Exam 6: Reporting and Analyzing Inventory

Exam 1: The Purpose and Use of Financial Statements90 Questions

Exam 2: A Further Look at Financial Statements130 Questions

Exam 3: The Accounting Information System96 Questions

Exam 4: Accrual Accounting Concepts87 Questions

Exam 5: Merchandising Operations93 Questions

Exam 6: Reporting and Analyzing Inventory98 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables70 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets139 Questions

Exam 10: Reporting and Analyzing Liabilities98 Questions

Exam 12: Reporting and Analyzing Investments130 Questions

Exam 13: Statement of Cash Flows75 Questions

Exam 14: Performance Measurement66 Questions

Select questions type

The inventory cost formula that best matches cost and revenues is FIFO.

(True/False)

5.0/5  (36)

(36)

Approximating the physical flow of inventory is not important when selecting an inventory cost formula.

(True/False)

4.9/5  (36)

(36)

Selection of an inventory cost formula by management should be influenced most by the

(Multiple Choice)

5.0/5  (37)

(37)

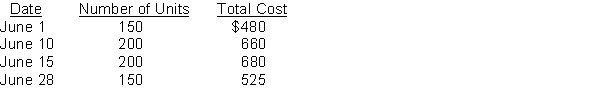

Use the following information for questions.

A company just starting its business made the following four inventory purchases in June:  On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

-The inventory cost formula that results in the highest gross profit for June is

On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system.

-The inventory cost formula that results in the highest gross profit for June is

(Multiple Choice)

4.8/5  (33)

(33)

In the average cost formula used in a periodic inventory system, the same weighted average cost per unit is used to calculate all of the goods sold during the period.

(True/False)

4.8/5  (34)

(34)

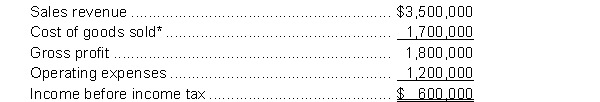

Houle Limited reported the following summarized annual data at the end of 2018:  *Based on an ending inventory of $420,000, using FIFO.The controller of the company is considering a switch from FIFO to average cost. He has determined that on an average cost basis, the ending inventory would have been $320,000.Instructions

a. Restate the summary information on an average cost basis.

b. If you were the management of this business, what would your reaction be to this proposed change?

*Based on an ending inventory of $420,000, using FIFO.The controller of the company is considering a switch from FIFO to average cost. He has determined that on an average cost basis, the ending inventory would have been $320,000.Instructions

a. Restate the summary information on an average cost basis.

b. If you were the management of this business, what would your reaction be to this proposed change?

(Essay)

4.9/5  (34)

(34)

The lower of cost and net realizable value basis of valuing inventories ensures that inventories are

(Multiple Choice)

4.9/5  (37)

(37)

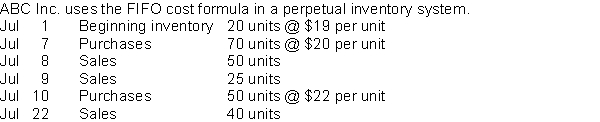

Use the following information for the month of July for questions.  -If ABC Inc. used the average cost formula instead of FIFO, gross profit from the July 8 sale would be

-If ABC Inc. used the average cost formula instead of FIFO, gross profit from the July 8 sale would be

(Multiple Choice)

4.8/5  (45)

(45)

Inventory that originally cost $100 had been written down to its net realizable value (NRV) of $75. Subsequently, the NRV of the inventory recovered to equal its cost of $100. In this situation, the amount of the $25 ($100 - $75) prior writedown in value should be reversed.

(True/False)

4.9/5  (32)

(32)

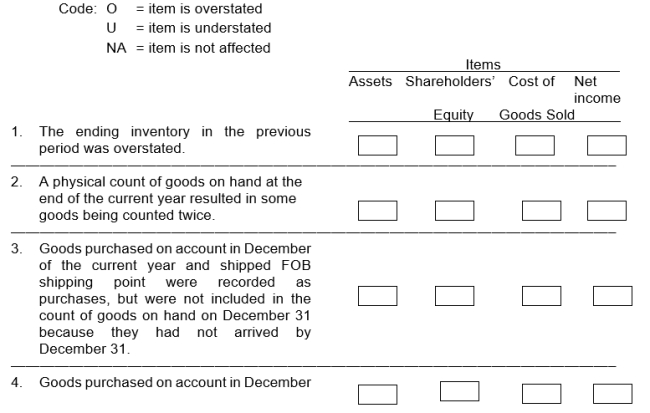

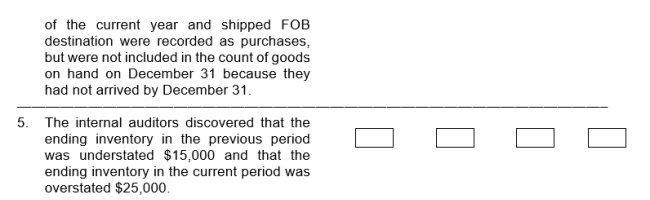

For each of the independent events listed below, analyze the impact on the indicated items at the end of the current year by placing the appropriate code letter in the box under each item.

(Essay)

4.9/5  (37)

(37)

The specific identification method of inventory cost formula must be used

(Multiple Choice)

4.9/5  (37)

(37)

Inventory cost formulas such as FIFO and average cost, deal more with the flow of costs than with the flow of goods.

(True/False)

5.0/5  (35)

(35)

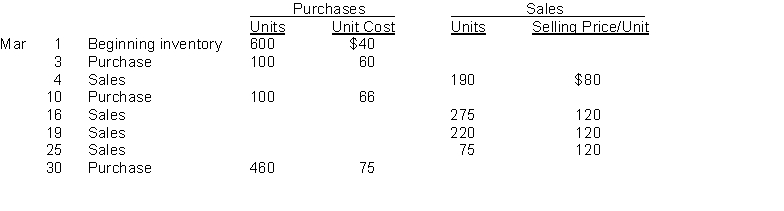

Owl Ltd. sells many products. Hoot is one of its popular items. Below is an analysis of the inventory purchases and sales of Hoot for the month of March. Owl uses the perpetual inventory system.  Instructions

a. Using the FIFO cost formula, calculate the cost of goods sold for March. Show calculations.

b. Using the average cost formula, calculate the ending inventory at March 31. Show calculations and use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.

Instructions

a. Using the FIFO cost formula, calculate the cost of goods sold for March. Show calculations.

b. Using the average cost formula, calculate the ending inventory at March 31. Show calculations and use unrounded numbers in your calculations but round to the nearest cent for presentation purposes in your answer.

(Essay)

4.9/5  (33)

(33)

The first-in, first-out (FIFO) inventory cost formula results in an ending inventory valued at the most recent cost.

(True/False)

4.9/5  (43)

(43)

Showing 81 - 98 of 98

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)