Exam 13: Introduction to Corporations

Exam 1: Accounting in Action162 Questions

Exam 2: The Recording Process163 Questions

Exam 3: Adjusting the Accounts179 Questions

Exam 4: Completion of the Accounting Cycle151 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventory Costing176 Questions

Exam 7: Internal Control and Cash130 Questions

Exam 9: Long-Lived Assets243 Questions

Exam 10: Current Liabilities98 Questions

Exam 11: Accounting Principles116 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Introduction to Corporations195 Questions

Exam 14: Corporations: Additional Topics and Ifrs136 Questions

Exam 15: Non-Current Liabilities139 Questions

Exam 16: The Cash Flow Statement158 Questions

Exam 17: Financial Statement Analysis155 Questions

Exam 18: Investments68 Questions

Select questions type

Cash dividends are shown as an addition to the statement of retained earnings.

(True/False)

4.8/5  (38)

(38)

Lake Ltd. was incorporated July 1, 2013. The company is authorized to issue an unlimited number of preferred and common shares. The company entered into the following transactions during its fiscal year ending June 30, 2014:

Jul 10 Issued 100,000 common shares for $12.50 per share.

Jul 15 Issued 400,000 common shares for $13 per share.

Sep 30 Issued 30,000 common shares in return for a warehouse. The common shares were trading for $15.50 on the date the warehouse was acquired. The assessed value of the warehouse on that date was $450,600.

Mar 16 Issued 1,000 preferred shares for $95 per share.

Instructions

Record the above transactions.

(Essay)

4.9/5  (37)

(37)

Companies incorporated in the province of Ontario will be incorporated under the Canada Business Corporations Act.

(True/False)

4.9/5  (35)

(35)

The transfer of ownership rights between shareholders has no effect on the corporations operating activities.

(True/False)

4.9/5  (37)

(37)

The ownership of the shares is determined on the date of declaration.

(True/False)

4.8/5  (31)

(31)

A privately held corporation can also be a publicly accountable enterprise if it has bonds that are publically held.

(True/False)

4.9/5  (41)

(41)

A cumulative dividend feature will mean that unpaid dividends from prior periods will be paid before the current dividend entitlement.

(True/False)

4.9/5  (37)

(37)

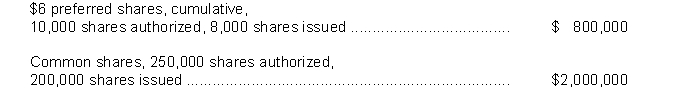

The shareholders' equity section of Karr Corporation at December 31, 2013 included the following:  Dividends were not declared on the preferred shares in 2013 and are in arrears.

On September 15, 2014, the board of directors of Karr Corporation declared dividends on the preferred shares for 2013 and 2014, to shareholders of record on October 1, 2014, payable on October 15, 2014.

On November 1, 2014, the board of directors declared a $2 per share dividend on the common shares, payable November 30, 2014, to shareholders of record on November 15, 2014.

Instructions

Prepare the journal entries that should be made by Karr Corporation in 2014 on the dates indicated below:

Dividends were not declared on the preferred shares in 2013 and are in arrears.

On September 15, 2014, the board of directors of Karr Corporation declared dividends on the preferred shares for 2013 and 2014, to shareholders of record on October 1, 2014, payable on October 15, 2014.

On November 1, 2014, the board of directors declared a $2 per share dividend on the common shares, payable November 30, 2014, to shareholders of record on November 15, 2014.

Instructions

Prepare the journal entries that should be made by Karr Corporation in 2014 on the dates indicated below:

(Essay)

4.9/5  (30)

(30)

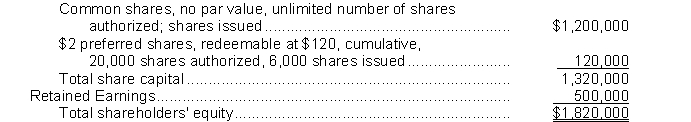

The following items were shown on the balance sheet of McKean Corporation on December 31, 2014:

Shareholders' Equity

Share Capital  Instructions

Complete the following statements and show your calculations. All of the common shares were issued at $5 per share.

a. The number of common shares issued was _______________.

b. The preferred shares dividend was $____________ per share.

c. It would cost the company $____________ to redeem 1,000 preferred shares.

d. The average issue price of the preferred shares was $_____________.

e. The total amount of cash and other assets paid to McKean Corporation in exchange for share capital, at December 31, 2014 was $______________.

Instructions

Complete the following statements and show your calculations. All of the common shares were issued at $5 per share.

a. The number of common shares issued was _______________.

b. The preferred shares dividend was $____________ per share.

c. It would cost the company $____________ to redeem 1,000 preferred shares.

d. The average issue price of the preferred shares was $_____________.

e. The total amount of cash and other assets paid to McKean Corporation in exchange for share capital, at December 31, 2014 was $______________.

(Essay)

4.8/5  (44)

(44)

Gabrial Ltd. was incorporated February 1, 2013 and is authorized to issue an unlimited number of preferred and common shares. The company entered into the following transactions during the year:

Feb 10 Issued 30,000 common shares for $23 per share.

Feb 21 Issued 700 common shares to the company's accountants as payment for a bill of $18,000 for services performed in helping the company to incorporate.

Mar 16 Issued 1,000 convertible preferred shares for $95 per share.

Sep 10 Issued 5,000 convertible preferred shares for $105 per share.

Oct 1 Converted 1,000 preferred shares into common shares. One preferred share is convertible into 10,000 common shares. The fair value of the common and preferred shares are $25 and $102 respectively.

Instructions

Prepare the journal entries to record the above transactions.

(Essay)

4.8/5  (36)

(36)

Showing 181 - 195 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)