additional financial statement disclosure is required, explain.

Instructions

For each of the above situations, identify the accounting assumption, concept, constraint, or recognition criteria that have been violated. Prepare the correct journal entry as it should have been made. If no entry should have been made, or if additional financial statement disclosure is required, explain.

(Essay)

4.8/5  (40)

(40)

Which is not necessary to ensure that faithful representation is achieved?

(Multiple Choice)

4.9/5  (40)

(40)

Fair value is the amount of cash expected to be collected if the asset is sold.

(True/False)

4.7/5  (38)

(38)

A company can change to a new accounting principle if management can justify that the new principle results in

(Multiple Choice)

4.9/5  (32)

(32)

The summary of significant accounting policies footnoted in the financial statements would not normally discuss

(Multiple Choice)

4.9/5  (36)

(36)

Retailers who sell a product with a warranty period can recognize revenue when

(Multiple Choice)

4.8/5  (38)

(38)

Timeliness means that accounting information is provided when it is still highly useful for decision-making.

(True/False)

4.9/5  (40)

(40)

The conceptual framework ensures that existing standards and practices are clear and consistent.

(True/False)

4.8/5  (45)

(45)

For each item below, indicate the area of the conceptual framework that pertains to that item by selecting the appropriate code.

Example:

C Asset (An asset is an element of financial statements.)

Example:

C Asset (An asset is an element of financial statements.)

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (38)

(38)

Generally accepted accounting principles include the following assumptions, concepts, and constraints:

For each of the situations, identify the assumption, concept, constraint, or recognition criteria that provides the best explanation by selecting the appropriate code. Each code will be used more than once; however, each situation only has one correct answer.

For each of the situations, identify the assumption, concept, constraint, or recognition criteria that provides the best explanation by selecting the appropriate code. Each code will be used more than once; however, each situation only has one correct answer.

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (49)

(49)

Using the contract-based approach to revenue recognition, the entity will record revenue at the amount that it expects to receive.

(True/False)

4.9/5  (42)

(42)

Canadian and International standards are based on specific rules for accounting.

(True/False)

4.7/5  (35)

(35)

Under ASPE, the characteristic which ensures, that when preparing financial statements, accountants should choose the accounting treatment or estimate that will be least likely to overstate assets, revenues, and gains and the least likely to understate liabilities, expenses, and losses is

(Multiple Choice)

4.9/5  (43)

(43)

Showing 41 - 60 of 138

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)