Exam 7: Internal Control and Cash

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

If the balance in Cash Short and Over at the end of a period is a credit, it should be reported as an "other income" item on the income statement.

(True/False)

4.8/5  (34)

(34)

Assign the letter to indicate whether the following items would be added to or subtracted from the company's books or the bank statement during the construction of a bank reconciliation.a.added to the company's books

b.subtracted from the company's books

c.added to the bank statement balance

d.subtracted from the bank statement balance

-EFT deposit from a customer

(Short Answer)

4.9/5  (41)

(41)

Hanna Co. sells art supplies and also has a custom framing department. Only two employees are trained to complete custom framing orders. They place the orders for the supplies they need. Also they are the only ones who take customer orders, as the ordering process is fairly technical. For the past several years, custom framing has been a very profitable part of Hanna Co.'s business. However, the financial reports for the most recent period show a substantial drop in profitability for custom framing. Upon investigation, it was determined that the supplies being used in custom framing had increased measurably. However, the sales generated did not support the amount of supplies being used. Further investigation discovered that one of the custom framing specialists had arranged for a co-conspirator to bring in orders and have them filled. The co-conspirator paid for the orders in cash, but the sales were not recorded in the accounting system. The two then sold the framed art through another business. What general internal control weaknesses contributed to the fraud?

(Essay)

4.8/5  (32)

(32)

Accompanying the bank statement was a debit memo for an NSF check received from a customer. What entry is required in the company's accounts?

(Multiple Choice)

4.7/5  (46)

(46)

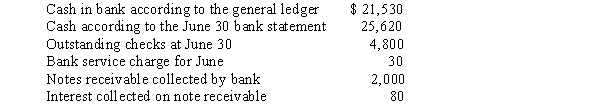

Nebraska Fields Co. records all cash receipts from data on the cash register tapes. Nebraska discovered during June that one of its sales clerks had stolen some cash. However, the amount is not known. The sales clerk was responsible for taking cash deposits to the bank. To determine the amount stolen, the following data have been obtained for June:  No deposits were in transit on June 30.

(a) Determine the amount of cash stolen by the clerk.(b) Suggest accounting controls that would have prevented or detected the theft.

No deposits were in transit on June 30.

(a) Determine the amount of cash stolen by the clerk.(b) Suggest accounting controls that would have prevented or detected the theft.

(Essay)

4.8/5  (41)

(41)

Separating the responsibilities for purchasing, receiving, and paying for equipment is an example of the control procedure: separating operations, custody of assets, and accounting.

(True/False)

4.7/5  (48)

(48)

Roper Electronics received its bank statement for the month of August with an ending balance of $11,740. Roper determined that check #613 for $155 and check #601 for $420 were both outstanding. Also, a $6,900 deposit for August 30 was in transit as of the end of the month. Northern Regional Bank also collected a $5,000 note receivable on August 1 that was issued March 1. Accrued interest is $250. Northern Regional Bank charged a $35 fee for the collection service. The bank statement reveals a bank service charge of $20. A customer check for $68 was returned with the bank statement marked "NSF." The ending balance of the Roper cash account is $12,938.

(a) Prepare a bank/account reconciliation.(b) Prepare any necessary journal entries for the reconciliation.(b) If a balance sheet were prepared for Roper Electronics on August 31, what amount should be reported for cash?

(Essay)

4.8/5  (36)

(36)

Assign the letter to indicate whether the following items would be added to or subtracted from the company's books or the bank statement during the construction of a bank reconciliation.a.added to the company's books

b.subtracted from the company's books

c.added to the bank statement balance

d.subtracted from the bank statement balance

-interest revenue earned by the note above

(Short Answer)

4.7/5  (37)

(37)

A check drawn by a company for $340 in payment of a liability was recorded in the journal as $430. What entry is required in the company's accounts?

(Multiple Choice)

4.8/5  (30)

(30)

On August 3, Sonar Sales decides to establish a $275.00 Petty Cash Account to relieve the burden on Accounting.

(a)Journalize the establishment of this fund.(b)On August 11, the petty cash fund has receipts for mail and postage of $124.75, contributions and donations of $53.25, meals and entertainment of $63.85, and $32.75 in cash. Journalize the replenishment of the fund. Record any missing funds in the cash short and over account.(c)On August 12, Sonar Sales decides to increase petty cash to $400.00. Journalize this transaction.

(Essay)

4.8/5  (25)

(25)

What are the processes and procedures a company uses to safeguard its assets, process information correctly, and ensure its compliance with laws are regulations called?

(Multiple Choice)

4.9/5  (38)

(38)

A voucher system is an example of an internal control procedure over cash payments.

(True/False)

4.8/5  (37)

(37)

A check for $342 was erroneously charged by the bank as $432. In order for the bank reconciliation to balance, you must add $90 to the bank statement balance.

(True/False)

4.8/5  (32)

(32)

Expenditures from a petty cash fund are documented by a petty cash receipt.

(True/False)

4.9/5  (41)

(41)

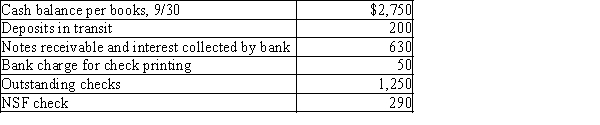

Gunnar Company gathered the following reconciling information in preparing its September bank reconciliation. Calculate the adjusted cash balance per books on September 30.

(Multiple Choice)

4.7/5  (32)

(32)

Which is the better choice for evaluating across companies: Days' Cash on Hand or the amount in the company's Cash account?

(Multiple Choice)

4.8/5  (34)

(34)

Accompanying a bank statement for Marsh Land Properties is a credit memo for payment on a $15,000 1-year note receivable and $900 of interest collected by the bank. Marsh Land Properties had been notified by the bank at the time of collection, but had made no entries. Journalize the entry that should be made by Marsh Land to bring the accounting records up to date.

(Essay)

4.8/5  (31)

(31)

Showing 41 - 60 of 197

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)