Exam 1: Managerial Accounting and Cost Concepts

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

A cost incurred in the past that is not relevant to any current decision is classified as a(n):

(Multiple Choice)

4.7/5  (39)

(39)

Which of the following statements is correct in describing manufacturing overhead?

(Multiple Choice)

4.8/5  (42)

(42)

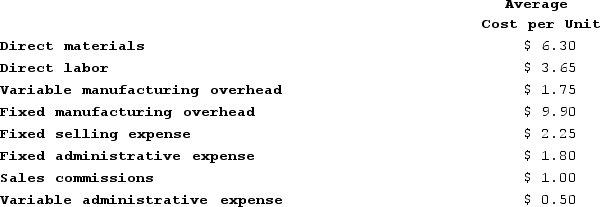

Mccaskell Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:  If 8,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

If 8,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

(Multiple Choice)

5.0/5  (30)

(30)

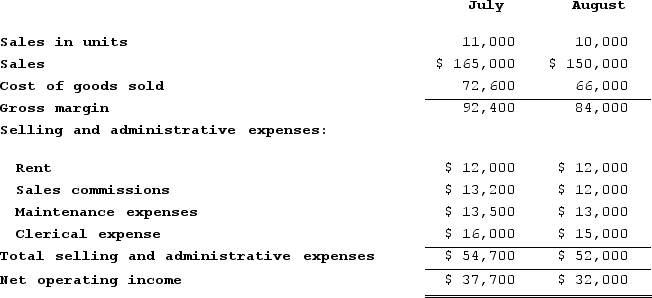

Comparative income statements for Boggs Sports Equipment Company for the last two months are presented below:  All of the company's costs are either fixed, variable, or a mixture of the two (i.e., mixed). Assume that the relevant range includes all of the activity levels mentioned in this problem.Which of the selling and administrative expenses of the company is variable?

All of the company's costs are either fixed, variable, or a mixture of the two (i.e., mixed). Assume that the relevant range includes all of the activity levels mentioned in this problem.Which of the selling and administrative expenses of the company is variable?

(Multiple Choice)

4.8/5  (32)

(32)

A fixed cost is a cost whose cost per unit varies as the activity level rises and falls.

(True/False)

4.9/5  (36)

(36)

Which of the following would most likely NOT be included as manufacturing overhead in a furniture factory?

(Multiple Choice)

4.8/5  (38)

(38)

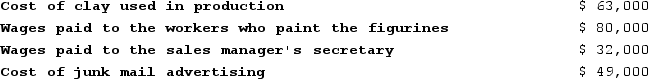

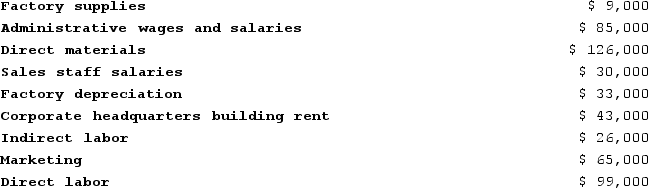

Vignana Corporation manufactures and sells hand-painted clay figurines of popular sports heroes. Shown below are some of the costs incurred by Vignana for last year:  What is the total of the product costs above?

What is the total of the product costs above?

(Multiple Choice)

4.8/5  (39)

(39)

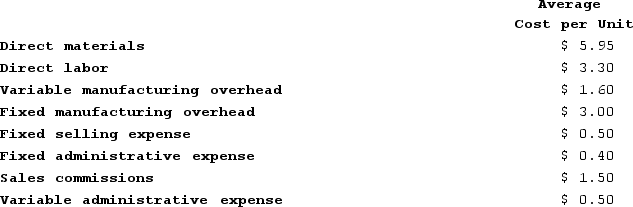

Varela Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

(Multiple Choice)

4.9/5  (45)

(45)

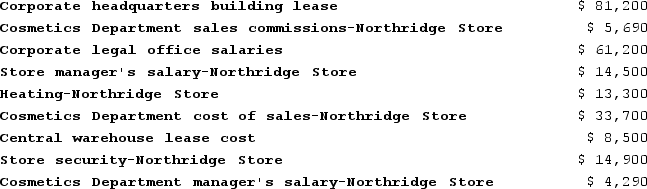

The following cost data pertain to the operations of Quinonez Department Stores, Incorporated, for the month of September.  The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

(Multiple Choice)

5.0/5  (36)

(36)

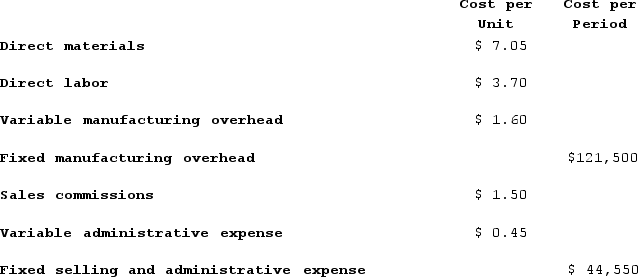

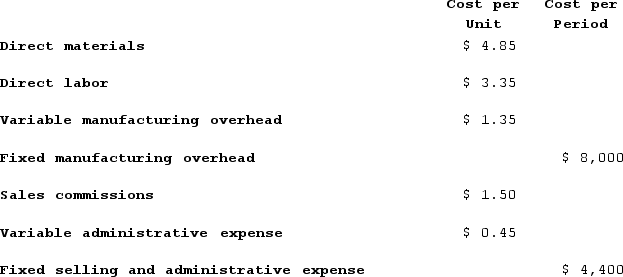

Norred Corporation has provided the following information:  If 8,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

If 8,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

(Multiple Choice)

4.9/5  (51)

(51)

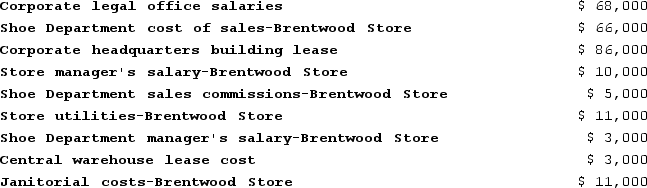

The following cost data pertain to the operations of Ladwig Department Stores, Incorporated, for the month of December.  The Brentwood Store is just one of many stores owned and operated by the company. The Shoe Department is one of many departments at the Brentwood Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are NOT direct costs of the Brentwood Store?

The Brentwood Store is just one of many stores owned and operated by the company. The Shoe Department is one of many departments at the Brentwood Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are NOT direct costs of the Brentwood Store?

(Multiple Choice)

4.8/5  (44)

(44)

Materials used in a factory that are not an integral part of the final product, such as cleaning supplies, should be classified as:

(Multiple Choice)

4.8/5  (36)

(36)

The cost of napkins put on each person's tray at a fast food restaurant is a variable cost with respect to how many persons are served.

(True/False)

4.8/5  (35)

(35)

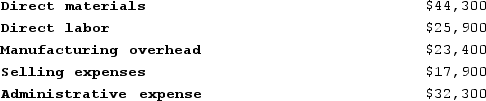

The following costs were incurred in May:  Prime costs during the month totaled:

Prime costs during the month totaled:

(Multiple Choice)

4.9/5  (38)

(38)

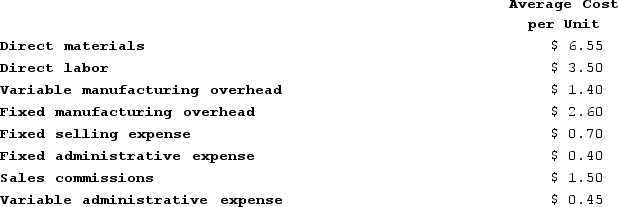

Lagle Corporation has provided the following information:  For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

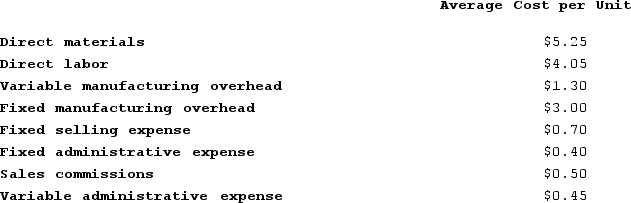

Dake Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  If 3,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

If 3,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Traditional format income statements are widely used for preparing external financial statements.

(True/False)

4.8/5  (38)

(38)

Ouelette Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,000 units, its average costs per unit are as follows:  If 6,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

If 6,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

A partial listing of costs incurred during March at Febbo Corporation appears below:  The total of the period costs listed above for March is:

The total of the period costs listed above for March is:

(Multiple Choice)

5.0/5  (47)

(47)

Showing 241 - 260 of 346

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)