Exam 8: Risk, Return, and Portfolio Theory

Exam 1: An Introduction to Finance53 Questions

Exam 2: Business Corporate Finance68 Questions

Exam 3: Financial Statements49 Questions

Exam 4: Financial Statement Analysis and Forecasting90 Questions

Exam 5: Time Value of Money82 Questions

Exam 6: Bond Valuation and Interest Rates77 Questions

Exam 7: Equity Valuation101 Questions

Exam 8: Risk, Return, and Portfolio Theory111 Questions

Exam 9: The Capital Asset Pricing Model Capm115 Questions

Exam 10: Market Efficiency52 Questions

Exam 11: Forwards, Futures, and Swaps56 Questions

Exam 12: Options55 Questions

Exam 13: Capital Budgeting, Risk Considerations, and Other Special Issues149 Questions

Exam 14: Cash Flow Estimation and Capital Budgeting Decisions127 Questions

Exam 15: Mergers and Acquisitions88 Questions

Exam 16: Leasing34 Questions

Exam 17: Investment Banking and Securities Law68 Questions

Exam 18: Debt Instruments52 Questions

Exam 19: Equity and Hybrid Instruments67 Questions

Exam 20: Cost of Capital68 Questions

Exam 21: Capital Structure Decisions69 Questions

Exam 22: Dividend Policy53 Questions

Exam 23: Working Capital Management: General Issues51 Questions

Exam 24: Working Capital Management: Current Assets and Current Liabilities78 Questions

Select questions type

Suppose you own a two-security portfolio.You have 25.0% of your funds invested in Security A and the balance of your funds invested in Security B.Security A has a standard deviation of 8.0% and Security B has a standard deviation of 12.0%.What is the covariance of the returns on Securities A and B if the portfolio standard deviation is 10.0%?

(Multiple Choice)

4.7/5  (43)

(43)

Which of the following is FALSE regarding Value at Risk (VaR)?

(Multiple Choice)

4.8/5  (38)

(38)

You have observed the following annual returns for Motherboard Inc.: 25%, 15%, -20%, 30%, and -15%.What are the variance and standard deviation of the returns?

(Multiple Choice)

4.8/5  (35)

(35)

Steve bought a share of Toronto Skates Inc.three years ago for $45.00.He was paid two annual dividends of $4.50 in the past two years.If the stock price today is $ 48.50, what is the annual holding period return of the stock?

(Multiple Choice)

4.9/5  (41)

(41)

In a two-security portfolio 25% of your money is invested in Security X and the remainder in Security Y.If the standard deviations of Securities X and Y are 22 % and 7 %, respectively, and the portfolio variance is 0.01155625, what is the correlation between the two securities?

(Multiple Choice)

4.9/5  (34)

(34)

The capital gain yield of an equity security is 9.27%.The security paid a quarterly dividend of $0.55 per share during the year.What is the current price of the security if the total return is 13.76 percent?

(Multiple Choice)

4.8/5  (39)

(39)

What is the covariance of the daily returns on Hocus and Pocus?

(Multiple Choice)

4.7/5  (35)

(35)

Which one of the following is NOT an example of systematic risk?

(Multiple Choice)

4.8/5  (37)

(37)

The geometric average daily return for Grumpy Inc.was 3.0% for this past week.Grumpy's stock was traded at $18.82 when the market closed on Friday.The daily returns for Monday through Thursday are 5.0%, 2.0%, -10.0%, and 8.0%, respectively.What is the opening price of Grumpy on Friday?

(Multiple Choice)

4.8/5  (36)

(36)

Aquarius Inc.has posted the following annual returns for the past 5 years: 17%, 23%, -13%, 7%, and -15%.What are the variance and standard deviation of these annual returns?

(Multiple Choice)

4.8/5  (32)

(32)

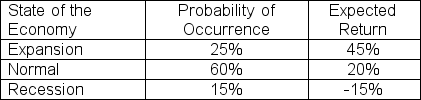

Given the following forecasts, what is the variance of returns?

(Multiple Choice)

4.8/5  (48)

(48)

The arithmetic average daily return for Dopey Inc.was 2.0% for this past week.Dopey's stock was trading at $23.70 when the market closed on Friday.The daily returns for Monday, Tuesday, Thursday, and Friday are 4.8%, 5.6%, -4.0%, and 12.2%, respectively.What was Dopey's opening price on Monday?

(Multiple Choice)

4.8/5  (35)

(35)

Steve bought a share of Toronto Skates Inc.three years ago for $45.00.He was paid two annual dividends of $4.50 in the past two years.If the stock price today is $ 48.50, which of the following are the three year's income yield (IY), capital gain (CGY), and total return (TR).

(Multiple Choice)

4.8/5  (44)

(44)

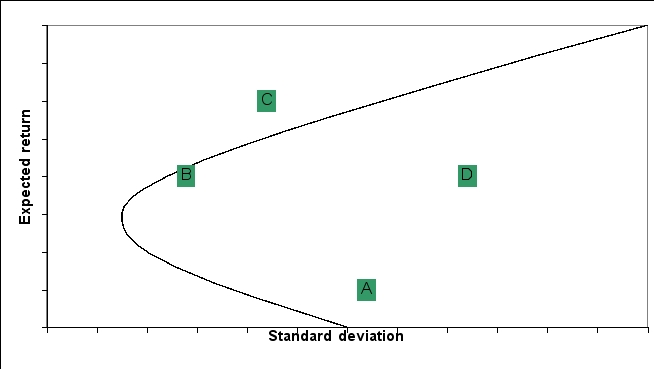

The standard deviation and expected returns for 4 portfolios (A, B, C, and D)are graphed on the following efficient frontier:  Which of the following portfolios are inefficient?

Which of the following portfolios are inefficient?

(Multiple Choice)

5.0/5  (33)

(33)

You made an investment in your RRSP account of $3,000 in an ETF that pays quarterly dividends.The price of each unit the day you made the investment is $60.The following year you invested another $2,000 in your RRSP account at a price of $ 70 per unit.How much would you have in your account two years after your initial investment if you know that the annual income yield of the ETF is 5% and an ETF unit is trading at $75 today?

(Multiple Choice)

4.8/5  (40)

(40)

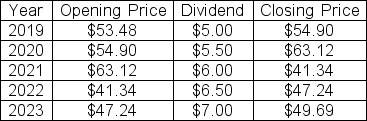

Suppose you are given the following information on The Doc & Company:

a)Calculate the total annual returns for each of the five years

b)Calculate the arithmetic average annual return

c)Calculate the geometric average annual return

d)Calculate the variance of annual returns

e)Calculate the standard deviation of annual returns

a)Calculate the total annual returns for each of the five years

b)Calculate the arithmetic average annual return

c)Calculate the geometric average annual return

d)Calculate the variance of annual returns

e)Calculate the standard deviation of annual returns

(Essay)

4.9/5  (33)

(33)

Suppose you own a portfolio that has 500 shares of SHC Company and 1,000 shares of MHC Company.The stock prices of SHC and MHC at the time of purchase were $40 and $25 per share, respectively.Given the following forecasts, what is the expected return for the portfolio?

(Multiple Choice)

4.8/5  (34)

(34)

A share of Oedipus Construction Company was selling for $32.16 one year ago.The stock paid an annual dividend of $0.25 during the year.What is the income yield (dividend yield)for shares of Oedipus Construction Company?

(Multiple Choice)

4.7/5  (30)

(30)

Showing 21 - 40 of 111

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)