Exam 17: Business Tax Credits and the Alternative Minimum Tax

Exam 1: Introduction to Taxation122 Questions

Exam 2: Working With the Tax Law101 Questions

Exam 3: Taxes on the Financial Statements70 Questions

Exam 4: Gross Income100 Questions

Exam 5: Business Deductions143 Questions

Exam 6: Losses and Loss Limitations147 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges126 Questions

Exam 8: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions119 Questions

Exam 9: Individuals As the Taxpayer132 Questions

Exam 10: Individuals: Income, Deductions, and Credits129 Questions

Exam 11: Individuals As Employees and Proprietors116 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules136 Questions

Exam 13: Corporations: Earnings and Profits and Distributions127 Questions

Exam 14: Partnerships and Limited Liability Entities142 Questions

Exam 15: S Corporations109 Questions

Exam 16: Multijurisdictional Taxation91 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax94 Questions

Exam 18: Comparative Forms of Doing Business84 Questions

Select questions type

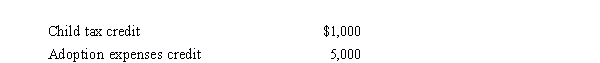

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000, and his tentative minimum tax is $195,000.Justin reports the following credits.  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

(Multiple Choice)

4.9/5  (33)

(33)

Employers are encouraged by the work opportunity tax credit to hire individuals who have been long-term recipients of family assistance welfare benefits.

(True/False)

4.8/5  (34)

(34)

The tax benefit received from a tax credit never is affected by the tax rate of the taxpayer.

(True/False)

4.7/5  (38)

(38)

The disabled access credit is computed at the rate of 50% of all access expenditures incurred by the taxpayer during the year.

(True/False)

4.9/5  (33)

(33)

Dale owns and operates Dale's Emporium as a sole proprietorship.On January 30, 2005, Dale's Emporium acquired a warehouse for $100,000.In 2019, for regular tax purposes, the MACRS depreciation deduction was calculated using a 2.564% rate.Determine the AMT adjustment for depreciation and indicate whether it is positive or negative.

(Multiple Choice)

4.8/5  (34)

(34)

Black Company paid wages of $180,000 of which $40,000 was qualified for the work opportunity tax credit under the general rules.Black Company's deduction for wages for the year is:

(Multiple Choice)

4.9/5  (41)

(41)

AMT adjustments can be positive or negative whereas AMT preferences always are positive.

(True/False)

4.8/5  (40)

(40)

In the current tax year, Ben exercised an incentive stock option (ISO), acquiring stock with a fair market value of $190,000 for $170,000.As a result, his AMT basis for the stock is $170,000, his regular income tax basis for the stock is $170,000, and his AMT adjustment is $0 ($170,000 - $170,000).

(True/False)

4.8/5  (38)

(38)

The standard deduction is allowed for regular income tax purposes but is disallowed for AMT purposes.This results in a positive AMT adjustment.

(True/False)

4.7/5  (38)

(38)

Which of the following statements describing the alternative minimum tax (AMT) is most correct?

(Multiple Choice)

4.9/5  (45)

(45)

Business tax credits reduce the AMT and the regular income tax in the same way.

(True/False)

4.8/5  (43)

(43)

An employer's tax deduction for wages is affected by the work opportunity tax credit.

(True/False)

4.8/5  (34)

(34)

Interest on a home equity loan that is not used to acquire or improve the taxpayer's principal residence cannot be deducted for AMT purposes.

(True/False)

4.8/5  (39)

(39)

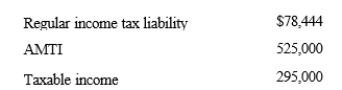

Ashby, who is single and age 30, provides you with the following information from his financial records for 2019.  Calculate his AMT exemption for 2019.

Calculate his AMT exemption for 2019.

(Multiple Choice)

4.9/5  (34)

(34)

Prior to the effect of tax credits, Eunice's regular income tax liability is $325,000 and her tentative minimum tax is $312,000.Eunice has general business credits available of $20,000.Calculate Eunice's tax liability after tax credits.

(Multiple Choice)

4.8/5  (34)

(34)

Cardinal Corporation hires two persons who are certified to be eligible employees for the work opportunity tax credit under the general rules (e.g., food stamp recipients), each of whom is paid $9,000 during the year.As a result of this event, Cardinal Corporation may claim a work opportunity credit of:

(Multiple Choice)

4.9/5  (41)

(41)

If a taxpayer elects to capitalize and to amortize intangible drilling costs over a three-year period for regular income tax purposes, there is no adjustment or preference for AMT purposes.

(True/False)

4.9/5  (47)

(47)

Unused foreign tax credits are carried back two years and then forward 20 years.

(True/False)

4.7/5  (36)

(36)

Cardinal Company incurs $800,000 during the year to construct a facility that will be used exclusively for the care of its employees' preschool age children during normal working hours.Assuming that Cardinal claims the credit for employer-provided child care this year, its basis in the newly constructed facility is $640,000.

(True/False)

4.8/5  (35)

(35)

Showing 21 - 40 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)