Exam 7: Internal Control and Cash

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

Consider the following information from the cash account. Assume cash payments were 84% of collections.  How much was the beginning balance of the cash account?

How much was the beginning balance of the cash account?

(Essay)

4.8/5  (39)

(39)

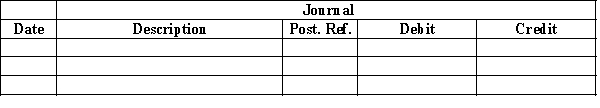

The actual cash received during the week ended June 6 for cash sales was $8,276 and the amount indicated by the cash register total was $8,262. Journalize the entry to record the cash receipts and cash sales.

(Essay)

5.0/5  (35)

(35)

Match the following elements of internal control:

-risk assessment

A)provides reasonable assurance that business goals will be achieved

B)used by management for guiding operations and ensuring compliance with requirements

C)overall attitude of management and employees

D)used to locate weaknesses and improve controls

E)identify, analyze and assess likeliness of vulnerabilities

(Short Answer)

4.8/5  (26)

(26)

You began your new job as the accountant at Bolivar Industries during the month of December. During your first month, you found several interesting issues.

1) While looking through the invoices, you found Invoices 213-242, 245-271, and 275-290. It appears that invoices

243, 244, 272, 273, and 274 are missing.

2) During the month, Clerk # 3 issued $250 in refunds as compared to Clerks #1, #2, and #4 who issued less than

$50 each.

3) The daily cash receipts and bank deposits reconcile, except on Tuesdays during the month.

4) Business is generally brisk during the holiday season, but two weeks before Christmas there was a sudden

increase in slow payments.

Part A: What kind of warning signs could be associated with these issues?

Part B: What control could you put in place regarding cash refunds mentioned in Part A (2)?

(Essay)

4.7/5  (29)

(29)

List the objectives of internal control and give an example of how each is implemented.

(Essay)

4.8/5  (43)

(43)

Cash equivalents include short-term investments that will be converted to cash within 120 days.

(True/False)

4.8/5  (36)

(36)

Assign the letter to indicate whether the following items would be added to or subtracted from the company's books or the bank statement during the construction of a bank reconciliation.a.added to the company's books

b.subtracted from the company's books

c.added to the bank statement balance

d.subtracted from the bank statement balance

-NSF check

(Short Answer)

4.9/5  (37)

(37)

Receipts from cash sales of $3,200 were recorded incorrectly in the cash receipts journal as $2,300. This item would be included on the bank reconciliation as a(n)

(Multiple Choice)

4.8/5  (43)

(43)

A $200 petty cash fund has cash of $20 and receipts of $177. The journal entry to replenish the account would include a credit to

(Multiple Choice)

4.9/5  (36)

(36)

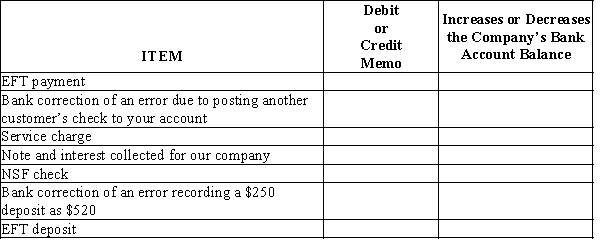

You are trying to explain debit and credit memos that appear on bank statements and whether these will increase or decrease your company's bank account balance. Complete the following table to help your new staff understand.

(Essay)

4.8/5  (29)

(29)

A $150 petty cash fund has cash of $54 and receipts of $83. The journal entry to replenish the account would include a

(Multiple Choice)

4.9/5  (33)

(33)

On April 3, Snappy Sales decides to establish a $135.00 petty cash fund to relieve the burden on Accounting.

(a)Journalize the establishment of the fund.(b)On April 11, the petty cash fund has receipts for mail and postage of $32.75, contributions and donations of$25.25, meals and entertainment of $68.00, and $9.75 in cash. Journalize the replenishment of the fund.Record any missing funds in the cash short and over account.(c)On April 12, Snappy Sales decides to increase petty cash to $175.00. Journalize this transaction.

(Essay)

4.9/5  (42)

(42)

The bank statement for Gatlin Co. indicates a balance of $7,735 on June 30. After the journal entries for June had been posted, the cash account had a balance of $4,098.

(a)Cash sales of $742 had been erroneously recorded in the cash receipts journal as $724.(b)Deposits in transit not recorded by bank, $425.(c)Bank debit memo for service charges, $35.(d)Bank credit memo for note collected by bank, $2,475 including $75 interest.(e)Bank debit memo for $256 NSF (not sufficient funds) check from Janice Smith, a customer.(f)Checks outstanding, $1,860.

Record the appropriate journal entries that would be necessary for Gatlin Co.

(Essay)

4.7/5  (39)

(39)

In preparing a bank reconciliation, the amount of an error indicating the recording of a check in the journal for an amount larger than the amount of the check is added to the balance per company's records.

(True/False)

4.9/5  (31)

(31)

The following procedures were recently implemented at the Pampered Pets, Inc. For each procedure, indicate whether the internal control over cash represents (1) a strength or (2) a weakness. If it is a weakness, please explain why.

(a) At the end of the day, cash register clerks are required to use their own funds to make up any cash shortages

in their registers.

(b) At the end of the day, an accounting clerk compares the duplicate copy of the daily cash deposit slip with the

deposit receipt obtained from the bank.

(c) After necessary approvals have been obtained for the payment of a voucher, the treasurer signs and mails the

check. The treasurer then stamps the voucher and supporting documentation as paid and returns the voucher

and supporting documentation to the accounts payable clerk for filing.

(d) Along with the petty cash receipts for postage, office supplies, etc., several postdated employee

checks are in the petty cash fund.

(Essay)

4.8/5  (40)

(40)

Match the following elements of internal control:

-monitoring

A)provides reasonable assurance that business goals will be achieved

B)used by management for guiding operations and ensuring compliance with requirements

C)overall attitude of management and employees

D)used to locate weaknesses and improve controls

E)identify, analyze and assess likeliness of vulnerabilities

(Short Answer)

4.8/5  (38)

(38)

In preparing a bank reconciliation, the amount indicated by a debit memo for bank service charges is added to the balance per company's records.

(True/False)

4.9/5  (39)

(39)

The bank statement for Farmer Co. indicates a balance of $7,735.00 on June 30. After the journal entries for June had been posted, the cash account had a balance of $4,098.00. Prepare a bank reconciliation on the basis of the following reconciling items:

(a)Cash sales of $742 had been erroneously recorded in the cash receipts journal as $724.(b)Deposits in transit not recorded by bank, $425.(c)Bank debit memo for service charges, $35.(d)Bank credit memo for note collected by bank, $2,475 including $75 interest.(e)Bank debit memo for $256 NSF (not sufficient funds) check from Janice Smith, a customer.(f)Checks outstanding, $1,860.

(Essay)

4.8/5  (32)

(32)

When the voucher system is used, the amount due on each voucher represents the credit balance of an account payable if the voucher is in full payment to a creditor.

(True/False)

4.8/5  (39)

(39)

The petty cash fund eliminates the need for a bank checking account.

(True/False)

5.0/5  (29)

(29)

Showing 81 - 100 of 197

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)