Exam 9: Net Present Value and Other Investment Criteria

Exam 1: Introduction to Corporate Finance262 Questions

Exam 2: Financial Statements, Taxes, and Cash Flow411 Questions

Exam 3: Working With Financial Statements414 Questions

Exam 4: Long-Term Financial Planning and Growth369 Questions

Exam 5: Introduction to Valuation: the Time Value of Money282 Questions

Exam 6: Discounted Cash Flow Valuation415 Questions

Exam 7: Interest Rates and Bond Valuation394 Questions

Exam 8: Stock Valuation401 Questions

Exam 9: Net Present Value and Other Investment Criteria409 Questions

Exam 10: Making Capital Investment Decisions365 Questions

Exam 11: Project Analysis and Evaluation428 Questions

Exam 12: Some Lessons From Capital Market History330 Questions

Exam 13: Return, Risk, and the Security Market Line417 Questions

Exam 14: Cost of Capital377 Questions

Exam 15: Raising Capital342 Questions

Exam 16: Financial Leverage and Capital Structure Policy385 Questions

Exam 17: Dividends and Payout Policy378 Questions

Exam 18: Short-Term Finance and Planning427 Questions

Exam 19: Cash and Liquidity Management378 Questions

Exam 20: Credit and Inventory Management384 Questions

Exam 21: International Corporate Finance372 Questions

Exam 22: Behavioral Finance: Implications for Financial Management269 Questions

Exam 23: Enterprise Risk Management336 Questions

Exam 24: Options and Corporate Finance308 Questions

Exam 25: Option Valuation449 Questions

Exam 26: Mergers and Acquisitions78 Questions

Select questions type

Floyd Clymer is the CFO of Bonavista Mustang, a manufacturer of parts for classic automobiles. Floyd is considering the purchase of a two-ton press which will allow the firm to stamp out auto

Fenders. The equipment costs $250,000. The project is expected to produce after-tax cash flows of

$60,000 the first year, and increase by $10,000 annually; the after-tax cash flow in year 5 will reach

$100,000. Liquidation of the equipment will net the firm $10,000 in cash at the end of five years,

Making the total cash flow in year five $110,000.

Assume the required return is 15%. What is the project's net present value?

(Multiple Choice)

4.8/5  (31)

(31)

Which capital investment evaluation technique is described by the following characteristics? (1) Easy to understand; (2) Biased towards liquidity; (3) Requires an arbitrary cutoff point; (4) Ignores the time

Value of money.

(Multiple Choice)

4.8/5  (42)

(42)

The essence of _________________ is determining whether a proposed investment or project will generate positive wealth for the owners of the firm once it is in place.

(Multiple Choice)

4.9/5  (41)

(41)

You are to present a proposed capital investment project to your board of directors. The project has

a NPV of $12,000 and an IRR of 12%. The firm's required return is 10%. You are to convey your

proposal to the board in a single paragraph. Write that paragraph here. Remember, your job is to

convince the board to either accept or reject the project, whichever you feel is appropriate given

this information.

(Essay)

4.8/5  (31)

(31)

A project will produce cash inflows of $3,650 a year for four years. The start-up costs are $15,000. In year five, the project will be closed and as a result should produce a cash inflow of $7,500. What

Is the net present value of this project if the required rate of return is 11.5 percent?

(Multiple Choice)

4.9/5  (37)

(37)

List and briefly discuss the advantages and disadvantages of the IRR rule.

(Essay)

5.0/5  (32)

(32)

The discounted payback rule states that you should accept projects:

(Multiple Choice)

4.7/5  (33)

(33)

A situation in which taking one investment prevents the taking of another is called:

(Multiple Choice)

4.8/5  (44)

(44)

Determining whether to sell bonds or issue stock is a capital budgeting decision.

(True/False)

4.9/5  (37)

(37)

The internal rate of return method of analysis is generally more popular in practice than NPV.

(True/False)

4.8/5  (46)

(46)

The average accounting return calculation takes the time value of money into account.

(True/False)

4.9/5  (32)

(32)

The internal rate of return (IRR) rule states that a project with an IRR that is less than the required

rate should be accepted.

(True/False)

4.9/5  (41)

(41)

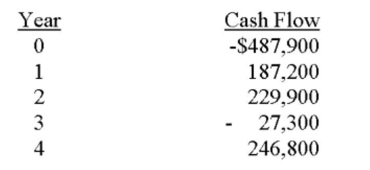

Bridgewater Fountains is considering expanding its current line of business and has developed the following expected cash flows for the project. Should this project be accepted based on the

Discounting approach to the modified internal rate of return if the discount rate is 9.6 percent? Why

Or why not?

(Multiple Choice)

4.7/5  (40)

(40)

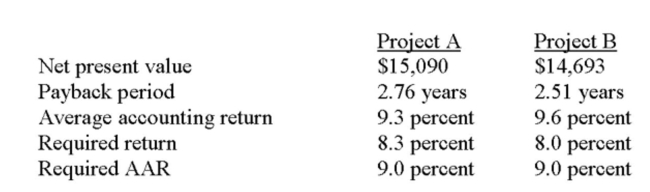

Matt is analyzing two mutually exclusive projects of similar size and has prepared the following data. Both projects have 5 year lives.  Matt has been asked for his best recommendation given this information. His recommendation

Should be to accept:

Matt has been asked for his best recommendation given this information. His recommendation

Should be to accept:

(Multiple Choice)

4.8/5  (35)

(35)

A project will produce cash inflows of $1,750 a year for four years. The project initially costs $10,600 to get started. In year five, the project will be closed and as a result should produce a cash inflow of

$8,500. What is the net present value of this project if the required rate of return is 13.75 percent?

(Multiple Choice)

4.8/5  (27)

(27)

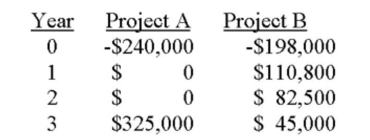

You are considering two mutually exclusive projects with the following cash flows. Will your choice

between the two projects differ if the required rate of return is 8 percent rather than 11 percent? If

so, what should you do?

(Multiple Choice)

4.7/5  (43)

(43)

A project which has a discounted payback period longer than its life also has a positive NPV.

(True/False)

4.8/5  (36)

(36)

If a project with conventional cash flows has a profitability index less than one, then:

(Multiple Choice)

4.8/5  (28)

(28)

Showing 161 - 180 of 409

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)