Exam 10: Foreign Currency Transactions

Exam 1: Conceptual and Case Analysis Frameworks for Financial Reporting41 Questions

Exam 2: Investments in Equity Securities32 Questions

Exam 3: Business Combinations60 Questions

Exam 4: Consolidation of Non-Wholly Owned Subsidiaries56 Questions

Exam 5: Consolidation Subsequent to Acquisition Date41 Questions

Exam 6: Intercompany Inventory and Land Profits42 Questions

Exam 7: A Intercompany Profits in Depreciable Assets B Intercompany Bondholdings62 Questions

Exam 8: Consolidated Cash Flows and Changes in Ownership45 Questions

Exam 9: Other Consolidation Reporting Issues62 Questions

Exam 10: Foreign Currency Transactions63 Questions

Exam 11: Translation and Consolidation of Foreign Operations17 Questions

Exam 12: Accounting for Not-For-Profit and Public Sector Organizations61 Questions

Select questions type

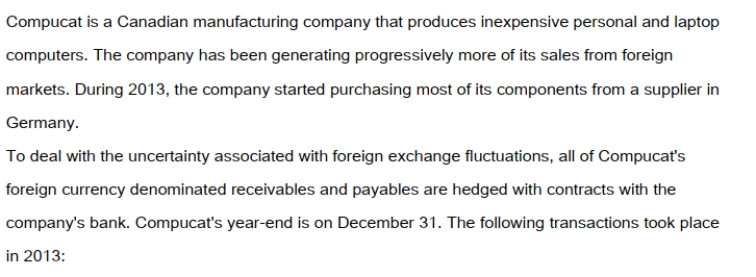

On September 1, 2013, Compucat purchased components from its German supplier for 100,000 Euros. On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro = $1.50CDN. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2013. On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.

On September 1, 2013, Compucat purchased components from its German supplier for 100,000 Euros. On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro = $1.50CDN. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2013. On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.  Prepare the December 31, 2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

Prepare the December 31, 2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

(Essay)

4.8/5  (39)

(39)

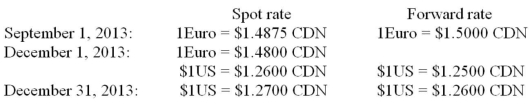

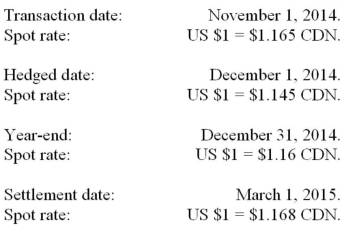

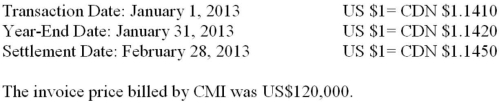

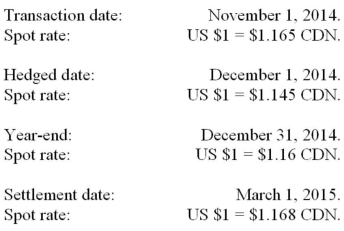

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

(Multiple Choice)

4.8/5  (41)

(41)

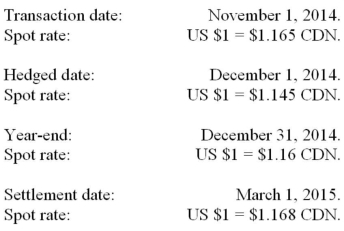

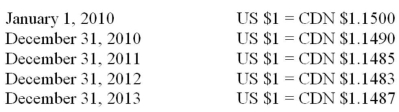

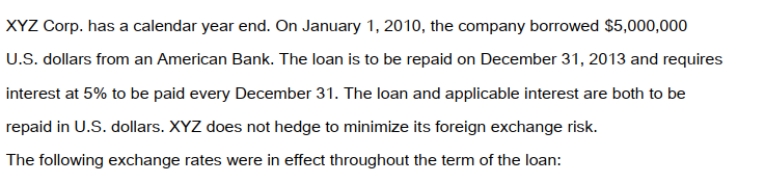

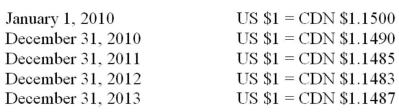

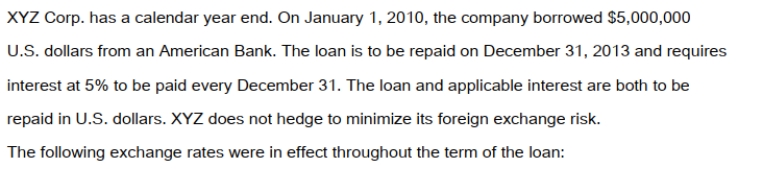

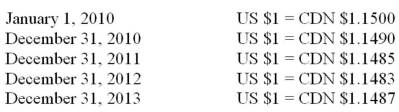

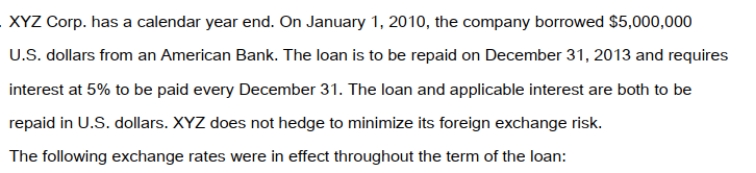

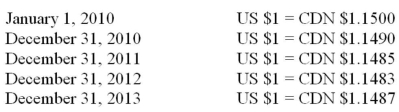

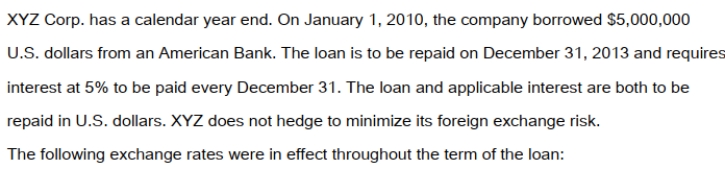

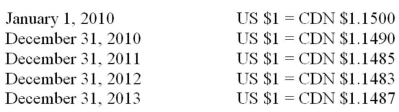

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2011 as a result of the year's foreign exchange rate fluctuations?

By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2011 as a result of the year's foreign exchange rate fluctuations?

(Multiple Choice)

4.8/5  (33)

(33)

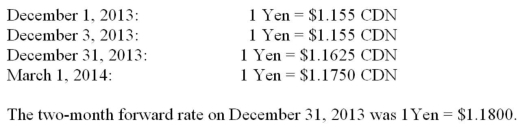

Canada Corp. sells raw lumber to a number of countries around the world. On December 1, 2013 the company shipped some lumber to a client in Japan. The selling price was established at 500,000 Yen with payment to be received on March 1, 2014. On December 3, 2013 the company entered into a hedge with a Canadian Bank at the 90 day forward rate of 1Yen = $1.185CDN. The forward contract was designated as a fair value hedge of the receivable from the Japanese customer. Canada Corp received the payment from its Japanese client on March 1, 2014. Canada Corp's year end is on December 31. Selected spot rates were as follows:  Prepare the journal entries to record the receipt of the 500,000 Yen on March 1, 2014, assuming that Canada Corp did not enter into a hedge transaction in December 2013.

Prepare the journal entries to record the receipt of the 500,000 Yen on March 1, 2014, assuming that Canada Corp did not enter into a hedge transaction in December 2013.

(Essay)

4.9/5  (44)

(44)

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2010 as a result of the year's foreign exchange rate fluctuations?

By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2010 as a result of the year's foreign exchange rate fluctuations?

(Multiple Choice)

4.7/5  (44)

(44)

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

(Multiple Choice)

5.0/5  (39)

(39)

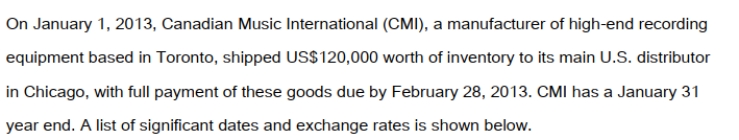

At what value would CMI record the initial sale to its American distributor?

At what value would CMI record the initial sale to its American distributor?

(Multiple Choice)

4.7/5  (36)

(36)

Which of the following is NOT currently a cause of fluctuation in foreign exchange rates?

(Multiple Choice)

4.9/5  (38)

(38)

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  At what amount (in Canadian Dollars) would the forward contract with the bank be recorded, if recorded gross?

At what amount (in Canadian Dollars) would the forward contract with the bank be recorded, if recorded gross?

(Multiple Choice)

4.9/5  (28)

(28)

On July 1, 2014, when the spot rate was US$1 = CDN$1.1445, North Inc., based in Alberta, ordered merchandise from an American supplier for US$600,000. Delivery was scheduled for the month of September, with payment to be made in full on November 15, 2014. Once the order was placed, North entered into a forward contract with its bank to purchase US$600,000 on the settlement date at the forward rate of $1.1625CDN. The forward contract was designated as a cash flow hedge of the cash flow required to settle with the American supplies. The merchandise was received on October 1, 2014, when the spot rate was US$1 = $1.1575CDN. On October 31, the company's year-end, the spot rate was $1.1690. North purchased the U.S. dollars to pay its supplier on November 15, 2014 when the spot rate was $1.1725CDN. The forward rate to November 15, 2014, was $1.165CDN on October 1 and $1.17CDN on October 31. What is the journal entry required to record the ordering of North's merchandise?

(Multiple Choice)

4.7/5  (37)

(37)

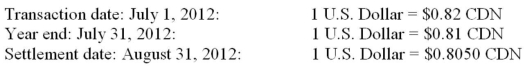

On July 1, 2012, CDN purchased inventory from its main U.S. supplier, RNB Enterprises, at a cost of US$1,000. CDN's year end is on July 31. Some important dates regarding this transaction, as well as the exchange rates in effect at each of these dates are shown below:  What was the cost to CDN of the amount paid to RNB on the settlement date?

What was the cost to CDN of the amount paid to RNB on the settlement date?

(Multiple Choice)

4.8/5  (32)

(32)

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of interest expense (in Canadian Dollars) recorded for 2010?

What is the amount of interest expense (in Canadian Dollars) recorded for 2010?

(Multiple Choice)

4.8/5  (37)

(37)

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of foreign exchange gain or loss recognized on the 2011 Income Statement as a result of revaluing the loan payable?

What is the amount of foreign exchange gain or loss recognized on the 2011 Income Statement as a result of revaluing the loan payable?

(Multiple Choice)

4.9/5  (36)

(36)

The average rates in effect for 2010 and 2011 were as follows:

The average rates in effect for 2010 and 2011 were as follows:  What is the amount of interest paid (in Canadian Dollars) during 2010?

What is the amount of interest paid (in Canadian Dollars) during 2010?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 21 - 40 of 63

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)