Exam 13: Introduction to Corporations

Exam 1: Accounting in Action162 Questions

Exam 2: The Recording Process163 Questions

Exam 3: Adjusting the Accounts179 Questions

Exam 4: Completion of the Accounting Cycle151 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventory Costing176 Questions

Exam 7: Internal Control and Cash130 Questions

Exam 9: Long-Lived Assets243 Questions

Exam 10: Current Liabilities98 Questions

Exam 11: Accounting Principles116 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Introduction to Corporations195 Questions

Exam 14: Corporations: Additional Topics and Ifrs136 Questions

Exam 15: Non-Current Liabilities139 Questions

Exam 16: The Cash Flow Statement158 Questions

Exam 17: Financial Statement Analysis155 Questions

Exam 18: Investments68 Questions

Select questions type

Sonoma Lakes Ltd. (SLL) has the following authorized share capital:

Unlimited Common voting shares

500,000 Class A, $5 cumulative preferred shares

500,000 Class B, $10 non-cumulative preferred shares

During 2014, SLL had the following share transactions for cash:

Jan 1 Issued 50,000 common shares for $100,000.

Mar 12 Issued 1,000 Class A preferred shares for $60,000.

Apr 30 Issued 20,000 common shares for $2.50 per share.

Jun 20 Issued 3,000 Class B preferred shares for $70 per share.

SLL did not declare any dividends during 2014. On December 31, 2015 a dividend of $3 per share was declared on preferred shares issued.

Instructions

a. Journalize the share transactions.

b. Calculate the number of common shares issued at December 31, 2014.

c. Calculate the amount of the December 31, 2015 total dividend declared and the amount of dividends in arrears after declaring the December 31, 2015 dividend.

(Essay)

4.8/5  (35)

(35)

Companies have one year after their fiscal year end to submit their corporate tax return without incurring penalties.

(True/False)

4.9/5  (34)

(34)

When shares are issued for services or non-cash assets, the shares should be recorded at the fair value of the services or noncash assets.

(True/False)

4.9/5  (40)

(40)

At the end of each accounting year, the profit for the corporation will be closed into the account called Income Summary.

(True/False)

4.7/5  (42)

(42)

The Adams Corporation issued 1,000, no par value, convertible preferred shares at $100 per share. Each share is convertible into 10 common shares. When the market values of the two classes of shares are $101 and $13, respectively, 150 preferred shares are converted into common shares.

Instructions

a. Journalize the conversion of the 150 shares.

a. assuming that the market values at conversion are $103 and $20, respectively.

b. Repeat

(Essay)

4.9/5  (42)

(42)

The articles of incorporation can contain all of the following EXCEPT

(Multiple Choice)

5.0/5  (31)

(31)

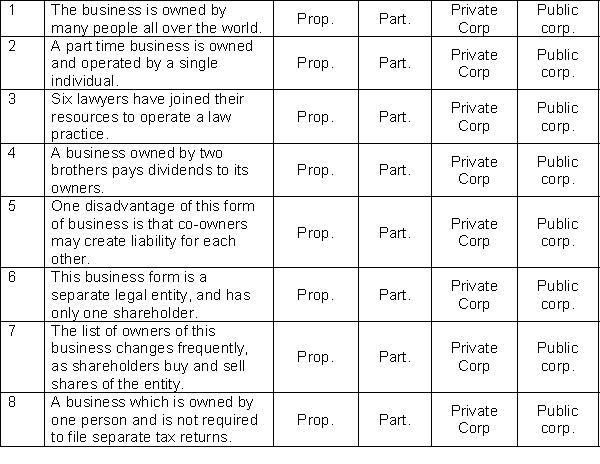

For each of the following statements, indicate whether the statement applies to a proprietorship, a partnership, a private corporation, or a public corporation.

(Select the most likely one by circling your choice).

(Essay)

4.9/5  (37)

(37)

Nicco Corporation had the following accounts at January 1, 2013:

common shares, unlimited number of shares authorized, 18,000 shares issued, $180,000;

preferred shares, $4 cumulative, unlimited number of shares authorized, 1,000 shares issued, $50,000;

retained earnings, $223,000.

The company has profit of $79,000 in 2013 and paid $85,000 in dividends.

Instructions

a. Calculate the return on equity at December 31, 2013.

b. What does this ratio tell you about the corporation?

(Essay)

4.7/5  (36)

(36)

Singh, Inc. has 5,000, $8, noncumulative preferred shares issued at $100, and 20,000 common shares issued at $1, at December 31, 2014. There were no dividends declared in 2013. The board of directors declares and pays a $60,000 dividend in 2014. What is the amount of dividends received by the common shareholders in 2014?

(Multiple Choice)

4.7/5  (36)

(36)

What is the correct journal entry to adjust for the income tax expense?

a. Petained Earnings

Income tax payable

b. Income tax expense

Retained Earnings

c. Operating expense

Income tax payable

d. Income tax expense

Income tax payable

(Short Answer)

4.9/5  (27)

(27)

When a preferred share is exchanged for a common share, cash flow for the company is increased.

(True/False)

4.8/5  (39)

(39)

A corporation acts under its own name rather than in the name of its shareholders.

(True/False)

4.7/5  (36)

(36)

A corporation may be organized for the purpose of making a profit or may be not-for-profit.

(True/False)

4.8/5  (42)

(42)

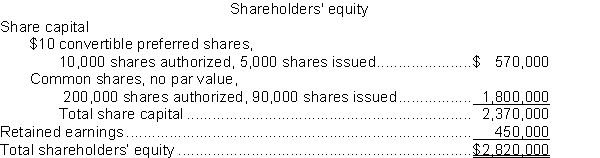

Jacobs Corporation has the following shareholders' equity on December 31, 2014:  -If one preferred share is convertible into 10 common shares, how many common shares are issued when 500 preferred shares are converted?

-If one preferred share is convertible into 10 common shares, how many common shares are issued when 500 preferred shares are converted?

(Multiple Choice)

4.9/5  (42)

(42)

Retained earnings will be reported on financial statements within the share capital section.

(True/False)

4.9/5  (24)

(24)

Income tax expense must be added on the income statement when determining profit.

(True/False)

4.9/5  (41)

(41)

Which of the following is NOT generally a right or preference associated with preferred shares?

(Multiple Choice)

4.8/5  (40)

(40)

Showing 61 - 80 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)