Exam 12: State and Local Taxes

Exam 1: Business Income, Deductions, and Accounting Methods99 Questions

Exam 2: Property Acquisition and Cost Recovery109 Questions

Exam 3: Property Dispositions110 Questions

Exam 4: Entities Overview80 Questions

Exam 5: Corporate Operations109 Questions

Exam 6: Accounting for Income Taxes100 Questions

Exam 7: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 8: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 9: Forming and Operating Partnerships106 Questions

Exam 10: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 11: S Corporations134 Questions

Exam 12: State and Local Taxes117 Questions

Exam 13: The U.S. Taxation of Multinational Transactions89 Questions

Exam 14: Transfer Taxes and Wealth Planning123 Questions

Select questions type

Which of the following sales is always subject to sales and use tax in a state that assesses a sales and use tax?

(Multiple Choice)

4.8/5  (36)

(36)

In which of the following state cases did the state not assert economic nexus?

(Multiple Choice)

4.9/5  (43)

(43)

Several states are now moving from a strict physical presence test towards an economic presence test.

(True/False)

4.9/5  (33)

(33)

Businesses engaged in interstate commerce are subject to income tax in every state in which they operate.

(True/False)

4.9/5  (39)

(39)

Tennis Pro is headquartered in Virginia. Assume it has a state income tax base of $200,000. Of this amount, $60,000 was non-business income. Assume that Tennis Pro's Virginia apportionment factor is 73.28 percent. The non-business income allocated to Virginia was $23,000. Assuming a Virginia corporate tax rate of 5.5 percent, what is Tennis Pro's Virginia state tax liability? (Round your answer to the nearest whole number.)

(Essay)

4.7/5  (43)

(43)

Public Law 86-272 protects only companies selling tangible personal property.

(True/False)

4.8/5  (35)

(35)

Which of the following regarding the state tax base is incorrect?

(Multiple Choice)

4.8/5  (47)

(47)

On which of the following transactions should sales tax generally be collected?

(Multiple Choice)

4.8/5  (35)

(35)

Interest and dividends are allocated to the state of commercial domicile.

(True/False)

4.8/5  (38)

(38)

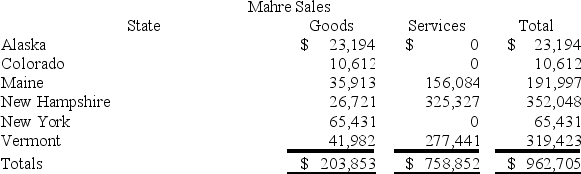

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store which ships to out-of-state customers. The ski tours operate in Maine, New Hampshire, and Vermont where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

(Multiple Choice)

4.9/5  (38)

(38)

The trade-show rule allows businesses to maintain a sample room for up to four weeks per year.

(True/False)

4.9/5  (44)

(44)

Giving samples and promotional materials without charge is a protected solicitation activity.

(True/False)

4.7/5  (36)

(36)

Which of the following isn't a criteria used to determine whether a unitary relationship exists?

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following is not a primary revenue source for most states?

(Multiple Choice)

4.9/5  (33)

(33)

Many states are either starting to or are in the process of expanding the types of services subject to sales tax.

(True/False)

4.7/5  (44)

(44)

Delivery of tangible personal property through common carrier is a protected activity.

(True/False)

4.8/5  (34)

(34)

Showing 101 - 117 of 117

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)