Exam 6: Inventories

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

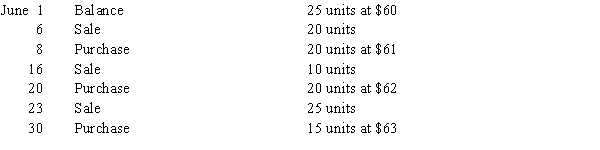

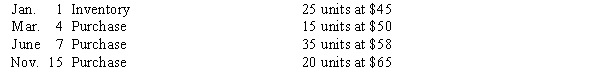

The following data regarding purchases and sales of a commodity were taken from the related perpetual inventory account:  Calculate the cost of the ending inventory at June 30, using (a) the first-in, first-out (FIFO) method and (b) the last-in, first-out (LIFO) method. Identify the quantity, unit price, and total cost of each lot in the inventory.

Calculate the cost of the ending inventory at June 30, using (a) the first-in, first-out (FIFO) method and (b) the last-in, first-out (LIFO) method. Identify the quantity, unit price, and total cost of each lot in the inventory.

(Essay)

4.9/5  (30)

(30)

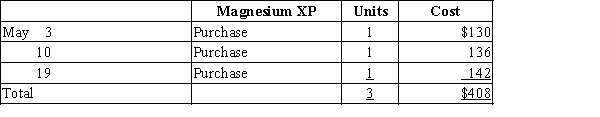

Three identical units of merchandise were purchased during May, as follows:  Assume that two units are sold on May 23 for $313 total. Determine the gross profit for May and ending inventory on May 31 using (a) FIFO, (b) LIFO, and (c) average cost methods.

Assume that two units are sold on May 23 for $313 total. Determine the gross profit for May and ending inventory on May 31 using (a) FIFO, (b) LIFO, and (c) average cost methods.

(Essay)

4.8/5  (37)

(37)

Hampton Co. took a physical count of its inventory on December 31. In addition, it had to decide whether or not the following items should be added to this count.(a)Inventory on hand had been sold earlier in the year but had been returned by customers for various warranty repairs.(b)Hampton Co. sent merchandise on a consignment basis on December 31 just prior to the physical count.(c)On December 22, Hampton Co. ordered merchandise on FOB destination terms. The merchandise was shipped by the supplier on December 30 but had not been received by December 31.(d)On December 27, Hampton Co. ordered merchandise on FOB shipping point terms. The merchandise was shipped on December 29 but had not been received by December 31.(e)Merchandise sold FOB shipping point on December 31 was picked up by the freight company just before closing on December 31.(f)Merchandise shipped to a customer FOB destination was picked up by the freight company on December 28 but had not arrived at its destination as of December 31.

Answer "yes" or "no" to indicate which items should and should not be added to the December 31 inventory count.

(Essay)

4.8/5  (35)

(35)

Match each situation to its impact (a-c) on the current year's net income.

a.Net income for the current year will be overstated.b.Net income for the current year will be understated.c.There will be no error effect on net income.

-A consignor included merchandise in the hands of the consignee in ending inventory.

(Short Answer)

4.9/5  (37)

(37)

Safeguarding inventory and proper reporting of the inventory in the financial statements are the reasons for controlling the inventory.

(True/False)

4.8/5  (34)

(34)

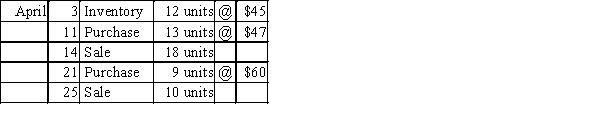

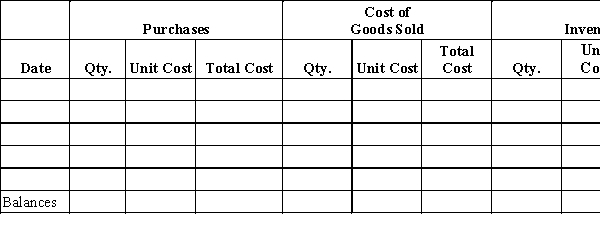

Beginning inventory, purchases, and sales data for tennis rackets are as follows:  Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using the weighted average cost method.

Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using the weighted average cost method.

(Essay)

5.0/5  (42)

(42)

Which of the following methods is appropriate for a business whose inventory consists of a relatively small number of unique, high-cost items?

(Multiple Choice)

4.7/5  (38)

(38)

"Market" as used in the phrase "lower of cost or market" for valuing inventory, refers to the price at which the inventory is being offered for sale by the company.

(True/False)

4.9/5  (43)

(43)

The use of the lower-of-cost-or-market method of inventory valuation increases net income for the period in which the inventory replacement price declined.

(True/False)

4.7/5  (42)

(42)

Match each situation to its impact (a-c) on the current year's net income.

a.Net income for the current year will be overstated.b.Net income for the current year will be understated.c.There will be no error effect on net income.

-Beginning inventory was understated.

(Short Answer)

4.8/5  (41)

(41)

Cost flow is in the order in which costs were incurred when using

(Multiple Choice)

4.8/5  (42)

(42)

Which document establishes an initial record of the receipt of the inventory?

(Multiple Choice)

4.9/5  (27)

(27)

The units of an item available for sale during the year were as follows:  There are 30 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost using FIFO.

There are 30 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost using FIFO.

(Essay)

4.8/5  (44)

(44)

All of the following are reasons to use an estimated method of costing inventory except

(Multiple Choice)

4.8/5  (42)

(42)

The inventory method that assigns the most recent costs to cost of goods sold is

(Multiple Choice)

5.0/5  (37)

(37)

If inventory is being valued at cost and the price level is steadily rising, the method of costing that will yield the highest net income is

(Multiple Choice)

4.7/5  (38)

(38)

If the estimated rate of gross profit is 30%, what is the estimated cost of the inventory on September 30, based on the following data?

(Multiple Choice)

4.8/5  (33)

(33)

The following lots of a Commodity P were available for sale during the year. Use this information to answer the questions that follow.

Beginning inventory

5 units at $61

First purchase

15 units at $63

Second purchase

10 units at $74

Third purchase

10 units at $77

The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year.

-What is the year-end inventory balance using the FIFO method? Use the information provided in the table to answer this question

(Multiple Choice)

4.9/5  (38)

(38)

Match each description to the appropriate cost flow assumption (a-c).

-Produces the highest gross profit when costs are decreasing

A)FIFO

B)LIFO

C)Weighted average

(Short Answer)

4.9/5  (31)

(31)

If a company mistakenly counts less items during a physical inventory than actually exist, how will the error affect the cost of goods sold?

(Multiple Choice)

4.7/5  (41)

(41)

Showing 121 - 140 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)