Exam 14: Corporations: Additional Topics and Ifrs

Exam 1: Accounting in Action162 Questions

Exam 2: The Recording Process163 Questions

Exam 3: Adjusting the Accounts179 Questions

Exam 4: Completion of the Accounting Cycle151 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventory Costing176 Questions

Exam 7: Internal Control and Cash130 Questions

Exam 9: Long-Lived Assets243 Questions

Exam 10: Current Liabilities98 Questions

Exam 11: Accounting Principles116 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Introduction to Corporations195 Questions

Exam 14: Corporations: Additional Topics and Ifrs136 Questions

Exam 15: Non-Current Liabilities139 Questions

Exam 16: The Cash Flow Statement158 Questions

Exam 17: Financial Statement Analysis155 Questions

Exam 18: Investments68 Questions

Select questions type

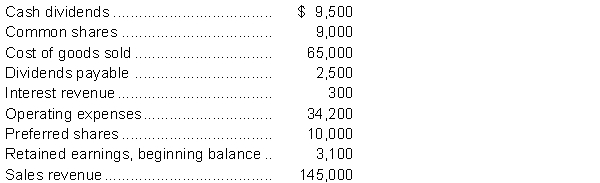

The following information is taken from the trial balance of GlaxonSmith Supplies Ltd. at December 31, 2014, the company's year end. GlaxonSmith has a 25% tax rate. One of the entries making up the balance of retained earnings is an adjustment that was required due to the overstatement of prior year's depreciation expense by $1,600 which is net of tax effect.  Instructions

Prepare the income statement and statement of retained earnings for GlaxonSmith for the year ended December 31, 2014 using the multiple-step format for the income statement.

Instructions

Prepare the income statement and statement of retained earnings for GlaxonSmith for the year ended December 31, 2014 using the multiple-step format for the income statement.

(Essay)

4.7/5  (36)

(36)

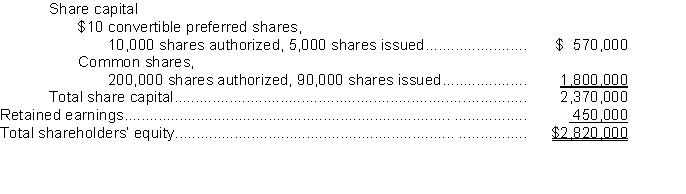

Jacobs Corporation has the following shareholders' equity on December 31, 2014:

Shareholders' equity  -The average cost per common share is

-The average cost per common share is

(Multiple Choice)

4.9/5  (34)

(34)

Correction of errors would always result in a decrease in Retained Earnings.

(True/False)

4.8/5  (29)

(29)

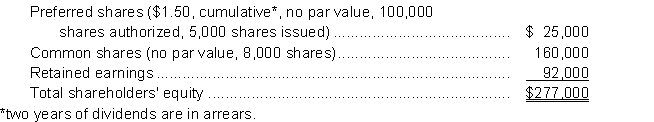

Oswala Inc. had the following balances in its shareholders' equity at the beginning of the current year (January 1, 2014):  During the year ended December 31, 2014, the following transactions took place:

1. On January 1, issued 9,000 common shares at $18 per share.

2. On July 1, declared a 10% stock dividend on the common shares, market price $18.50 per share. The dividend is to be paid on August 15 to shareholders of record on July 31.

3. On August 15, the company paid the stock dividend.

4. On September 15, Ryder's board of directors declared a 4-for-1 stock split.

During the year, the company had a profit of $85,000.

Instructions

a. Prepare the journal entries to record the above transactions. Closing entries are not required.

b. Prepare a statement of changes in shareholders' equity for 2014.

c. Prepare the shareholders' equity section of the balance sheet at December 31, 2014.

During the year ended December 31, 2014, the following transactions took place:

1. On January 1, issued 9,000 common shares at $18 per share.

2. On July 1, declared a 10% stock dividend on the common shares, market price $18.50 per share. The dividend is to be paid on August 15 to shareholders of record on July 31.

3. On August 15, the company paid the stock dividend.

4. On September 15, Ryder's board of directors declared a 4-for-1 stock split.

During the year, the company had a profit of $85,000.

Instructions

a. Prepare the journal entries to record the above transactions. Closing entries are not required.

b. Prepare a statement of changes in shareholders' equity for 2014.

c. Prepare the shareholders' equity section of the balance sheet at December 31, 2014.

(Essay)

4.9/5  (40)

(40)

In discontinued operations reporting, the amounts shown on the income statement are shown net of tax.

(True/False)

4.8/5  (30)

(30)

Match the items below by entering the appropriate code letter in the space provided.

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (35)

(35)

Comprehensive income includes all changes in shareholders equity during a period with the exception of changes in share capital or the payment of dividends.

(True/False)

4.7/5  (39)

(39)

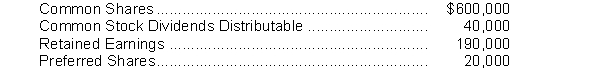

What is the total shareholder's equity based on the following account balances?

(Multiple Choice)

4.8/5  (37)

(37)

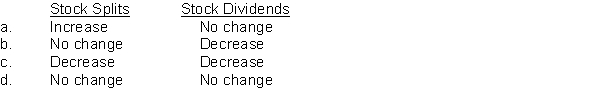

Stock dividends and stock splits have the following effects on retained earnings:

(Short Answer)

5.0/5  (33)

(33)

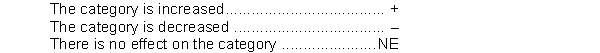

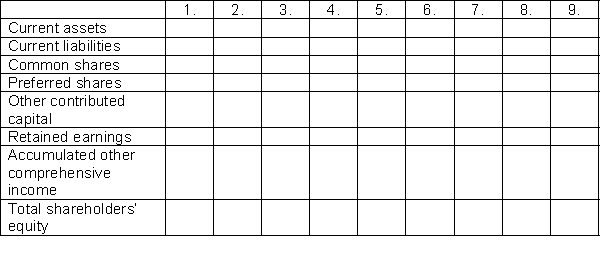

Connolly Corporation had the following events during one fiscal year:

1. A stock dividend is declared on common shares.

2. The stock dividend is distributed.

3. Other comprehensive income for the year totals $350,000.

4. Cash dividends are declared.

5. The cash dividends are paid.

6. Profit for the year is $1,500,000.

7. Prior year's profit had to be corrected to record additional revenue that had been earned, but which had not yet been paid for by the customer. The additional revenue increases the amount of taxes payable on the prior year's income.

8. Repurchased common shares for an amount less than their average cost.

9. One third of the preferred shares are converted to common shares on a 1:10 ratio.

Instructions

Using the table provided, for each of the following financial statement categories, indicate the effect of the transaction as follows:

(Essay)

4.8/5  (29)

(29)

Lee Holdings Ltd. was incorporated on January 2, 2014 and on that date issued 50,000 common shares for cash at $1 each. On April 30, Lee issued 1,000 preferred, $3 cumulative preferred shares, convertible to common shares at the rate of 6 common shares for one preferred share. The preferred shares were issued for $18 each. On October 15, 600 of the preferred shares were converted to common shares. On that date, the market value was $1.50 for the common shares and $17.50 for the preferred shares. On December 15, 10,000 common shares were reacquired for $0.90 each.

Instructions

a. Journalize the share transactions described.

b. Calculate the number of issued shares and average cost per share of each class remaining at the end of the year.

(Essay)

4.8/5  (28)

(28)

Juan Inc. has 1,000 common shares issued at $100 and currently trading at $200. The entry to record declaration of a 10% stock dividend is

(Multiple Choice)

4.9/5  (38)

(38)

The following information is available regarding a corporation's common shares: authorized 30,000 shares; issued 10,000 at $100,000; and 15,000 at $175,000. The average cost of the corporation's shares is

(Multiple Choice)

5.0/5  (38)

(38)

Showing 121 - 136 of 136

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)