Exam 7: Internal Control and Cash

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

On April 2, Granger Sales decides to establish a $125.00 petty cash fund to relieve the burden on Accounting.

(a) Journalize the establishment of the fund.(b) On April 10, the petty cash fund has receipts for mail and postage of $43.50, contributions and donations of $29.50, meals and entertainment of $38.25, and $13.55 in cash. Journalize the replenishment of the fund. Record any missing funds in the cash short and over account.(c) On April 11, Granger Sales decides to increase petty cash to $200.00. Journalize this event.

(Essay)

5.0/5  (38)

(38)

What entry is required in the company's accounts to record outstanding checks?

(Multiple Choice)

4.9/5  (40)

(40)

Money market accounts, commercial paper, and U. S. Treasury bills are examples of cash equivalents.

(True/False)

4.8/5  (28)

(28)

For each of the following, explain whether the issue would require you to prepare a journal entry for your company, assuming any original entry is correct. If an entry is required, please include it as part of your answer.(1) The bank recorded your deposit as $91 rather than the actual amount of $191.(2) Two outstanding checks amounted to $450.(3) Company check number 538 for postage was recorded incorrectly by the company bookkeeper as $50 instead

of $59.(4) The bank paid a check for $500 after the company had issued a stop payment and voided the check.(5) An EFT deposit was made by one of the company's customers, Atlas Design, for merchandise received. The

sale had previously been recorded when shipped and was equal to the payment amount of $125.

(Essay)

4.9/5  (27)

(27)

Which one of the following below is not an element of internal control?

(Multiple Choice)

4.9/5  (38)

(38)

If the balance in Cash Short and Over at the end of a period is a credit, it indicates that cash shortages have exceeded cash overages for the period.

(True/False)

4.9/5  (40)

(40)

Which of the following statements is true about the Days' Cash on Hand ratio?

(Multiple Choice)

5.0/5  (35)

(35)

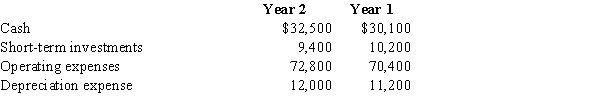

Selected financial statement data for two years ended December 31 for Carey Co. follow. Assets are reported at their year-end value.  Calculate the days' cash on hand for the two years, rounding all calculations to one decimal place.

Calculate the days' cash on hand for the two years, rounding all calculations to one decimal place.

(Essay)

4.9/5  (25)

(25)

Minor Company had checks outstanding totaling $19,200 on its April bank reconciliation. In May, Minor Company issued checks totaling $64,900. The May bank statement shows that $47,600 in checks cleared the bank in May. A check from one of Minor Company's customers of $300 was also returned marked "NSF." The amount of outstanding checks on Minor Company's May bank reconciliation should be

(Multiple Choice)

4.8/5  (38)

(38)

The amount of the outstanding checks is included on the bank reconciliation as a(n)

(Multiple Choice)

4.7/5  (30)

(30)

A firm's internal control environment is not influenced by

(Multiple Choice)

4.7/5  (30)

(30)

Internal control does not consist of policies and procedures that

(Multiple Choice)

4.8/5  (37)

(37)

A compensating balance occurs when a bank may require a company to maintain a maximum cash balance.

(True/False)

4.7/5  (37)

(37)

Match each item to a bank statement adjustment, a company books adjustment, or either.

-Note collected by the bank

A)bank statement adjustment

B)company books adjustment

C)either

(Short Answer)

4.9/5  (39)

(39)

In preparing a bank reconciliation, the amount of outstanding checks is added to the balance per bank statement.

(True/False)

4.7/5  (39)

(39)

Identify each of the following reconciling items as (a) an addition to the cash balance according to the bank statement, (b) deduction from the cash balance according to the bank statement, (c) an addition to the cash balance according to the company's records, or (d) a deduction from the cash balance according to the company's records. Assume that none of the transactions reported by bank debit and credit memos have been recorded by the company. Also, indicate by writing "entry" by those items that will require a journal entry in the company's accounts.

1.Deposits in transit.

2.Bank service charges.

3.NSF check.

4.Outstanding checks.

5.Check for $690 incorrectly recorded by the company as $960.

6.Check for $420 incorrectly recorded by the company as $240.

(Essay)

4.7/5  (43)

(43)

When the petty cash fund is replenished, the petty cash account is credited for the total of all expenditures made since the fund was last replenished.

(True/False)

4.8/5  (32)

(32)

Showing 141 - 160 of 197

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)