Exam 7: Activity-Based Costing: a Tool to Aid Decision Making

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

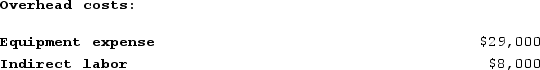

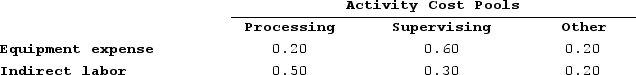

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

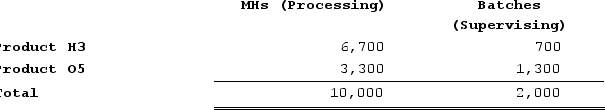

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

What is the overhead cost assigned to Product H3 under activity-based costing?

What is the overhead cost assigned to Product H3 under activity-based costing?

(Multiple Choice)

4.9/5  (38)

(38)

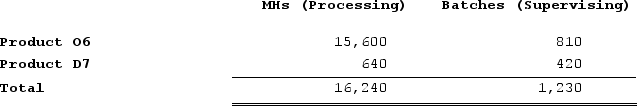

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $51,000; Supervising, $31,600; and Other, $20,300. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (25)

(25)

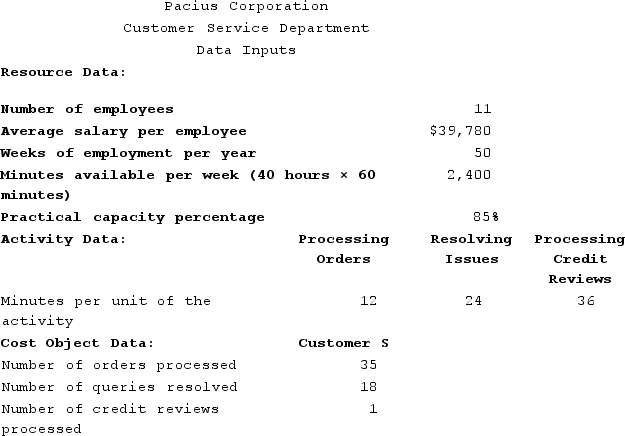

Pacius Corporation is conducting a time-driven activity-based costing study in its Customer Service Department. The company has provided the following data to aid in that study:  On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer S would be closest to:

On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer S would be closest to:

(Multiple Choice)

4.7/5  (39)

(39)

When activity-based costing is used for internal decision-making, the costs of idle capacity should be assigned to products.

(True/False)

4.8/5  (41)

(41)

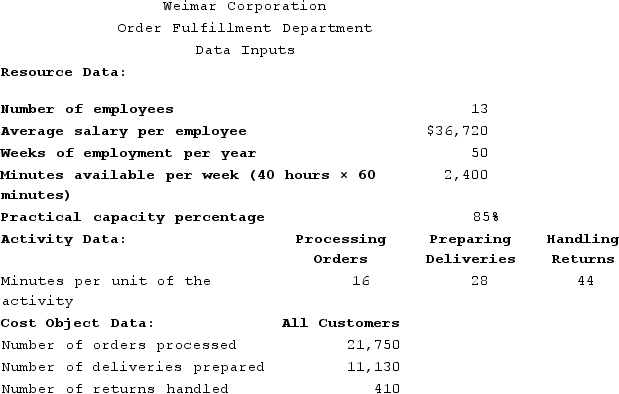

Weimar Corporation is conducting a time-driven activity-based costing study in its Order Fulfillment Department. The company has provided the following data to aid in that study:  On the Capacity Analysis report in time-driven activity-based costing, the "unused capacity in number of employees" would be closest to:

On the Capacity Analysis report in time-driven activity-based costing, the "unused capacity in number of employees" would be closest to:

(Multiple Choice)

4.7/5  (34)

(34)

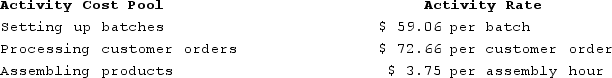

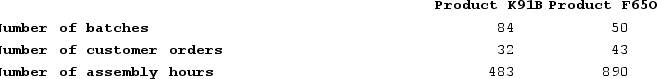

Gould Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data concerning two products appear below:

Data concerning two products appear below:

How much overhead cost would be assigned to Product K91B using the activity-based costing system?

How much overhead cost would be assigned to Product K91B using the activity-based costing system?

(Multiple Choice)

4.7/5  (40)

(40)

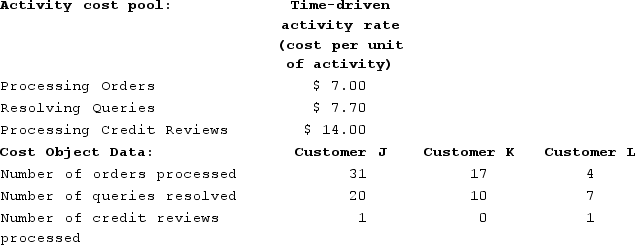

Raycroft Corporation is conducting a time-driven activity-based costing study in its Customer Service Department. The company has provided the following data to aid in that study:

Required:Using time-driven activity-based costing, determine the total Customer Service Department cost assigned to each customer.

Required:Using time-driven activity-based costing, determine the total Customer Service Department cost assigned to each customer.

(Essay)

4.8/5  (39)

(39)

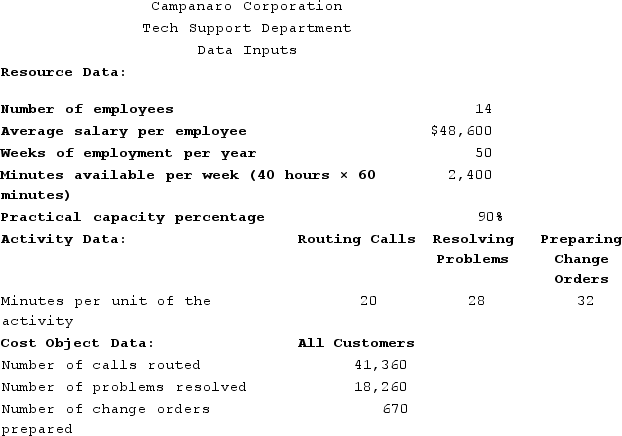

Campanaro Corporation is conducting a time-driven activity-based costing study in its Tech Support Department. The company has provided the following data to aid in that study:  On the Capacity Analysis report in time-driven activity-based costing, the "unused capacity in number of employees" would be closest to:

On the Capacity Analysis report in time-driven activity-based costing, the "unused capacity in number of employees" would be closest to:

(Multiple Choice)

4.9/5  (32)

(32)

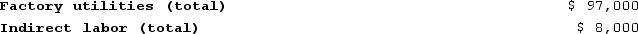

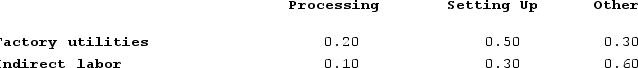

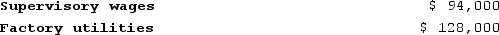

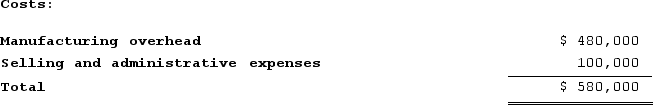

Hagy Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Data concerning the company's costs and activity-based costing system appear below:

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

Required:Assign overhead costs to activity cost pools using activity-based costing.

Required:Assign overhead costs to activity cost pools using activity-based costing.

(Essay)

4.9/5  (40)

(40)

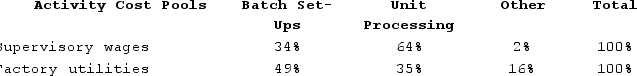

Desilets Corporation has provided the following data from its activity-based costing accounting system:

Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of supervisory wages and factory utilities costs that would be allocated to the Unit Processing activity cost pool.b. Determine the total amount of supervisory wages and factory utilities costs that would NOT be assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of supervisory wages and factory utilities costs that would be allocated to the Unit Processing activity cost pool.b. Determine the total amount of supervisory wages and factory utilities costs that would NOT be assigned to products.

(Essay)

4.9/5  (34)

(34)

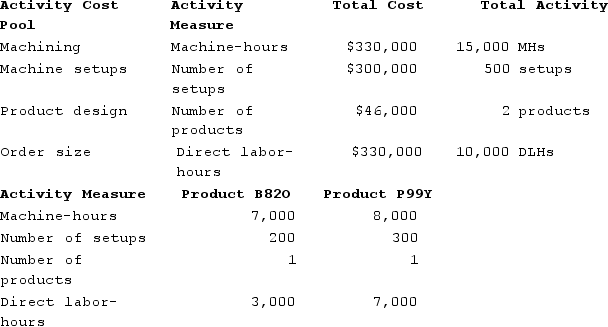

Immen Corporation manufactures two products: Product B82O and Product P99Y. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products B82O and P99Y.  Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product B82O?

Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product B82O?

(Multiple Choice)

4.9/5  (37)

(37)

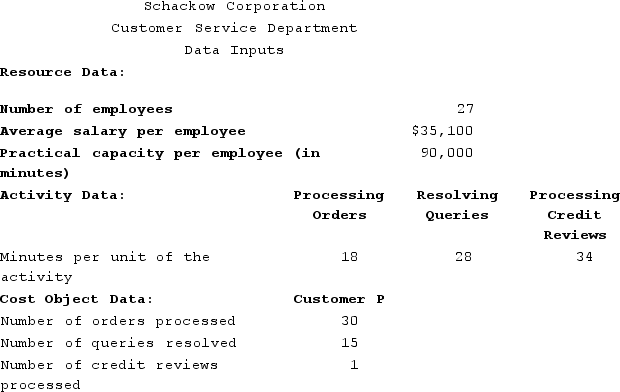

Schackow Corporation is conducting a time-driven activity-based costing study in its Customer Service Department. The company has provided the following data to aid in that study:  On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer P would be closest to:

On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer P would be closest to:

(Multiple Choice)

4.8/5  (41)

(41)

In activity-based costing, as in traditional costing systems, manufacturing costs are not assigned to products.

(True/False)

4.7/5  (42)

(42)

Direct labor costs are usually included in the costs that are allocated to activity cost pools in an activity-based costing system.

(True/False)

4.9/5  (35)

(35)

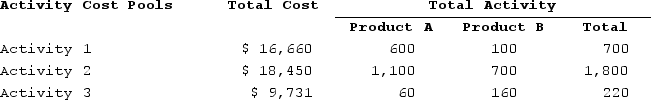

Abel Corporation uses activity-based costing. The company makes two products: Product A and Product B. The annual production and sales of Product A is 200 units and of Product B is 400 units. There are three activity cost pools, with total cost and activity as follows:  The cost per unit of Product B is closest to:

The cost per unit of Product B is closest to:

(Multiple Choice)

4.8/5  (41)

(41)

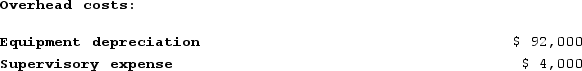

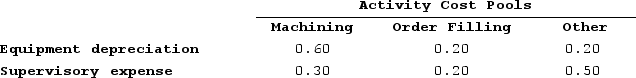

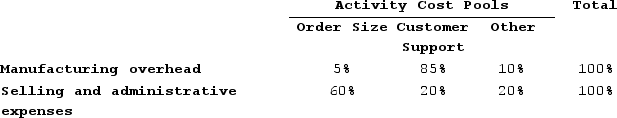

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

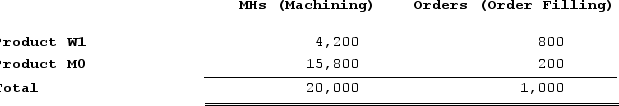

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

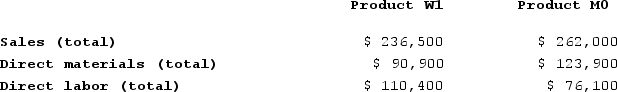

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.9/5  (34)

(34)

When combining activities in an activity-based costing system, batch-level activities should be combined with unit-level activities whenever possible.

(True/False)

4.8/5  (41)

(41)

Activity-based costing is best proposed, designed and implemented by the accounting department without requiring the time of busy managers.

(True/False)

4.8/5  (31)

(31)

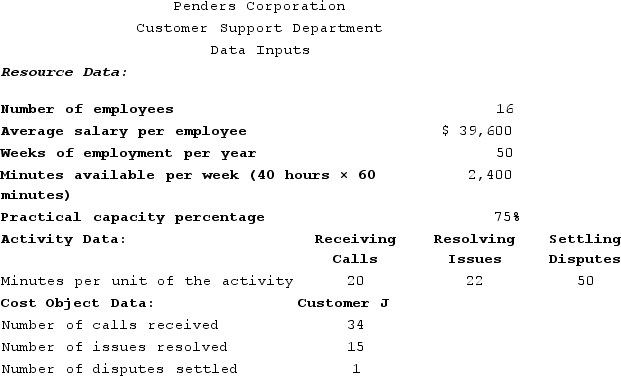

Penders Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study:

Required:

Prepare a time-driven activity-based costing Customer Cost Analysis report that determines the total Customer Support Department cost assigned to Customer J.

Required:

Prepare a time-driven activity-based costing Customer Cost Analysis report that determines the total Customer Support Department cost assigned to Customer J.

(Essay)

4.9/5  (28)

(28)

Diehl Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:  Distribution of resource consumption:

Distribution of resource consumption:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.You have been asked to complete the first-stage allocation of costs to the activity cost pools. How much cost, in total, should NOT be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision-making?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.You have been asked to complete the first-stage allocation of costs to the activity cost pools. How much cost, in total, should NOT be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision-making?

(Multiple Choice)

4.9/5  (43)

(43)

Showing 241 - 260 of 382

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)