Exam 13: Introduction to Corporations

Exam 1: Accounting in Action162 Questions

Exam 2: The Recording Process163 Questions

Exam 3: Adjusting the Accounts179 Questions

Exam 4: Completion of the Accounting Cycle151 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventory Costing176 Questions

Exam 7: Internal Control and Cash130 Questions

Exam 9: Long-Lived Assets243 Questions

Exam 10: Current Liabilities98 Questions

Exam 11: Accounting Principles116 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Introduction to Corporations195 Questions

Exam 14: Corporations: Additional Topics and Ifrs136 Questions

Exam 15: Non-Current Liabilities139 Questions

Exam 16: The Cash Flow Statement158 Questions

Exam 17: Financial Statement Analysis155 Questions

Exam 18: Investments68 Questions

Select questions type

KBR Investments Inc. has issued 90,000 Class A $3 cumulative preferred shares and 45,000 Class B $5 non-cumulative preferred shares. At the end of 2012, there were no dividends in arrears. During 2013, KBR paid dividends of $100,000 to its Class A shareholders. In January of 2014, KBR paid dividends of $120,000 to its Class A shareholders. On December 31, 2014, KBR declared dividends in an amount sufficient to pay out all of the remaining dividends in arrears plus the entire current year obligation including dividends on Class B shares, so that they can pay dividends on common shares.

Instructions

Calculate the dividends declared for Class A and for Class B shareholders on December 31, 2014.

(Essay)

4.8/5  (30)

(30)

Profit for Sandos Inc., was $10,000 in 2013. Shareholders' equity was $100,000 at December 31 2011, $200,000 at December 31, 2012, and $300,000 at December 31, 2013. Return on equity for 2013 is

(Multiple Choice)

4.9/5  (31)

(31)

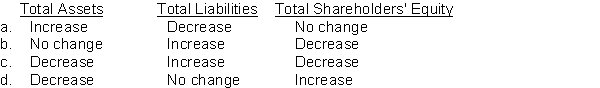

Indicate the respective effects of the declaration of a cash dividend on the following balance sheet sections:

(Short Answer)

4.8/5  (38)

(38)

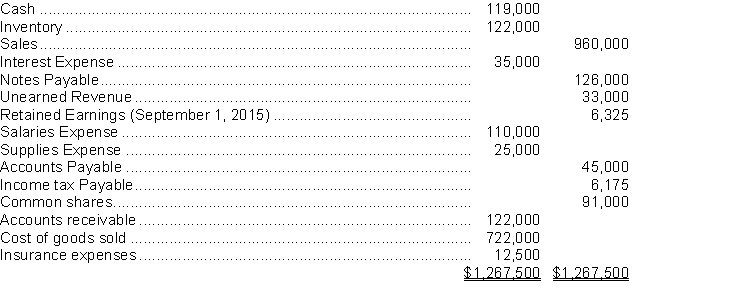

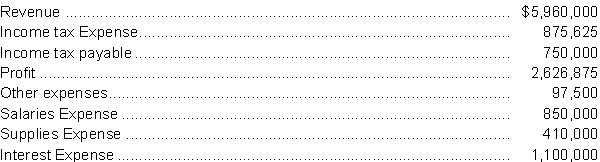

Maki and Levesque Inc. has recorded all necessary adjusting entries, except for income tax expense, at its fiscal year end August 31, 2016. The following information has been taken from the adjusted trial balance:  Maki and Levesque Inc. has a 15% tax rate.

Instructions

a. Prepare a multi step income statement and the required journal entry to adjust income tax expense.

b. Prepare a statement of retained earnings.

c. Prepare closing entries.

Maki and Levesque Inc. has a 15% tax rate.

Instructions

a. Prepare a multi step income statement and the required journal entry to adjust income tax expense.

b. Prepare a statement of retained earnings.

c. Prepare closing entries.

(Essay)

4.8/5  (47)

(47)

Mayer corporation, a private company reporting under ASPE has the following information available with respect to the company's operations until December 31, 2016:

1. Collected $345,000 cash for service revenue earned.

2. Paid $125,000 salaries expense, $56,000 rent expense, and $5,000 insurance expense.

3. Purchased a new vehicle for $35,000 cash on January 1, 2016. This vehicle will be depreciated over 5 years with no salvage value.

4. Accrued $16,000 for income taxes during 2016.

5. On December 31. 2016 the following adjustments were completed:

Service revenue earned but not yet collected in cash $22,500

Accrued Interest expense $4,500

Accrued Salaries expense $7,200

Mayer has a 20% income tax rate.

Instructions

Prepare an income statement and record the adjustment to income taxes.

(Essay)

4.7/5  (34)

(34)

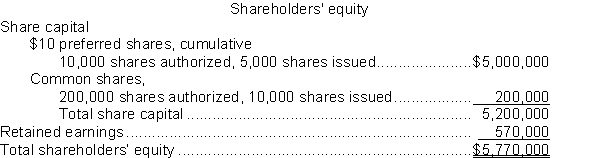

Norton Corporation has the following shareholders equity on September 30, 2014:  On September 15, 2014, Norton Corporation declared a $170,000 dividend to be paid on October 15 to shareholders of record on September 30.

-Assuming there were no dividends in arrears, the total amount of the dividend paid to the preferred shareholders in 2014 would be

On September 15, 2014, Norton Corporation declared a $170,000 dividend to be paid on October 15 to shareholders of record on September 30.

-Assuming there were no dividends in arrears, the total amount of the dividend paid to the preferred shareholders in 2014 would be

(Multiple Choice)

4.9/5  (30)

(30)

On January 1, 2014, Mandy Merchandise Ltd. has 25,000 common shared issued for a total of $62,500, and no other shares or contributed capital. During 2014, Mandy had the following transactions:

Jan 15 Issued 15,000 common shares for $2.50 each.

Mar 31 Settled an account for legal expenses by issuing 2,500 shares. The value of the legal services was $5,000.

Sep 30 Issued 9,000 shares in exchange for equipment with a fair value of $22,500.

Instructions

a. Record the transactions.

b. Calculate the total number issued and average cost per share of the common shares at the end of 2014.

(Essay)

5.0/5  (32)

(32)

Which one of the following is NOT an ownership right of a shareholder in a corporation?

(Multiple Choice)

4.9/5  (40)

(40)

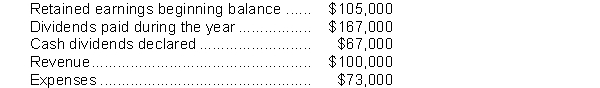

The following information is available for Mobily Corporation.  What is the ending retained earnings balance?

What is the ending retained earnings balance?

(Multiple Choice)

4.9/5  (32)

(32)

Below is a list of income statement accounts for Debui Inc. as of December 31, 2014:  Instructions

a. Present the income statement in the correct order.

b. What is the applicable tax rate for Debui Inc.?

Instructions

a. Present the income statement in the correct order.

b. What is the applicable tax rate for Debui Inc.?

(Essay)

4.8/5  (22)

(22)

Which of the following statements concerning taxation is accurate?

(Multiple Choice)

4.8/5  (33)

(33)

The authorization of share capital will have an immediate effect on assets and shareholders' equity.

(True/False)

5.0/5  (35)

(35)

All of the following are examples of organization costs EXCEPT

(Multiple Choice)

4.9/5  (33)

(33)

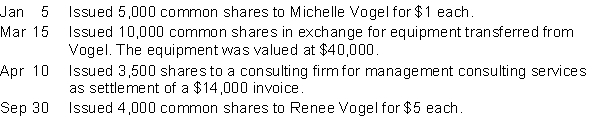

During its first year of operations, Millwoods Enterprises Inc. had the following transactions related to its common shares:  Instructions

a. Journalize the share transactions.

b. Calculate the average cost of the common shares of Millwoods Enterprises Inc. at December 31.

Instructions

a. Journalize the share transactions.

b. Calculate the average cost of the common shares of Millwoods Enterprises Inc. at December 31.

(Essay)

4.9/5  (37)

(37)

A dividend is a pro rata distribution of a portion of a corporation's retained earnings to its shareholders.

(True/False)

4.8/5  (33)

(33)

Showing 101 - 120 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)