Exam 17: Business Tax Credits and the Alternative Minimum Tax

Exam 1: Introduction to Taxation122 Questions

Exam 2: Working With the Tax Law101 Questions

Exam 3: Taxes on the Financial Statements70 Questions

Exam 4: Gross Income100 Questions

Exam 5: Business Deductions143 Questions

Exam 6: Losses and Loss Limitations147 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges126 Questions

Exam 8: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions119 Questions

Exam 9: Individuals As the Taxpayer132 Questions

Exam 10: Individuals: Income, Deductions, and Credits129 Questions

Exam 11: Individuals As Employees and Proprietors116 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules136 Questions

Exam 13: Corporations: Earnings and Profits and Distributions127 Questions

Exam 14: Partnerships and Limited Liability Entities142 Questions

Exam 15: S Corporations109 Questions

Exam 16: Multijurisdictional Taxation91 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax94 Questions

Exam 18: Comparative Forms of Doing Business84 Questions

Select questions type

Wallace owns a construction company that builds both commercial and residential buildings.He contracts to build a residential building for $800,000, and for which he is eligible to use the completed contract method of accounting.In the current year for regular income tax purposes, Wallace does not recognize any gross income on the contract.Under the percentage of completion method, the income recognized under the contract would have been $60,000.Wallace's AMT effect is:

(Multiple Choice)

4.9/5  (29)

(29)

Which of the following correctly describes the tax credit for rehabilitation expenditures?

(Multiple Choice)

4.8/5  (35)

(35)

The AMT adjustment for mining exploration and development costs can be avoided if the taxpayer elects to deduct the expenditures in the year incurred for regular income tax purposes rather than writing off the expenditures over a 10-year period for regular income tax purposes.

(True/False)

4.9/5  (29)

(29)

Joel placed real property in service in 2019 that cost $900,000 and used MACRS depreciation for regular income tax purposes.He is required to make a positive adjustment for AMT purposes in 2019 for the excess of depreciation calculated for regular income tax purposes over the depreciation calculated for AMT purposes.

(True/False)

4.9/5  (35)

(35)

For regular income tax purposes, Yolanda, who is single, is in the 32% tax bracket.Her AMT base is $420,000.Her tentative AMT is:

(Multiple Choice)

4.8/5  (39)

(39)

Income from some long-term contracts can be reported using the completed contract method for regular income tax purposes, but the percentage of completion method is required for AMT purposes for all long-term contracts.

(True/False)

4.7/5  (42)

(42)

The disabled access credit was enacted to encourage small businesses to make their businesses more accessible to disabled individuals.

(True/False)

4.8/5  (35)

(35)

Which of the following best describes the treatment applicable to unused business credits?

(Multiple Choice)

4.9/5  (40)

(40)

If the cost of a building constructed and placed into service by an eligible small business in the current year includes the cost of a wheelchair ramp, which qualifies for the disabled access credit.

(True/False)

4.9/5  (35)

(35)

Elmer exercises an incentive stock option (ISO) in March for $6,000 (fair market value of the stock on the exercise date is $7,600).If Elmer sells the stock in November of the same tax year for $8,000, he reports a $1,600 AMT adjustment for the year.

(True/False)

4.9/5  (41)

(41)

On February 1, 2019, Omar acquires used 7-year personal property for 100,000.The property will be used in his business.Omar does not elect § 179 expensing, but he does take the maximum regular tax depreciation deduction.As a result, Omar incurs a positive AMT adjustment in 2019 of what amount?

(Multiple Choice)

4.7/5  (32)

(32)

Prior to consideration of tax credits, Clarence's regular income tax liability is $200,000 and his tentative minimum tax (TMT) is $180,000.Clarence holds nonrefundable business tax credits of $35,000.His tax liability for the year is $165,000.

(True/False)

4.8/5  (38)

(38)

Nell records a personal casualty loss deduction of $14,500 for regular income tax purposes.The loss was the result of a Federally declared disaster.The actual loss was $26,600, but it was reduced by $100 and by $12,000 (10% × $120,000 AGI) for regular tax purposes.For AMT purposes, the casualty loss deduction also is $14,500.

(True/False)

4.9/5  (40)

(40)

Qualified research and experimentation expenditures are not only eligible for the 20% tax credit but also can be expensed in the year incurred.

(True/False)

4.9/5  (46)

(46)

BlueCo incurs $900,000 during the year to construct a facility that will be used exclusively for the care of its employees' pre-school age children during normal working hours.The credit for employer-provided child care available to BlueCo this year is $225,000.

(True/False)

4.7/5  (35)

(35)

In deciding whether to enact the alternative minimum tax, Congress was concerned about the inequity that resulted when taxpayers with substantial economic incomes could avoid paying regular income tax.

(True/False)

4.8/5  (49)

(49)

The AMT adjustment for research and experimental expenditures can be avoided if the taxpayer capitalizes the expenditures and amortizes them over a 10-year period for regular tax purposes.

(True/False)

4.8/5  (35)

(35)

Waltz, Inc., a U.S.taxpayer, pays foreign taxes of $50,000 on foreign-source general basket income of $90,000. Waltz's worldwide taxable income is $450,000, on which it owes U.S.taxes of $94,500 before FTC.Waltz's FTC is $50,000.

(True/False)

5.0/5  (48)

(48)

Any unused general business credit must be carried back three years and then forward for 20 years.

(True/False)

4.8/5  (33)

(33)

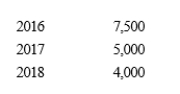

Molly has generated general business credits over the years that have not been utilized.The amounts generated and not utilized equal:

In the current year, 2019, her business generates an additional $15,000 general business credit.In 2019, based on her tax liability before credits, she can utilize a general business credit of up to $20,000.After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2019 is available for future years?

a.$0.

b.$1,000.

c.$14,000.

d.$15,000.

In the current year, 2019, her business generates an additional $15,000 general business credit.In 2019, based on her tax liability before credits, she can utilize a general business credit of up to $20,000.After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2019 is available for future years?

a.$0.

b.$1,000.

c.$14,000.

d.$15,000.

(Essay)

4.8/5  (33)

(33)

Showing 61 - 80 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)