Exam 6: Inventories

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

If a company values inventory at the lower of cost or market, which of the following is the value of inventory on the balance sheet? Apply the lower-of-cost-or-market method to inventory as a whole.

(Multiple Choice)

4.8/5  (36)

(36)

Control of inventory should begin as soon as the inventory is received. Which of the following internal control steps is not done to meet this goal?

(Multiple Choice)

4.8/5  (34)

(34)

Match each description to the appropriate document used for inventory control (a-c).

-establishes an initial record of the receipt of inventory

A)Receiving report

B)Vendor's invoice

C)Purchase order

(Short Answer)

4.9/5  (30)

(30)

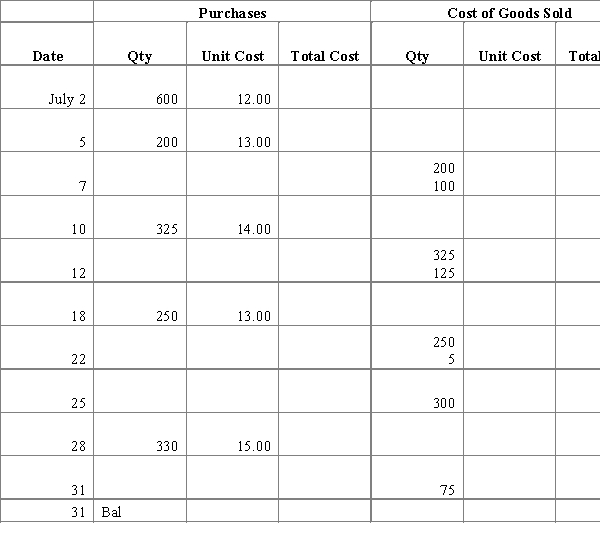

Complete the following table using the perpetual LIFO method of inventory flow.

(Essay)

4.9/5  (34)

(34)

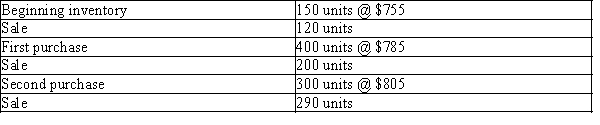

Beginning inventory, purchases, and sales for an inventory item are as follows:  The firm uses the perpetual inventory system and there are 240 units of the item on hand at the end of the year. What is the total cost of ending inventory according to FIFO?

The firm uses the perpetual inventory system and there are 240 units of the item on hand at the end of the year. What is the total cost of ending inventory according to FIFO?

(Short Answer)

4.8/5  (34)

(34)

If a company mistakenly counts more items during a physical inventory than actually exist, how will the error affect their bottom line?

(Multiple Choice)

4.8/5  (33)

(33)

During periods of rapidly rising costs, the use of the LIFO method results in illusory or inventory profits.

(True/False)

4.8/5  (34)

(34)

Which of the following is used to analyze the efficiency and effectiveness of inventory management?

(Multiple Choice)

4.9/5  (35)

(35)

One of the two internal control procedures over inventory is to properly report inventory on the financial statements.

(True/False)

4.9/5  (43)

(43)

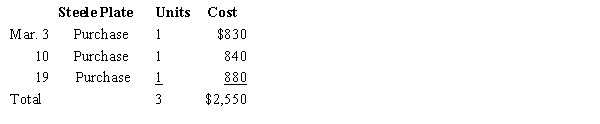

Three identical units of merchandise were purchased during March, as shown:  Assume that one unit is sold on March 23 for $1,125. What is the gross profit for March using FIFO?

Assume that one unit is sold on March 23 for $1,125. What is the gross profit for March using FIFO?

(Multiple Choice)

4.8/5  (40)

(40)

During periods of increasing costs, an advantage of the LIFO inventory cost method is that it matches more recent costs against current revenues.

(True/False)

4.8/5  (34)

(34)

The following lots of a Commodity P were available for sale during the year. Use this information to answer the questions that follow.

Beginning inventory

5 units at $61

First purchase

15 units at $63

Second purchase

10 units at $74

Third purchase

10 units at $77

The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year.

-What is the year-end inventory balance using the average cost method? Use the information provided in the table to answer this question

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following will be the same amount regardless of the cost flow assumption adopted?

(Multiple Choice)

4.7/5  (31)

(31)

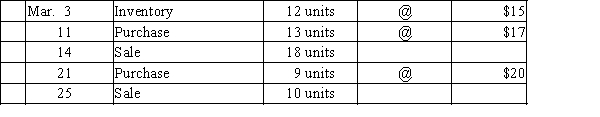

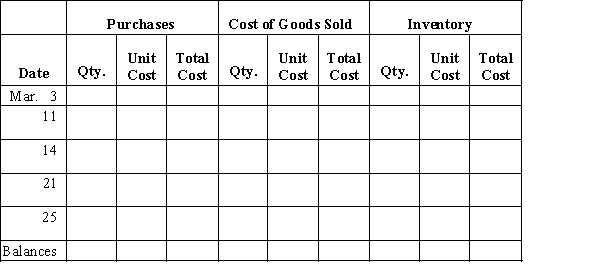

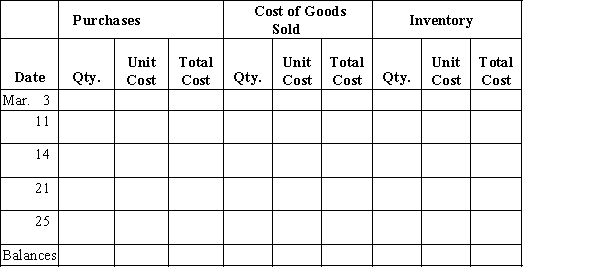

Beginning inventory, purchases, and sales data for hammers are as follows:  Assuming the business maintains a perpetual inventory system, complete the inventory cards and calculate the cost of goods sold and ending inventory under the following assumptions:

(a) First-in, first-out

Assuming the business maintains a perpetual inventory system, complete the inventory cards and calculate the cost of goods sold and ending inventory under the following assumptions:

(a) First-in, first-out  (b) Last-in, first-out

(b) Last-in, first-out

(Essay)

4.7/5  (42)

(42)

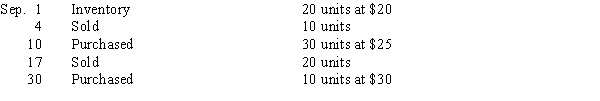

Addison, Inc. uses a perpetual inventory system. Below is information about one inventory item for the month of September. Use this information to answer the questions that follow.  -If Addison uses FIFO, the September 30 inventory is

-If Addison uses FIFO, the September 30 inventory is

(Multiple Choice)

4.8/5  (36)

(36)

Three identical units of merchandise were purchased during March, as shown:  Assume that one unit is sold on March 23 for $1,125. What is the ending inventory on March 31 using LIFO.

Assume that one unit is sold on March 23 for $1,125. What is the ending inventory on March 31 using LIFO.

(Multiple Choice)

4.8/5  (38)

(38)

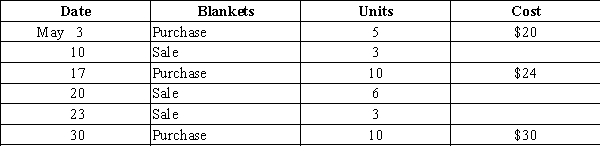

Use the information below to answer the following questions.The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.  -Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the LIFO inventory cost method.

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the LIFO inventory cost method.

(Multiple Choice)

4.9/5  (40)

(40)

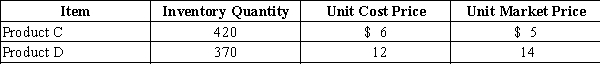

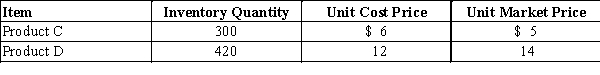

On the basis of the following data, what is the value of the total inventory at the lower of cost or market. Apply lower of cost or market to each inventory item.

(Multiple Choice)

4.8/5  (31)

(31)

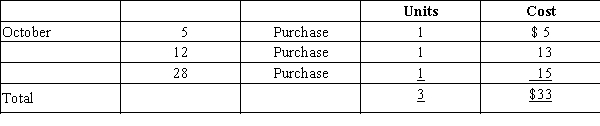

Assume that three identical units of merchandise are purchased during October, as follows:  Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the FIFO method.

Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the FIFO method.

(Essay)

4.9/5  (43)

(43)

Showing 61 - 80 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)